Morgan Stanley sees weakening outlook

Morgan Stanley has released a research note that analyses the results of a survey of its CIO database, which suggests a weakening of IT spend in 2013.

Key takeaways:

- 2013e expectations decelerating

- Overall 2013e growth has been revised downward since our last survey, slowing to +2.7 percent for the financial year

- Both US and EU sentiment has declined since October. EU and US growth are expected at +0.7 percent and +3.6 percent, respectively, down from +1.2 percent and +5.1 percent.

Positive indicators:

- The decision cycle of CIOs has continued to shorten.

Cautious indicators:

- There seems to be a shift towards more aggressive cost cutting compared to our last survey, and the percentage of CIOs expecting budgets to increase has fallen materially

- Additionally, there appears to be more willingness amongst vendors to discount, which indicates a tough sales environment.

As always, the devil is in the detail, but before getting into that, it's worth reminding about macro trends.

It's noteworthy that, on this occasion, general weakness is reported in both the UK and US. This does not surprise. At the end of last year, many companies in both geographies closed for an extended period over the holiday season. This was unusual. Europe is used to taking a longer break, whereas the US often takes less time out. Last year, the timing of the main holiday meant that for many, there was little point in breaking up the weeks. In addition, consumer spending was not as much of a bonanza as brands had hoped. Add in a procession of high profile brand failures in the UK, and it is not hard to see why sentiment has fallen. Back to the details.

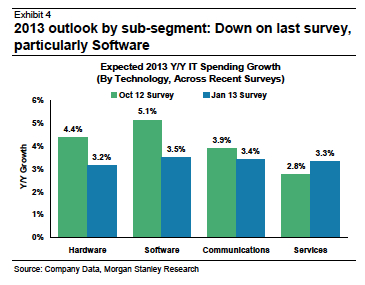

Morgan Stanley reported that weakness is not confined to any specific segment, but across the board (see illustration below).

The report draws attention to specific weaknesses in software, which the report authors described as:

Software spending growth (at 3.5 percent) is still expected to see the fastest growth in 13e, but this is the largest downtick (from 5.1 percent last survey). The data for SAP (OW) is slightly mixed, but still positive overall, we believe. ERP spending has fallen down the priority lists, but BI/Analytics, Cloud, and HR all remained strong, and the proportion of CIOs expecting to increase spending on SAP increased vs. the last survey.

The good news for some vendors is that spend on cloud technology, business intelligence, and HR are all expected to be strong areas, with cloud leading the field:

For the first time in recent surveys, Cloud Computing has placed highest in areas where CIOs expect highest increase in spending. In previous surveys, BI/Analytics has ranked highly and the results from this survey are in line with this pattern. Additionally, HR spending has increased in importance.

On the downside, consulting and outsourcing are the weakest areas of projected spend.

When Morgan Stanley looked at verticals, a mixed bag emerges. Retail and financial services are particularly weak while business services and technology are reported as more positive.

My take for vendors

Nothing much in this survey should surprise.

While high street retail may be weakening, and with no end in sight, online sales continue to take share. Businesses that start out online are far less likely to buy on-premise applications, although there are exceptions when those same businesses achieve large scale

Financial services have historically been strong tech spenders as they see this as a differentiator, so weakness here is bad news

The stronger verticals may be more optimistic, but they are more likely to opt for lower cost cloud solutions than on premise

While it is easy to fall in line with predictions on functional spend, I see this as incremental and not transformational. Any benefit that vendors see in concentrating on those segments may well be useful to keeping products alive, but buyers will be far more savvy about investment levels. Have alternatives in mind

Shorter decision cycles may be good for pipeline transformation, but expect pressure in price/value conversations

The market for business intelligence solutions is changing rapidly. While this is a hard market to break at scale, I am seeing strong growth in areas that contribute to goal driven outcomes. Be prepared for tough questions in this area

Presenting deployment choices will give buyers more comfort when considering how to spend their budgets. Have you got what it takes to present a coherent picture?

Look for CIOs who are aligning themselves to LOB leaders. That provides the "spread bet" opportunity that improves the likelihood of winning deals.

My take for buyers

It is no surprise that Morgan Stanley predicts aggressive discounting. If you're in the market, then bargain hard, but don't be tempted into bundling technology. That's lock-in by another name, and often carries hidden costs that don't emerge until very late in the deal.

While tech analysts will argue that it is always worth spending on improved functionality you have to question whether you're getting the right bang for the buck. We are seeing more buyers prepared to compromise on functionality if that means faster time to use/adoption and at lower cost.

Workday (financials) and Plex Systems (manufacturing) momentum, along with a generally improved sentiment to cloud solutions, should be a signal to look beyond incumbancy. If so, be careful to ensure you understand what you're buying into and that you have the right "apples for apples" kinds of comparison

Outcomes that speak to goals should be the watchword. Vendors who can show case studies that talk to that topic are few and far between, but they can be found

Budgets may be tight, and if you haven't already invested, then there is a risk that you take safe options. Businesses that invest in technologies that help transform for the digital age fare much better than those that don't. In other words, keep calm, but spend wisely

Check out the smaller consultancies that cover multiple vendors. That's where the innovation can be found. The big boys are (mostly) locked into a model that is tied to ERP and other older technologies. They find it hard to transition to new models and may no longer offer best value.