NetApp delivers strong Q3, teases new hyperconverged systems

Enterprise storage vendor NetApp upped its outlook for the fourth quarter as its all-Flash arrays and new products gain momentum.

For the fourth quarter, NetApp projected adjusted earnings of 79 cents a share to 84 cents a share on revenue between $1.39 billion to $1.4 billion. Wall Street was looking for fourth quarter earnings of 77 cents a share on revenue of $1.4 billion.

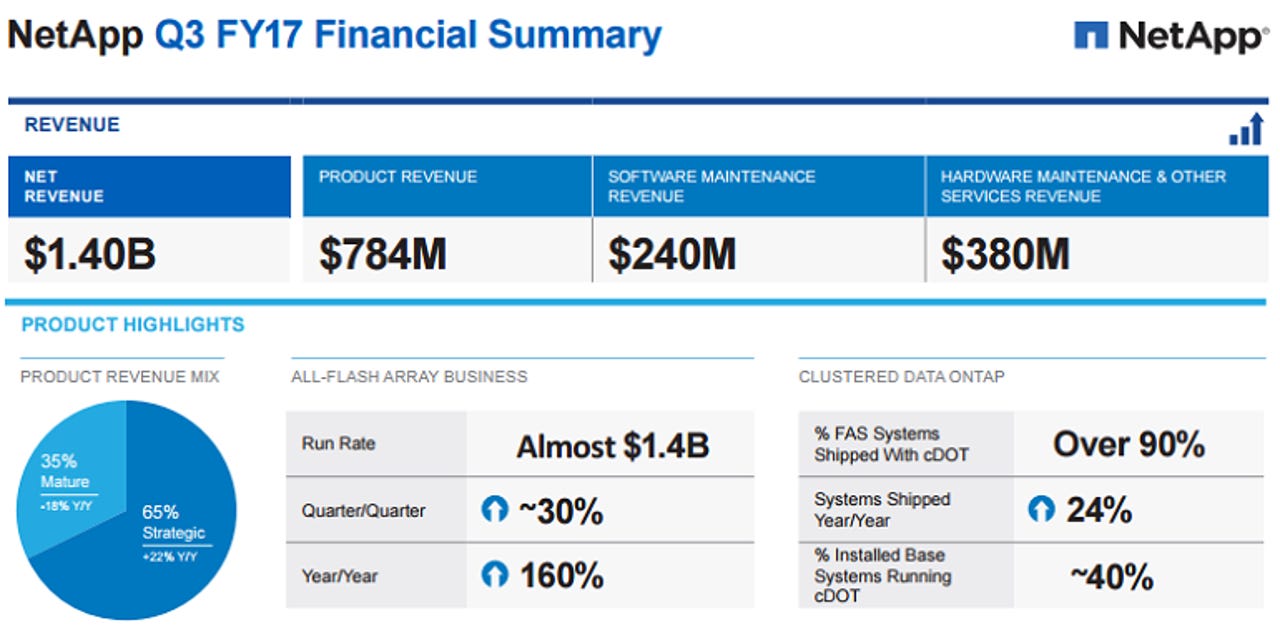

NetApp's transition to all-flash storage deployments has been rocky at times, but the company said that business is on a annual run rate of $1.4 billion now.

The company reported third quarter earnings of $146 billion, or 52 cents a share, on revenue of $1.4 billon. Non-GAAP earnings for the third quarter was 82 cents a share, well above the 74 cents a share expected by Wall Street.

On a conference call, CEO George Kurian said will use the acquisition of SolidFire, now a year old, to create new hyperconverged systems in the future.

Kurian said:

We are further leveraging our SolidFire investment and expanding our growth potential by developing the next-generation of hyper converged infrastructure, built on SolidFire innovation. We will do what has not yet been done by the immature first generation of hyperconverged solutions - bring hyperconverged infrastructure to the enterprise by allowing customers the flexibility to run multiple workloads without compromising performance, scale or efficiency.

Kurian added that this hyperconverged system sill be software defined and leverage data across multiple clouds. The system will be outlined in the first quarter of NetApp's fiscal year.

On the software front, NetApp noted that its ONTAP storage operating system is doing well with the installed base of customers.