Microsoft: We'll raise our bid for Yahoo, but can't make up our mind yet

Update: Microsoft's board met Wednesday to mull over its next move regarding its Yahoo board, but couldn't reach a decision.

The Wall Street Journal, which has been tipped off, cites "people familiar with the matter," also known as Microsoft, and reports an announcement could now come later this week. In other words, the wait continues.

Here's a look at the scenarios:

- Microsoft is willing to go to $32 to $33 a share for Yahoo. However, Yahoo wants $35 to $37 a share. I agree with Microsoft CFO Christopher Liddell here: Yahoo is unrealistic.

- Microsoft appears to be pressuring Yahoo shareholders to lean on the portal's board.

- Add it up and Microsoft could walk away--at least initially. The fact that Microsoft is entertaining a higher bid means that the software giant really doesn't want a proxy war. However, just the fact Microsoft is willing to raise its offer may woo Yahoo shareholders to its side.

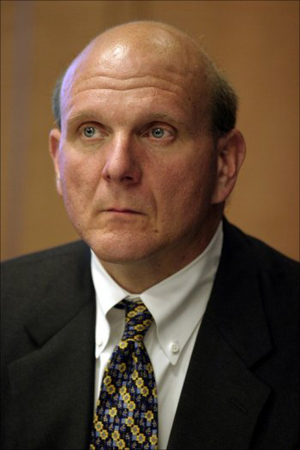

In any case, it appears to be Microsoft CEO Steve Ballmer's call whether to pursue Yahoo, walk away or pony up more cash. The Journal seems to indicate that Ballmer may be waffling, but that statement could be a well placed piece of disinformation to spook Yahoo into coming to the negotiating table.

Another question is whether Yahoo will do a deal with Time Warner for AOL, which has a lot of traffic but no ad revenue growth, for more leverage. Frankly, the two should just meet at $35 a share and get this over with.