Motorola: Handset unit spin-off delayed; No Android 'til next Christmas; Layoffs on tap

Motorola's sick patient--its handset business--is too sick to spin off right now and it’s unlikely that a big bet on Google's Android operating system is going to save it. Meanwhile, Motorola won't deliver Android smartphones until this time next year give or take a few days.

The company said it is postponing the spin-off of its handset business. Motorola's plan was to quarantine the unit so its enterprise mobility and home networks unit could shine. Update: The Wall Street Journal is reporting that Motorola will layoff 3,000 employees, with the bulk of them residing in the handset unit.

Also see: Motorola picks Android in mobile phone shakeup. Ammunition for smartphone war?

Motorola on Thursday said the handset unit wouldn't be spun off until after 2009. Its previous target was the third quarter of 2009 for the handset business spin-off. In a statement (Techmeme), new CEO of Motorola's Mobile Devices business Sanjay Jha said:

While our strategic intent to separate the company remains intact, we are no longer targeting the third quarter of 2009, primarily due to the macro-economic environment, stresses in the financial markets and the changes underway in Mobile Devices.

The news isn't that surprising given the turbulence in the stock market, but there's another wrinkle: The mobility unit needs to revamp before it goes out on its own or it will fail quickly. For instance, is Motorola's handset business going to bet on Android? Does it have a hit design? Can it compete in smartphones? Those unresolved questions need to be answered before the handset business goes free.

Jha said on a conference call (see Silicon Alley Insider's live notes) that Motorola will focus on three mobile platforms--Android for mid- and high-end phones, Windows Mobile for some smartphones and a proprietary OS for low-end phones. The big takeaway: Motorola will launch Android phones in time for next Christmas. Motorola will also cancel a bunch of phones based on Symbian or Linux and Java operating systems.

Meanwhile, Motorola reported a weak third quarter. The company reported a loss from continuing operations of $397 million, or 18 cents a share, on revenue of $7.5 billion. Wall Street was expecting Motorola to report earnings of 2 cents a share on revenue of $7.82 billion. Motorola's earnings did include a bevy of charges:

If you exclude all of those charges, Motorola topped estimates on disappointing sales.

But the big picture is this: Motorola continues to be a tale of two companies--the home networks and enterprise units and the sickly handset business. For instance, Motorola's mobile devices unit had an operating loss of $840 million on sales of $3.1 billion, down 31 percent from a year ago. Motorola shipped 25.4 million handsets, but lacks a big hit. In fact, Wall Street was expecting Motorola to ship 27.4 million handsets. Perhaps the Motorola KRAVE ZN4 will fit the bill.

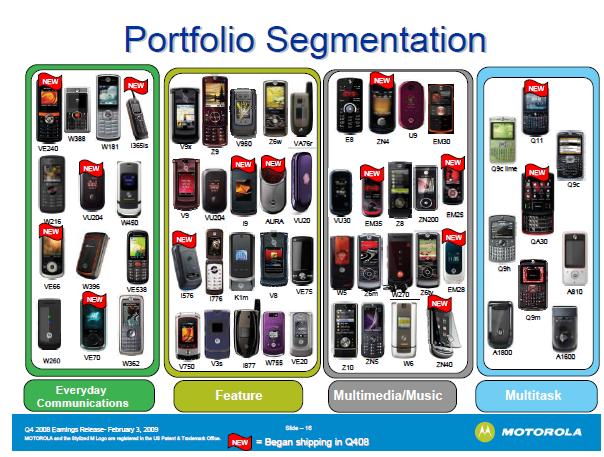

Jha said the handset business is way too complicated with 20 combinations of software, chips and user interfaces. In other words, Motorola's handset business is a rat's nest of product plans. Jha's job is to prune. This slide tells the tale of Motorola's mess of handsets:

Motorola calls that mess a portfolio. I'd call it a lack of focus. Judging from Jha's comments, Motorola isn't going to sweat its declining market share so it can focus on the financials.

Meanwhile, Motorola is set for a rough first half of 2009. Credit Suisse analyst Matthew Hoffman wrote:

Handset shipments of 25.4MM were lighter than expected; Motorola is now the world’s #4 global handset OEM (behind Sony Ericsson). ASPs were the bright spot in the quarter, coming in at $123, up 3% from $119 in 2Q08. Based upon Motorola’s results, we now believe 3Q08 global handset sell-in will be sized at ~317MM, up 4% q/q, lower than our initial 326MM estimate as sell-in slowed at the end of 3Q08. In addition, global handset market share is shifting to smartphone OEMs (e.g. Apple, RIM, HTC, etc.), and away from the traditional OEMs. We expect the traditional Big 5, led by Nokia, to continue to debut new smartphone models over then next twelve months. The combination of a weak economy and shifting preferences will keep pressure on those with weak line-ups.

The handset unit looks even worse relative to its sister divisions.

- The home and networks mobility division had operating earnings of $263 million on sales of $2.4 billion. The big story here: Motorola's operating earnings were up 65 percent on sales that were down 1 percent from a year ago.

- The enterprise mobility group had operating earnings of $403 million, up 23 percent from a year ago. Sales for this unit were $2 billion, up 4 percent from a year ago.

Add it up and you have two good businesses and a disaster. Motorola's outlook was also lacking.

Motorola projected earnings from continuing operations of 2 cents a share to 4 cents a share in the fourth quarter compared to Wall Street estimates of 7 cents a share. For the year, Motorola sees earnings of 5 cents a share to 7 cents a share roughly in line with expectations.