Microsoft's mixed quarter: 'We expect weakness to continue'

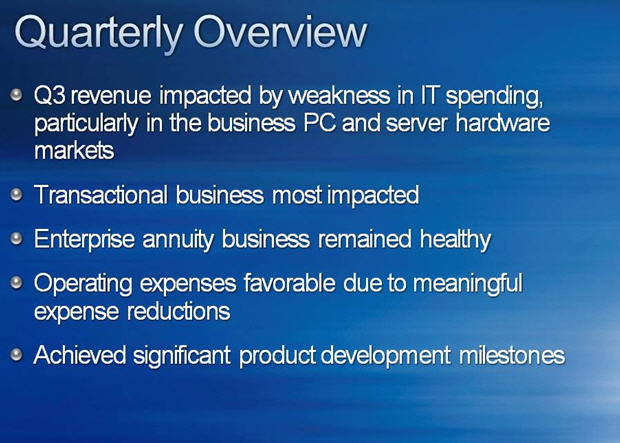

Microsoft on Thursday delivered a mixed fiscal third quarter with earnings that were on target, revenue on the light side and an outlook that projected weakness "to continue through at least the next quarter."

The company reported third quarter earnings of $2.98 billion, or 33 cents a share, on revenue of $13.65 billion. That earnings figure includes an investment and restructuring charge that adds up to 6 cents a share. Excluding those charges, Microsoft's earnings were in line with Wall Street estimates. Revenue, however, was lighter than Wall Street's projected $14.09 billion. Meanwhile, sales fell 6 percent from a year ago---the first year over year decline since Microsoft has been a public company.

In a statement, Microsoft acknowledged a few of the elephants in the room ahead of its earnings report. For instance, client revenue (Windows), the business division (Office) and server and tools all were hurt "by weakness in the global PC and server markets. On the bright side, Microsoft indicated that enterprise revenue was stable.

CFO Chris Liddell said the company's cost cutting effort went well---the software giant cut 5,000 positions. Unlike a few other tech giants, Microsoft declined to call a bottom. "We expect the weakness to continue through at least the next quarter," said Liddell. He later added that Microsoft expected a slow and gradual recovery.

Microsoft declined to give guidance other than its operating expenses.

Here's a look at the notable moving parts (click to enlarge):

By the numbers:

- Microsoft's client revenue was $3.4 billion, down from $4.03 billion a year ago. Operating income for the third quarter was $2.5 billion.

- Servers and tools revenue was $3.46 billion, up from $3.24 billion a year ago. Operating income was $1.34 billion.

- Business division revenue was $4.5 billion, down from $4.73 billion a year ago. Operating income was $2.87 billion.

- As usual, Microsoft's online unit lost money. The unit lost $575 million compared to $226 million a year ago. Revenue was $721 million, down from $843 million a year ago.

- Microsoft ended the quarter with $25.3 billion in cash, equivalents and short-term investments.