Microsoft's Q4 solid excluding charges; Windows 8 wait on tap

Microsoft's fourth quarter had a bevy of moving parts, but the results set the company up for a series of product launches including the latest Windows and Office.

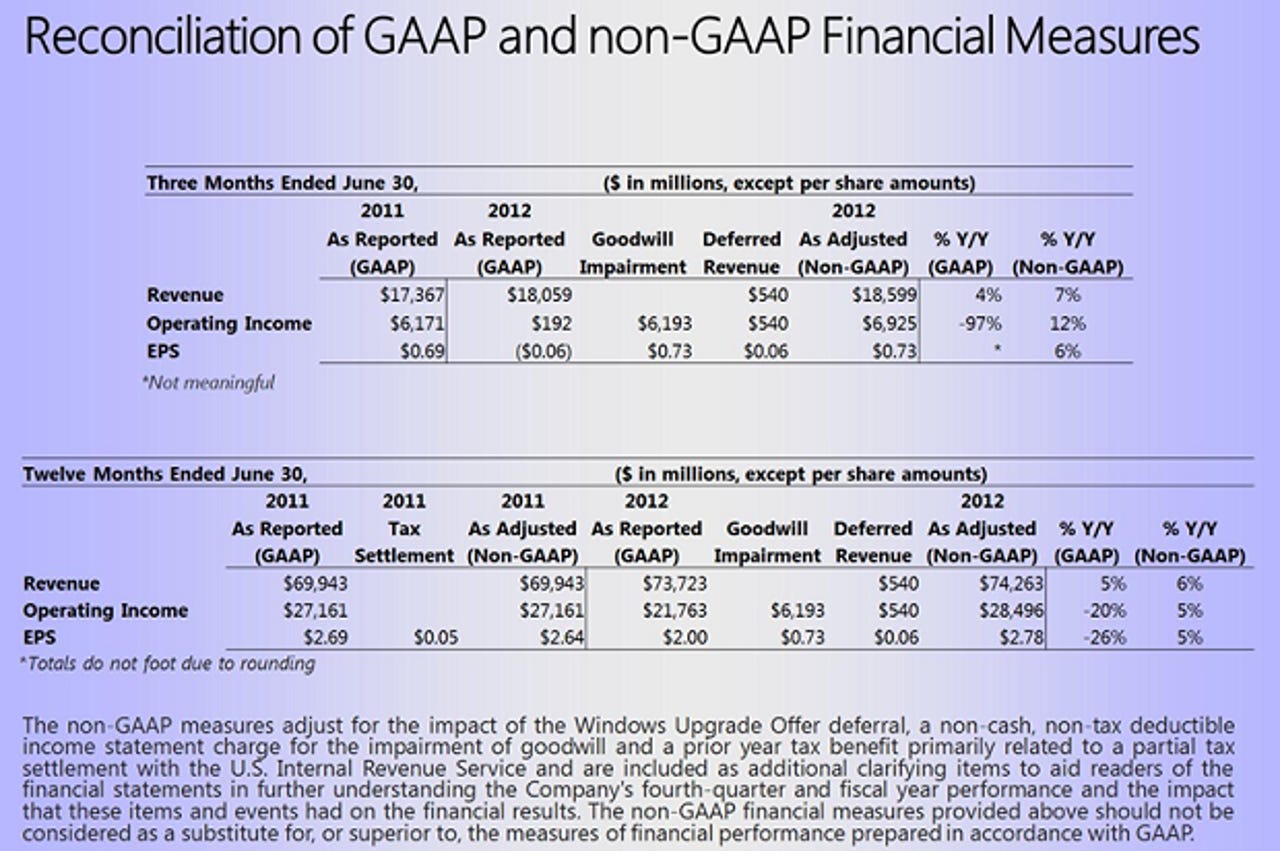

The company reported a fourth quarter loss of 6 cents a share on revenue of $18.06 billion. That sum includes a goodwill impairment charge from the acquisition of aQuantive as well as deferred revenue of $540 million due to Windows upgrade offers. Excluding those items, Microsoft reported non-GAAP earnings of 73 cents a share on revenue of $18.6 billion.

Wall Street was looking for fiscal fourth quarter earnings of 62 cents a share on revenue of $18.12 billion.

Given the addbacks, charges and other items, it's worth noting Microsoft's earnings bridge.

The biggest thing to note for Microsoft is that its online services unit losses were inflated due to the aQuantive charge. Excluding charges, Microsoft's online services unit reported an operating loss of $479 million, an improvement relative to the $745 million lost a year ago. For fiscal 2012, Microsoft's online division lost $1.93 billion.

In a statement, Microsoft CEO Steve Ballmer said that the next year will feature "the most exciting launch season" in the company’s history. For fiscal 2012, Microsoft reported earnings of $2 a share on revenue of $73.7 billion. That tally includes charges as well as deferred revenue.

Microsoft's businesses stuck to the script of recent quarters. The server and tools unit delivered fourth quarter revenue growth of 13 percent and the business division, which features Office, was up 7 percent. Microsoft's entertainment and device division saw revenue jump 20 percent largely because it now includes Skype.

As expected, Microsoft's Windows revenue fell 13 percent in the first quarter. Windows 7 is now on more than half global enterprise desktops.

By the numbers:

- The business unit was Microsoft's cash cow with fourth quarter operating income of $4.1 billion on revenue of $6.3 billion.

- The servers and tools unit reported an operating profit of $2.1 billion on revenue of $5.1 billion in the fourth quarter.

- Windows and Windows Live had operating income of $2.4 billion on revenue of $4.14 billion.

- Microsoft had cash and equivalents of $6.94 billion with short term investments of $56.1 billion. In total, Microsoft's war chest is $62.04 billion.

- R&D spending in the fourth quarter was $2.6 billion and $9.81 billion for fiscal 2012.