Microservers are taking over the datacentre - and Intel, ARM are ready for battle

Driven by the booming demand for new datacentre services to support mobile and cloud computing, shipments of microservers are expected to more than triple this year.

Microservers contain one or more low-power microprocessors and usually consume less than 45 watts in a single motherboard. The machines share infrastructure such as power, cooling and cabling with other similar devices, allowing for an extremely dense configuration.

These small form-factor servers are designed for workloads such as serving web content, characterised by large amounts of data throughput but little processing: in other words, lots of I/O but CPU-lite. Using traditional servers for such tasks means wasting a lot of processing power unnecessarily.

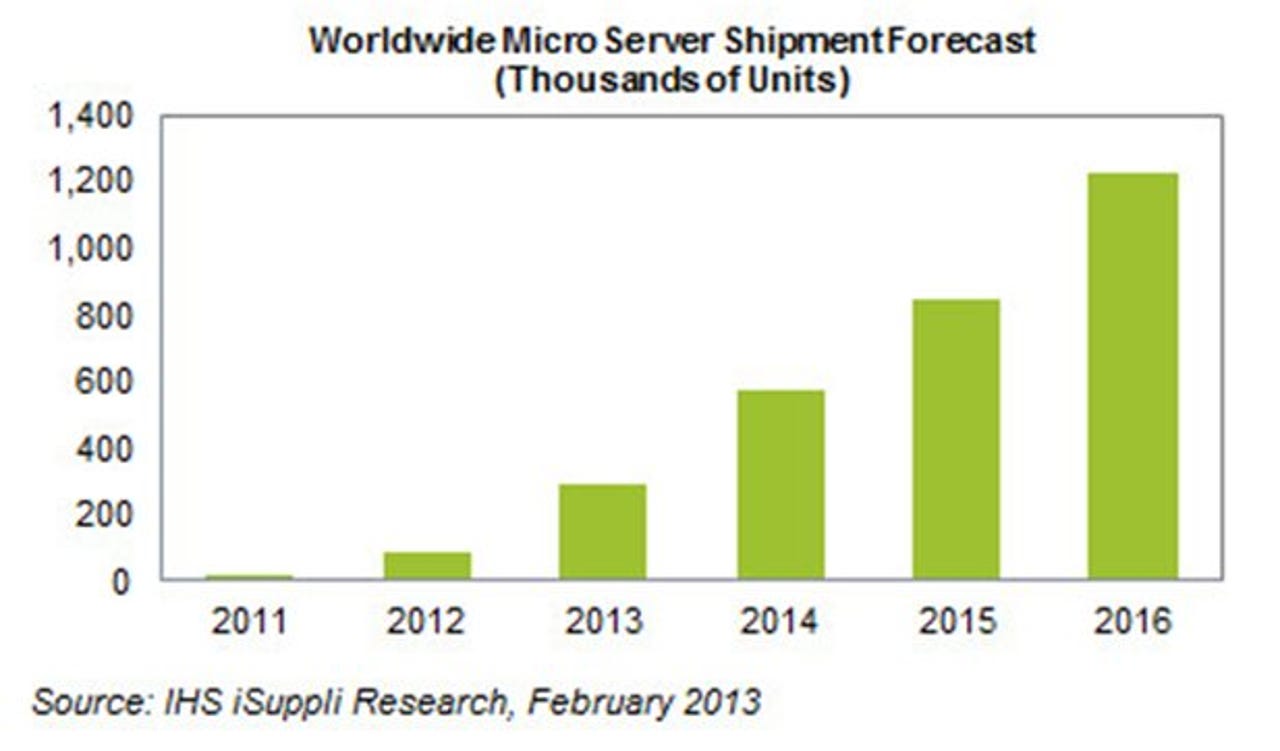

The excitement around microservers started back in 2011 when shipments were a modest 19,000 units – a negligible 0.2 percent of the total server market. However, analysts expect shipments to hit 1.2 million units by the end of 2016 – making up 10 percent of the total server market. This year, shipments of microservers will hit 291,000 units, compared to 88,000 last year.

Peter Lin, senior analyst for compute platforms at IHS, said pressure on datacentres to serve more smartphones, tablets and mobile PCs means some aspects of server design are becoming increasingly important – such as ease of maintenance, expandability, energy efficiency and low cost.

"Such factors are among the advantages delivered by microservers compared to higher-end machines like mainframes, supercomputers and enterprise servers — all of which emphasise performance and reliability instead," he said in a statement.

IHS iSuppli said that while cloud servers, blade servers and virtualisation servers will also see growth, microservers will be the fastest-growing server segment.

"Given the dazzling outlook for microservers, makers with strong product portfolios of the machines will be well-positioned during the next five years — as will their component suppliers and contract manufacturers," said the firm.

Already a number of vendors are positioning themselves for the coming battle for microserver supremacy, including chip companies Intel, ARM and AMD; server makers such as Dell and HP; and OEMs including Quanta Computer and Wistron.

But the most fierce battle for the microserver space will be between Intel and ARM. Intel first unveiled the microserver concept and reference design in 2009, ostensibly to block rival ARM from entering the field.

But ARM, because of the low-power design of its CPUs, has been just as eager to enter the server arena — dominated by x86 chip architecture from the likes of Intel and a third chip player, AMD.

According to the researchers, ARM faces an uphill battle, as the majority of server software is written for x86 architecture. Shifting from x86 to ARM will also be difficult for legacy products.

ARM, however, is gaining greater support from software and OS vendors, which could potentially put pressure on Intel in the coming years.