Nokia Q3: By the numbers

Nokia's third quarter results are a small improvement on its second quarter results. A mixed results package, there are a few glimmers of light at the end of the tunnel for the Finnish phone giant.

- Nokia saw a Q3 loss of €576 million ($754m);

- Net sales on devices are down to €7.2 billion ($5.49bn) from €8.98 billion in the same period a year ago, a decline of 19 percent on Q2 2012;

- Smartphones sales dropped by 37 percent in Q3 2011 on the previous quarter;

- Non-smartphone sales increased by 4 percent on the previous quarter to 77 million, but dropped 15 percent year-on-year.

- Its current net cash position stands at €3.6 billion ($4.72bn) -- down from €4.2 billion ($5.17bn) in Q2.

But Lumia sales, the Windows Phone-powered smartphone keeping the company's barely beating heart in rhythm, have declined rapidly in the past quarter. This can mostly be attributed to the decline in sales, due to the existing Lumia smartphones' incompatibility with the latest Windows Phone 8 software.

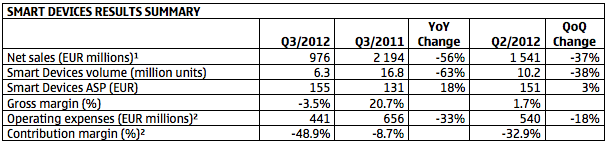

However, Symbian and MeeGo continue to hold the crown in Nokia's smartphone device portfolio, despite pushing for the Lumia lineup. The figures show a year-on-year decline by 63 percent in Nokia's 'smart' devices range: unpopularity for Symbian and MeeGo, and a tepid consumer response to the Lumia range.

- Nokia shipped 6.3 million 'smart' devices in total, including 2.9 million Lumia devices -- a 28 percent drop from Q2 -- meaning 3.4 million devices shipped were running the Symbian or MeeGo mobile operating systems;

- Smartphone shipments were down from 10.2 million 'smart' devices in Q2, and down from 16.7 million 'smart' devices in Q2.

- Compare this to recent figures by Strategy Analytics, where Samsung sold 55 million devices and Apple sold 27 million iPhones, Nokia's performance in the smartphone sector is pretty abysmal.

Breaking down the numbers by geographical area and region, Nokia lost out across all continents year-on-year, but was hardest hit in Greater China and North America where interest for Nokia feature phones are in decline.

Europe, where Nokia is based, also saw a 19 percent decline year-on-year. However, from the previous quarter, only the Asia-Pacific and European regions saw growth.

Having said that, the firm's telecoms joint venture, Nokia Siemens Networks, showed record profits. Sales at the division rose by 3 percent to €3.5 billion ($4.58bn).

While Nokia's deep decline during the first and second quarter, the firm's share price is looking healthier again. Nokia currently looks like this:

- Nokia's share price is up more than 8 percent on NYSE pre-market trading, but settling down around 5--6 percent in the early morning;

- Nokia's market cap stands at $11.01 billion, around 92 times less than its peak in 2000;

- Nokia shares have dropped 68 percent since unveiling its Windows phones strategy;

- 15,000 employees lost year-on-year. Currently, Nokia has 105,000 employees across its entire global operations.