NetSuite + AdaptivePlanning = BPM disruption

This slipped under the radar but on June 10th NetSuite and AdaptivePlanning announced a marketing and integration partnership that will see NetSuite acting as a reseller for AdaptivePlanning's business performance management (BPM) solution. Why should this matter?

So far, the saas/on-demand transaction app players have been running hell for leather to bring functionality to a point where they can compete effectively in mainstream deals. One area that's been ripe for disruption but which is buoyant is BPM. According to Channel Web:

Worldwide sales of business intelligence software, including BI platforms, analytical applications and performance management software, reached $8.8 billion last year, according to a new report from Gartner...The 2008 sales were up 21.7 percent over $7.2 billion in 2007, a remarkable showing given the economic headwinds vendors faced all year during which the U.S. was officially in a recession and much of the rest of the world's economies were struggling.

"In tough times, the first step is to increase transparency, which helps identify cost centers and then to more tightly align strategy with execution," said Gartner analyst Dan Sommer in a statement.

The recession may be a two-edged sword for BI software vendors and their channel partners. Some prospective customers may delay product purchases as part of their overall cost-cutting efforts, but the need for companies to improve visibility into their business operations and gain control of their spending may be boosting BI software sales.

We have to be a tad careful not to totally confuse BI with BPM but they tend to come under the same broad umbrella.

BPM has been one of the few bright spots in enterprise sales but it often comes with a high price ticket. Part of the reason is that BPM is an add-on to existing database structures which require a lot of heavy lifting in the form of ETL plus mapping to solutions. This has been a sticky issue for many years because many of the tools have not really advanced as much as the front end functionality. IT needs to be involved, a lot of (expensive) horsepower is required and the ability of the incumbents to get tools into the hands of many users has been difficult.

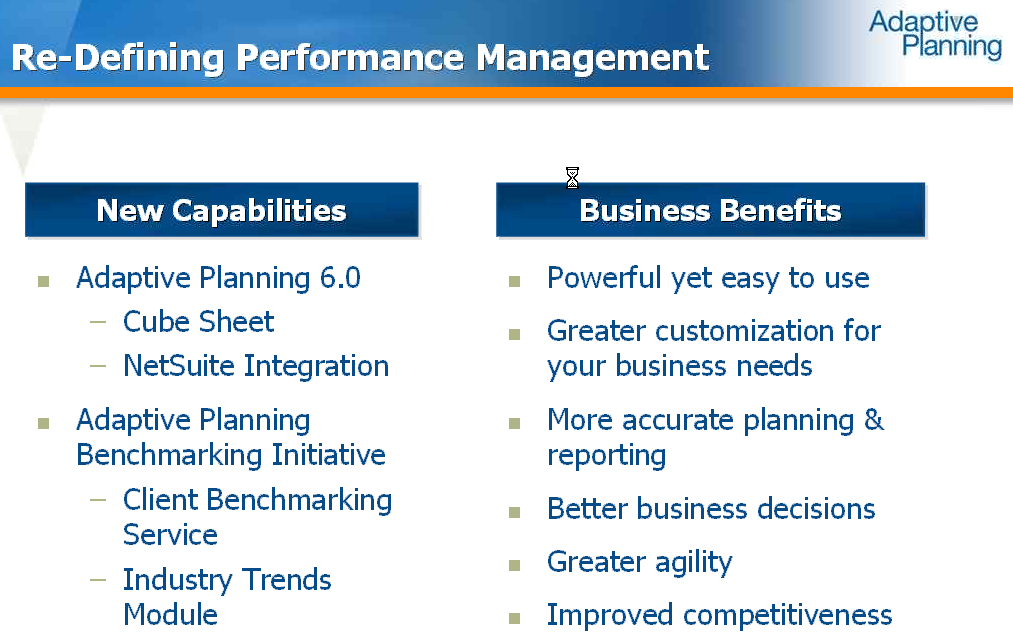

The surprise with the NetSuite and AdaptivePlanning deal is that none of the heavy lifting usually associated with reporting is required. So far, they've done a one way integration from NetSuite to Adaptive. In the future they will have a two way connection, vital for tying up the loose ends of putting planning into practice.

During my conversation with Bill Soward, CEO of Adaptive, he said the magic words: "The link is saas to saas so even though you can think of it as a sort of batch operation, it's pretty much minutes." As the comic books say: 'Kerraaaaanng!' This is a massive advantage because it not only cuts time to information but it means that much of the cost associated with BPM evaporates. That allows Adaptive to offer its solutions at an average implementation cost of $15,000 with a per seat price of $800 per user.

Compare with Host Analytics, another saas BPM provider, which is trying to go up against SAP/Oracle at a price point of some $50-60,000 - which is competitive in anyone's language for an enterprise deal in this space. Compare again with BusinessObjects, Hyperion and Cognoes where you'll see precious little change from $100,000 before the obligatory 17-22% maintenance fees, consulting, implementation and hardware costs, often to reach a handful of finance and market analysis rock stars.

Adaptive is able to reach 1:15 employees in a 200 person company across both finance and sales. NetSuite on the other hand expects to reach everyone in a similar sized company. Think about it. If NetSuite is already reaching this level of penetration then it bodes very well for Adaptive and/or Adaptive style solutions alongside NetSuite while NetSuite has an extra strong string to its bow.

There is more. Since Adaptive is a saas solution, it can use the data it unearths to provide broad industry benchmarking data. In this economy, what company would not wish to know how its performance fares against its peers? What business would not like to discover others with which it might share resources?

I also spoke with NetSuite about the offering. They were a little less gung ho about it and I was surprised they didn't seem to have thought benefit all the way through. That might be a tad harsh because this is a fresh deal and Adaptive are in the driving seat when it comes to knowledge about how this can change the planning and modeling landscape, especially for big 'M' in the SMB space. As with all partnerships of this kind, both parties need to be joined at the hip and that's not quite where they're at today.

This is exciting stuff. The SMB market has been poorly served in the analytics space, often defaulting to Excel, a tool I have long railed against as dangerous. Right now, mid market businesses are especially vulnerable for all sorts of structural and economic reasons. They need tools such as these. If Adaptive is able to drive adoption through NetSuite's larger channel AND is able to make the concept of bench marking stick then it becomes a disruptor the incumbents will struggle to compete against. And that despite their longevity and deep experience.

Assuming NetSuite and Adaptive make a good go of this then there is a clear win-win-win. How many times do you see that in the on-premise world?