Microsoft's first quarter: Outlook light; Recession assumed; Office shines; Online doesn't

Microsoft on Thursday handily topped its revenue targets and slid by Wall Street estimates with solid fiscal first quarter results, but cut its outlook for the December quarter. CFO Chris Liddell noted on a conference call that business "clearly weakened" at the end of the third quarter and carried over into October.

For its first quarter ending Sept. 30 (statement and presentation), Microsoft reported net income of $4.37 billion, or 48 cents a share, on revenue of $15.06 billion. According to Thomson Reuters, Wall Street expected earnings of 47 cents a share on revenue of $14.78 billion.

However, Microsoft did cut its earnings targets for the December quarter, but not by enough to spook investors, which took shares a bit higher after hours. Liddell said Microsoft sees a "mild to deep recession." Meanwhile, the credit crunch is curbing software spending.

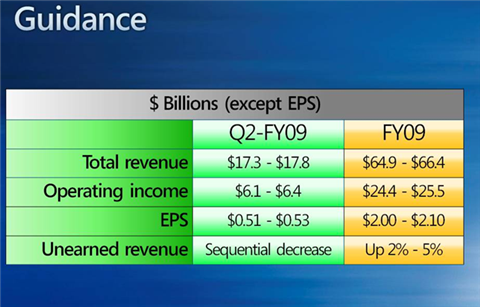

Microsoft projected revenue in the fiscal second quarter to be between $17.3 billion to $17.8 billion compared to Wall Street estimates of $17.98 billion. Earnings per share are expected to be between 51 and 53 cents a share compared to Wall Street estimates of 55 cents a share. For 2009, Microsoft said revenue will be between $64.9 billion and $66.4 billion (estimate $66.5 billion) with earnings of $2 a share to $2.10 a share (estimate $2.10).

The outlook wasn't perfect, but it was close enough--for now. However, Liddell didn't sound an optimistic note about the immediate future. "The environment clearly weakened in the third quarter," said Liddell, who said that Microsoft's previous assumption that the economy would improve in its fiscal second half isn't likely to play out.

In a statement, Microsoft execs made two points:

- The company's software can be used to cut your IT budget: Kevin Turner, chief operating officer, said: "Microsoft is uniquely positioned to help our customers save money through supplier consolidation, increased productivity, and a low total cost of ownership through the depth and breadth of our product portfolio and solutions."

- And that Microsoft is well positioned. Liddell said: "In a challenging economic environment, the first-quarter results exhibit the strength and diversity of our business model."

Although some folks will debate that first point, there's no question that Microsoft's model is a cash cow (except for that online unit of course).

Key conference call points:

- PC growth in the quarter was 10 percent to 12 percent. Most of that was netbooks, but officials said it's unclear whether these smaller devices are taking share away from traditional laptops.

- Microsoft reckons it can grow at a high single-digit to low double-digit clip even in a slowdown. But the projections for the second half of the year are uncertain (potentially guesses).

- Microsoft is pulling back on spending in lower priority areas. Liddell said Microsoft wants to be in a position to "dial up or down" based on the current economic environment.

- Emerging market demand (China and elsewhere) remains in tact.

- Netbooks could be disruptive to client margins--at least in terms of forecasting. It's unclear how Netbooks will impact Microsoft's licensing, but a lot of them run on Linux or stripped down XP.

By the numbers:

- Microsoft's online services business continues to lose dough. For the fiscal first quarter, Microsoft's online unit lost $480 million on revenue of $770 million. A year ago, the online unit lost $267 million on revenue of $671 million.

- Client revenue (Vista, XP et. al.) had an operating profit of $3.26 billion on revenue of $4.22 billion, roughly flat with a year ago.

- Server and tools delivered operating income of $1.15 billion on revenue of $3.4 billion.

- Microsoft's business unit (Office) had operating income of $3.3 billion on revenue of $4.95 billion. In the same quarter a year ago, the business unit had operating income of $2.7 billion on revenue of $4.1 billion. That performance reinforces what Microsoft execs have been saying: Office 2007 is a juggernaut.

- The entertainment and device division (Xbox) had operating income of $178 million on revenue of $1.81 billion. Sales were down from a year ago but profits were up.

- Research and development spending in the first quarter was up 24 percent from a year ago. Sales and marketing expenses were up 13 percent in the quarter with general and administrative costs up 24 percent.

- Microsoft ended the quarter with $20.7 billion in cash, equivalents and short-term investments.

And here's the outlook for those aforementioned units: