Merrill Lynch downgrades SAP and Oracle

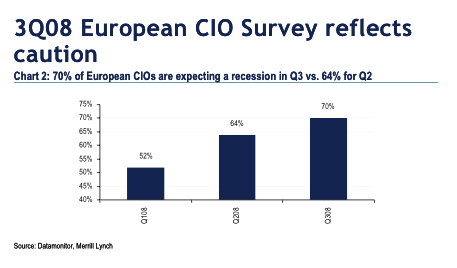

It should come as no surprise that investment research at Merrill Lynch sees downgraded assessments of both SAP and Oracle's near terms results. In the last month, Merrill has conducted research among European CIO's and finds that a full 40% are less bullish on IT spending than they were three months ago and that 70% expect a recession. It also says that 44% of companies are delaying spend. In a paragraph entitled 'Most negative CIO survey ever' lead author Raimo Lenschow says:

A first look at the data from our CIO survey conducted at the end of October and the beginning of November shows that we are getting readings that we have not seen before. These are significantly more cautious than in the last downturn when it was perceived that IT was really suffering.

For SAP, Merrill is cutting revenue projections 4% for both 2009 and 2010, chopping $180 million from its Q4 license estimate to $1.2 billion. It fears that the current spend reduction of $200 million SAP has already announced will be outstripped by the potential fall in license sale run rate. If Merrill is correct, then this will damage bottom line profit.

For Oracle, lead author Kash Rangan believes application license sales will take a full 27% hit in FY2009 with an overall license sales decline of 13-14% in 2009 and 2010. However, in drawing comparisons with the last major downturn Rangan says:

Recurring and high margin maintenance revenues, most investors already appreciate, are nearly 50%, up from 32% in FY01. No question that ORCL is in a better position this time.

I'm not convinced about this last part. While maintenance revenues are always seen by financial analysts as a good defense in recessionary times, they forget that recession also gives buyers a stronger bargaining position.

I'll add to that by making what some will say is an outrageous statement. That fact SAP and Oracle have worked hard to lock in their customers does not mean that lock is permanent. If, at current rates, customers effectively pay for their software three times over a 10 year period, do both Oracle and SAP honestly believe they can get away with that forever? Forrester's Ray Wang offers this view:

Software vendors under pressure to make margins will be forced to choose whether they are willing to take short term pain in stock valuations for long term gain in improving the vendor-client commitment or make their numbers by disenfranchising customers during a time of crisis by violating any one of the three tenants of maintenance pricing (choice, value, predictability.)

In this context I believe SAP is in the weaker position. Last week for example I listened to a very well known retail brand talking about the lack of value in moving from R/34.6 to 4.7. That company is considering re-implementing to the later EC6 offering. Any time there is a re-implementation, the door opens for alternatives and re-negotiation. Oracle on the other hand has plenty of options to trade up its customers from the smorgasbord of applications it has acquired over the last few years. While my colleague Vinnie Mirchandani bemoans the lack of progress on Oracle's Fusion applications, I am hearing favorable reports. In competitive deals, I see it as content to nibble around SAP rather than attempt to go for the big hit. But then another SAP customer told me they are loving the BusinessObjects offerings. Confused? Imagine what it's like for folk like me, trying to make sense of it all!

From a financial viewpoint, Oracle doesn't have the cost base manoeuvrability that SAP has. By any measure, SAP is carrying a lot more fat. It can therefore put the brake on spend cuts if it needs to deploy resources to close deals. Oracle would almost certainly have to spend more to win those big deals at a time when it has managed its cost base rather better than SAP. That would put pressure on margins.

As we move into the next reporting season, we will get better visibility into what's happening. My view is that this is not business as usual. I believe that whatever the new economics hold, buyers will be forced into demanding a better deal from their software providers. It only requires a determination by a relatively small number of key accounts to get the ball rolling. If that happens, then the economics of both companies could be radically affected.