Making money by betting against Silicon Valley's 'wisdom of the crowd'

In Wall Street, fortunes are made by those who bet against the market, because the breakout investment ideas are never found within the wisdom of the crowd. That's what hedge funds do, and we know how incredibly successful some of them have become.

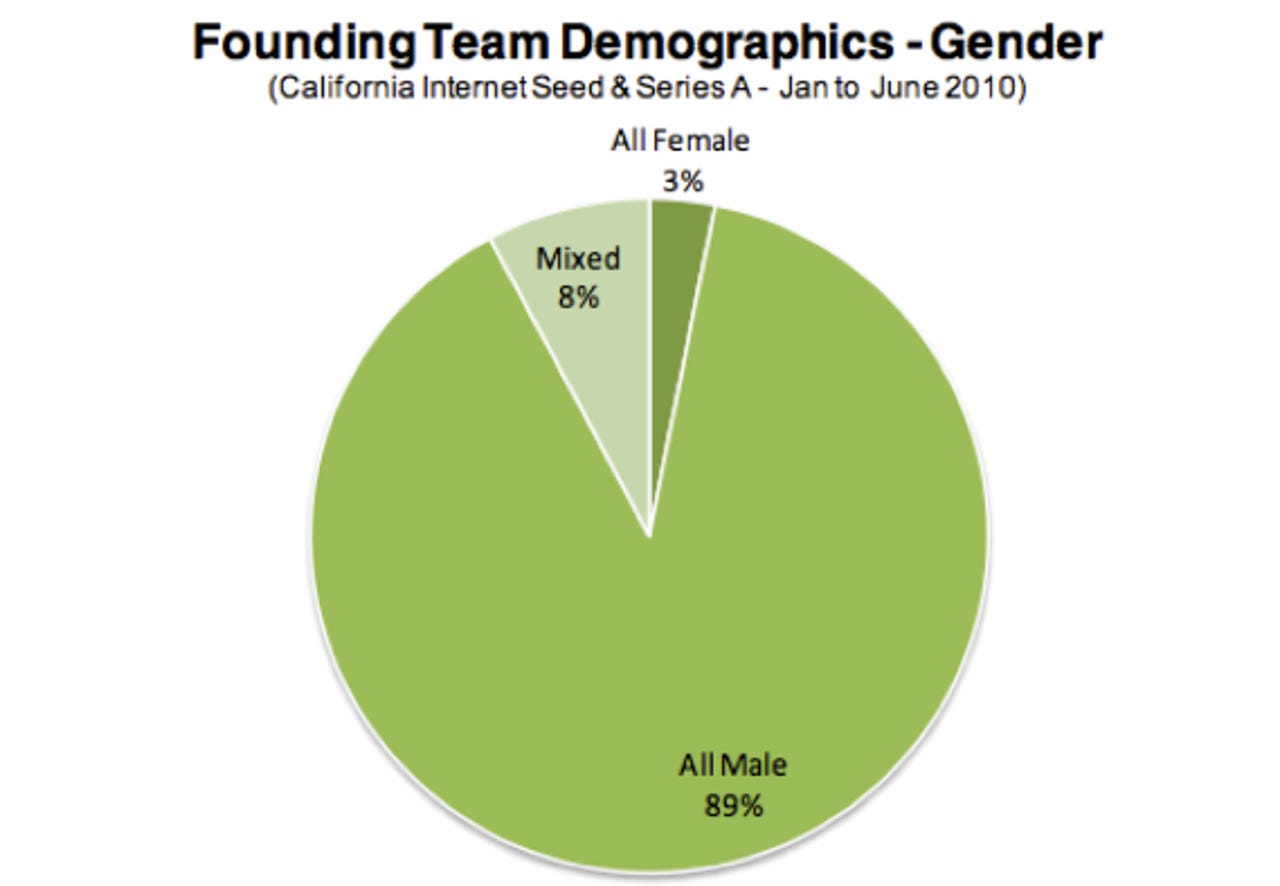

Silicon Valley investors run as a crowd and fund the same types of companies run by the same types of people. They invest in copy-cat, me-too startups by the dozens, and they only invest in teams that are nearly identical to each other: White or Asian males with a technical Ivy League education.

Chris Yey, an angel investor and serial entrepreneur, points out on his blog Adventures in Capitalism that meritocracy doesn't exist in Silicon Valley.

He points to these charts from Catherine Bracy at Team Obama's technology field office:

We know that successful startups are the ones that challenge the wisdom of the crowd in various industry sectors. That's where the big money is always made.

So why do Silicon Valley's super-smart investors all follow each other and invest in the same type of teams? Surely, there's an arbitrage opportunity here? There's a huge amount of untapped resources.

Since we know that gender or "race" don't limit people's abilities or intelligence, it means Silicon Valley has a massive, nearly 100 percent untapped pool of resources at its disposal, waiting to be harnessed to the yoke of innovation.

It's often said that Silicon Valley's biggest problem isn't the supply of investment capital; it's the lack of capable startup teams. To say that there are no capable startup teams unless they are all-male, white, and Ivy League educated is clearly nonsense.

Which means that there are fortunes waiting to be made by investing in female founders who aren't just techies, with broadly diverse teams.

Silicon Valley investors run as a herd, but what's needed are some lone wolves to bring in some big dollars by betting against the market. Then they'll all jump in and consign the above graphs into the dustbin of history.

So where are Silicon Valley's counter-culture investors? There's a lot of money waiting to be made.