Microsoft: The four elephants in the room

Microsoft's fiscal third quarter results will be notable on four fronts: Potential layoffs, the impact on weak PC demand, the effect of netbooks and how Windows 7 may impact the June quarter.

Wall Street is expecting Microsoft to report third quarter earnings of 39 cents a share on revenue of $14.09 billion, according to Thomson Reuters. For the fourth quarter, Wall Street is expecting Microsoft to report earnings of 40 cents a share on revenue of $15.02 billion.

Here's a look at the four elephants that will be roaming on Microsoft's conference call:

1. The potential restructuring

Analysts are widely expecting Microsoft to cut jobs. Many of the questions on the earnings conference call will revolve around potential layoffs.Sid Parakh, an analyst at McAdams Wright Ragen, said that Microsoft "may embark on another round of restructuring in the near future." He writes:

While our checks seem to unanimously imply further headcount cuts, there is uncertainty around whether such cuts will be a moderate revision to plans announced in January or is a sizable addition to prior headcount reduction plans. Moreover, we have few details on the size, timing of announcement, timeframe of cuts, geography or business units where reductions may happen, and whether outside contractors are also a part of such reduction plans. We believe that additional restructuring plans are likely prompted by continuing macroeconomic/business weakness.

2. PC demand's impact on Microsoft's core business

Parakh also addressed the elephant in the room: How bad will Microsoft's core client business be amid weak PC demand---especially when all the growth is in netbooks?Parakh notes:

Enterprise purchases of traditional PCs/laptops remained weak; a headwind for sales of Microsoft’s core products, in view of which bookings/enterprise renewal rates may have been under pressure. In the last quarter, renewal rates were within the historical 66% to 75% range.

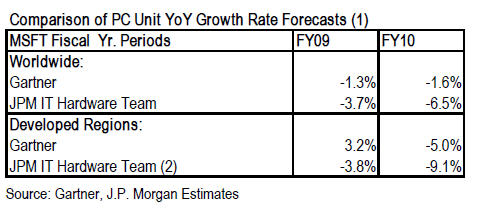

John DiFucci, an analyst JP Morgan, has cut his client, business division and earnings estimates to reflect weak PC demand projections from Gartner. JP Morgan's estimates are even more grim. DiFucci notes:

The JPM IT Hardware Team has a more pessimistic outlook for PC unit sales in F10 than industry analysts, calling for a worldwide decline 6.5% in F10 (vs. Gartner’s 1.6% decline) and developed region decline of 9.1% (vs. Gartner's 5.0% decline). Additionally, we have adjusted our F09 operating expense estimate to be more closely aligned with Microsoft’s guidance of $27.4 billion. We believe more conservative PC unit shipment assumptions for F10 are appropriate at this time, even though industry analysts’ preliminary data for the March quarter were slightly better than expected. It remains unclear how much of the outperformance in March was due to inventory replenishment that may not be sustainable in future periods.

3. Netbooks: Good news, bad news

Netbooks are the other big worry. Jeffries analyst Katherine Egbert writes:Netbooks are driving unit growth, but are not good for revenue or profits. Microsoft's company's commanding lead in PCs/notebooks seems to be translating over to the netbook market, with recent company bloggers reporting a Windows attach rate of >90% now on netbooks vs >80% last quarter. That's the good news.

The bad news is that, in the past two quarters, the difference between Microsoft's Client revenue and PC unit growth has widened to a record 8-11% due to the rise of netbooks, which mostly run Windows XP. Our new estimates reflect an 8% decrease in PC unit sales year over year (y/y) plus a 4% revenue headwind from netbooks, for an overall Client growth rate of -12% y/y in the March quarter. The y/y decline in revenue would have been greater on a percentage basis, save for the easy y/y compare to March 2008.

Meanwhile Egbert adds that netbook demand may begin to hurt Office sales.

We are also watching for signs that MBD (Office) sales might be adversely affected by the rising popularity of netbooks. Most netbooks are used solely for web surfing and for checking email. It remains to be seen if Windows 7, with its much smaller footprint and memory requirements, leave room on netbooks for Office deployments.

4. Windows 7 effects

A surprising number of analysts indicated that they are increasingly wondering how Windows 7 will impact Microsoft's results in future quarters, especially the three months ending June 30.Egbert notes:

Windows 7 technology guarantees could start adversely impacting Client revenue in the June quarter. Microsoft typically provides guarantees to consumers in front of major Windows releases to prevent a slowdown in hardware sales.

Here's a look at Egbert's projections:

And the Windows 7 average price expectations.

DiFucci adds that it's too early to project Windows 7's impact. He adds:

Though we believe the overwhelming majority of PC users will acquire Windows 7 when they ultimately buy a new PC, we are assuming that Windows 7 does not in itself drive new PC sales. However, it is likely that a small contingent of Vista users may be frustrated enough to upgrade to Windows 7 before they make their next PC purchase. How many such users purchase an upgrade could provide upside. Note: Windows 7 is expected to be less onerous to PC hardware resources than Vista making such an upgrade plausible.