Nokia and Microsoft: Economics, risks of a 2-year transition to Windows Phone 7

For today, the focus of the Microsoft and Nokia partnership revolves around smartphones, Windows Phone 7 and an app ecosystem, but the economics of the pact will soon move to the front. The biggest unknown is whether Nokia can endure a two-year transition to Windows Phone 7 devices in a mobile world evolving so quickly.

In many respects, the Microsoft-Nokia partnership is similar to the search pact the software giant has with Yahoo. Microsoft pays for share and the partner can focus, cut research and development spending and lay off employees to become more efficient.

Here's a look at what's known at the moment. Also see: Nokia/Microsoft partnership - Winners and losers

Benefits to Nokia:

- According to the New York Times, Nokia was offered "hundreds of millions" in engineering assistance and marketing support. Needless to say, Microsoft paid Nokia nicely.

- Nokia gets to pare down a bloated corporate structure. Nokia CEO Stephen Elop on Friday alluded to cost cutting, job retraining and layoffs ahead. Reuters notes that there may be "thousands of layoffs ahead."

- With a pared down structure, Nokia can focus, become more streamlined and potentially get a cut of future ad revenue via Bing and location based services.

- Microsoft's marketing budget can help Nokia break into the U.S. and open a new market.

- CNet News' Stephen Shankland quotes Elop: "We have different forms of value transfer in different directions. We have new opportunities that come from advertising and new forms of monetization." It's safe to say Nokia comes out ahead on the payment side of the equation.

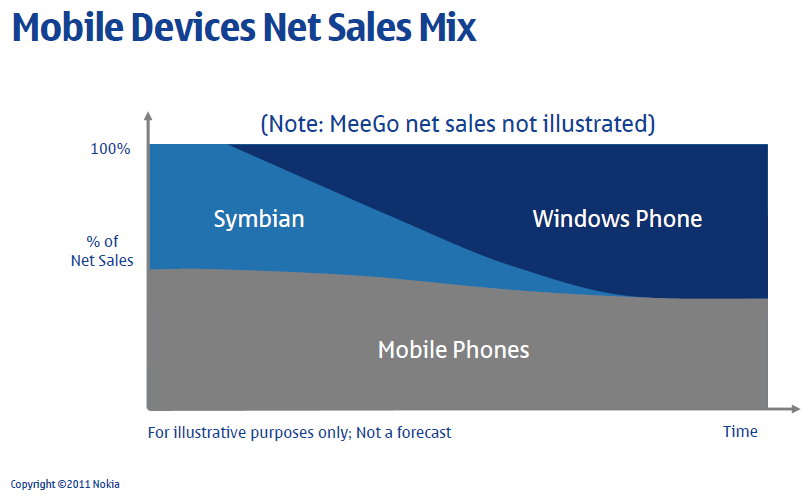

- It's unclear what Nokia spent on software development, but this chart highlights how costs will be dropping dramatically. Nokia will ship Windows Phone 7 devices in volume in 2012 as Symbian is phased out, support costs will decline.

Benefits to Microsoft:

- Microsoft gets distribution for its Windows Phone 7 OS. It's unclear what the licensing arrangement is between Nokia and Microsoft, which will collect undisclosed royalties.

- The software giant dents what could have been mobile domination by Google.

- Microsoft will get more developers on board due to Nokia's global distribution.

- Note many of the benefits to Microsoft are intangible. Microsoft becomes a mobile player again, but as we know from the company's Internet efforts---profits can be elusive.

Risks to both:

The biggest risk to Nokia and Microsoft is the transition period. Nokia indicated a two year transition period to Windows Phone 7 devices. The smartphone market operates in dog years. Two years is an eternity and if consumers don't play ball with Nokia and Microsoft, both companies could become irrelevant.Stifel Nicolaus analyst Doug Reid noted:

Nokia’s planned transition period to a Windows Phone smartphone OS world appears to be slow. Notably, Nokia did not announce a Windows Phone product. Interim plans for multi-OS support to add to cost burden during long path to market share recovery. Curiously, Nokia plans to proceed later in 2011 with the introduction of a smartphone based on Nokia’s MeeGo platform. Nokia also plans to continue to launch new Symbian-based devices, with plans to ship up to 150mn such devices. CEO Stephen Elop indicated that the agreement with Microsoft was non-exclusive and that 2011 and 2012 would both be transition years for Nokia. Nokia declined to provide clear guidance for 2011, citing uncertainty related to the OS transition.

In other words, this two-year transition period is going to mean some economic pain for Nokia. Barclays analyst Andrew Gardiner crunches a few numbers:

The one piece of financial guidance provided by Nokia was that they expected Devices and Services operating margins to return to greater than 10% following the transition period of 2011 and 2012. Implicitly, they are therefore guiding for margins to be below 10% in this year and next, which is below our current estimates of 11% and 13%. This assumes a steady deterioration in industry gross margins. Nokia currently posts 29% gross margins.

Bottom line: Nokia is in for a rough two years and when it emerges with Microsoft's mobile OS it's unclear what market share base it will be working from.

More: Nokia statement, Microsoft statement and open letter

- Windows Phone 7 gets asked to the mobile dance by Nokia

- What will the Nokia deal mean for Microsoft's other phone-maker partners?

- Nokia/Microsoft partnership - Winners and losers

- Nokia to rely on Microsoft's Windows Phone 7: 'This is now a three horse race'

- Microsoft and Nokia announce my dream partnership so why aren’t you all happy?

- CEOs: Nokia, Microsoft join forces to disrupt mobile ecosystems

- Nokia and Microsoft announce Windows Phone partnership

- Nokia and Microsoft team up: Suffering together, merging to survive?

- Google vs. Microsoft: The ongoing battle moves to Nokia’s “burning platform”