Mark your calendars: Amazon Web Services transparency on deck

Amazon's move to break out Amazon Web Services beginning in the first quarter will shed light on what is arguably the company's most important business and opens up options for the company.

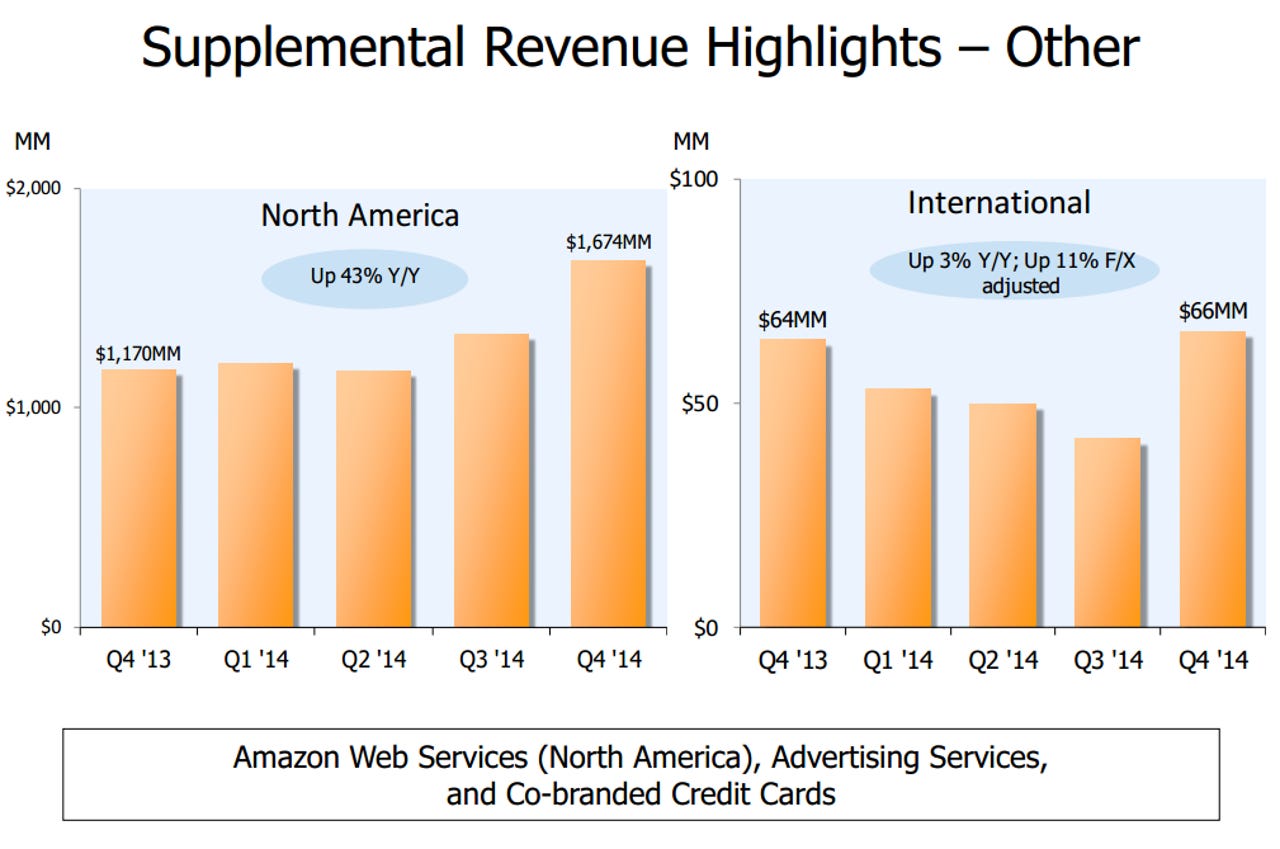

To date, AWS, the largest infrastructure as a service player in the enterprise, has been relegated to the "other" category in Amazon's earnings results. Meanwhile, Amazon's capital expenses would surge as it built out data center capacity as well as its usual fulfilment centers.

Also: Amazon's ability to invest in AWS: By the numbers

But the big news on Amazon's fourth quarter earnings call---aside from the company actually giving a hoot about profits for a few minutes---was that AWS is going to be more transparent. Amazon will report its earnings and break them up into North America, International and AWS, which now has 1 million active customers.

What's the big deal here? Breaking out AWS into its own reportable unit, gives Amazon a lot of options. For instance, Amazon CFO Tom Szkutak was asked why the company doesn't invest more in AWS---like two or three times more. Szkutak said:

We are expanding very rapidly. We are -- have been hiring a lot of great people over the past few years, and several years. We do think it's a big opportunity. We're making sure we keep the hiring bar really high to make sure we're bringing great resources, like we do across all of Amazon. And we're super-excited about the opportunity, so we are investing very heavily.

You see that certainly in our CapEx numbers. And the assets that we are acquiring with some of our capital leases, you see that represented. So again, we are investing very heavily, both in terms of people as well as capital for that business, and we share your excitement about the business.

What Szkutak didn't say is that it's not easy for Amazon to thread the needle between non-stop investment, retail profit and focus. In other words, AWS is all grown up now. That fact isn't news to most of the legacy enterprise providers chasing it.

As I noted previously, it's quite possible that e-commerce isn't the best business to fund AWS. By breaking AWS out in the future (with historical data we hope), Amazon sets up the possibility to eventually spin it off, float a small portion of shares and raise capital more efficiently.

Analysts asked Szkutak a bevy of questions about AWS, but didn't get much in return. After all, the AWS transparency can wait a few more months.