NBN October map update extending to three-year outlook

In five to six weeks, when the company responsible for the rollout of the National Broadband Network (NBN) updates its rollout maps, it will begin to provide information on its network rollout for the next three years.

Speaking to Triple J Hack yesterday, NBN CEO Bill Morrow said that the company feels it can provide more information now with a degree of accuracy.

"We now put out a forecast for the next 18 months, and probably in a month and a half, you're going to see a three-year view," he said. "You'll be able to go onto the website, at that point, look up your suburb, and see exactly when that's going to occur, or in the rough time frame as to when construction will start."

Soon after the 2013 election, NBN Co, as the company was then known, came under fire for removing a large number of premises from its rollout maps.

In its results announced yesterday, NBN posted a loss of AU$1.5 billion, with revenue coming in at AU$161 million, up from last year's AU$60 million.

The company also revealed that the cost of rolling out the network could blow out to AU$56 billion in peak funding. In its three-year corporate plan, NBN said the cost for the project will reach between AU$46 billion and AU$56 billion, with a base case peak funding target of AU$49 billion.

"Management are targeting a base case peak funding of AU$49 billion, which includes a contingency of AU$4.6 billion for unforeseen risks inherent in a complex infrastructure build over multiple years. This contingency is intended to cover revenue, operating costs, and capex risks," it said.

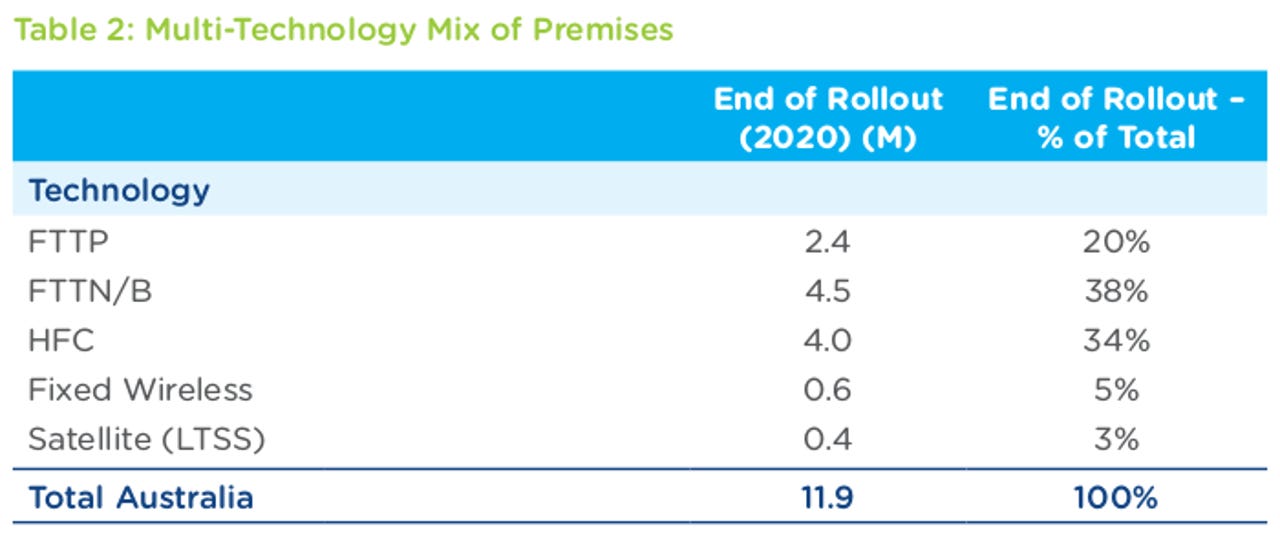

The new corporate plan also updated the variety of technologies that NBN would use in the so-called multi-technology mix (MTM) network. Compared to its previous 2014-17 corporate plan, NBN would reduce the percentage of premises able to connect via fibre to the premises (FttP) by 5 percent; the percentage of premises connected by fibre to the node (FttN) or fibre to the basement decreased from a collective 40 percent to 38 percent; while hybrid fibre-coaxial (HFC) jumped 7 percentage points to cover 34 percent of premises in the future. Fixed wireless and satellite remained unchanged, covering 5 percent and 3 percent of Australian premises, respectively.

The total number of premises dropped by 500,000, which NBN said was due to a change in the number reported by the Australian Bureau of Statistics.

On a state basis, NBN said Tasmania would be completed within three years, with the majority of other states being around the 75 percent mark at the same time.

Over the next three years, the company said that its wholesale speed mix would not change drastically, with the majority of users sticking to its 25/5Mbps plans or lower, and approximately 20 percent of users choosing the 100Mbps option.

"The NBN network is designed so that RSPs [Retail Service Providers] will be able to access wholesale peak speeds of 25Mbps download data rates at all premises, and of 50Mbps or greater in 90 percent of the fixed-line footprint," the company said.

NBN could see revenue drop if the copper quality in the network is not up to scratch.

"The quality of this network is not fully known, as there has been limited opportunity to evaluate the physical infrastructure at significant scale," the company said. "However, it is known that there is significant work required to remove broadband blockers from the copper network. If copper rehabilitation costs are prohibitively high in an area, NBN can choose alternative technologies to reduce costs."

The company also showed its internal calculations for the cost per premises (CPP) of each of the technologies used in the rollout.

Satellite and fixed wireless were the most expensive, at AU$7,900 and AU$4,900 per premises, respectively; rolling out FttP to existing premises cost AU$4,400, with new premises less than half the cost, at AU$2,100; more expensive than greenfields FttP, but cheaper than brownfields FttP was FttN, at AU$2,300; and HFC was the cheapest technology of all, at AU$1,800.

"The CPP reported is a weighted average over the full period of build (which extends beyond the corporate plan period, and as such contains estimates beyond FY18) and depends on a number of factors such as geographic build conditions, wholesale speed performance required by technology, population density of the area considered, the number of premises per multi-dwelling unit buildings, and the extent of reuse of the existing infrastructure," the company said.