NPD: RIM, Android best Apple in Q1 2010 mobile phone adoption

The competition is heating up to unseat Apple as smartphone king.

According to more than 150,000 self-reported surveys by U.S. wireless users assembled by the NPD Group, the BlackBerry operating system counts the most users, at 36 percent.

Android phones? 28 percent.

Apple? 21 percent.

NPD also found some interesting sales numbers broken down by carrier:

- Sales at AT&T made up 32 percent of the entire smartphone market.

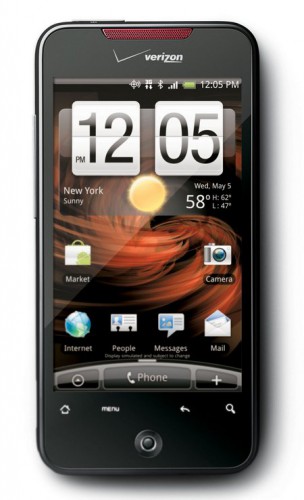

- Sales at Verizon made up 30 percent.

- Sales at T-Mobile made up 17 percent.

- Sales at Sprint made up 15 percent.

NPD said strong sales of the Motorola Droid, HTC Droid Eris, and RIM Blackberry Curve -- thanks to heavy marketing and buy one, get one promotions -- helped keep Verizon competitive with AT&T in the first quarter.

The average price of a smartphone dropped 3 percent to $151; meanwhile, the average price of all mobile phones increased 5 percent to $88.

What this means: an increase in smartphone sales is skewing the average price of all phones higher, but it's also showing that competition among smartphones is generating price wars, too.

The NPD figures are interesting in context of sales figures from one year ago, which showed the following breakdown:

- RIM BlackBerry Curve (all 83XX models)

- Apple iPhone 3G (all models)

- RIM BlackBerry Storm

- RIM BlackBerry Pearl (all models, except “Flip“)

- T-Mobile G1

RIM was able to dominate this list thanks to Verizon's hard push for buy one, get one promotions.

There are a few key takeaways from these figures, as far as I can see it:

- If you have a hot device (Apple iPhone), you'll gain market share.

- If you don't have a hot device (RIM BlackBerry), ubiquity and aggressive pricing will help gain market share.

- If you have neither (Palm Pre) and are late to the pricing game, you will lose market share.

As I've written before, Android seems to be sweeping up what's left of the mobile market that isn't called "iPhone" and "BlackBerry." At risk: Windows Mobile, Palm, and any company that dominates standard mobiles phones but hasn't gotten their smartphone act together (Nokia, Samsung).

Skeptical? ZDNet editor-in-chief Larry Dignan is. As for me, I would simply note that these figures are only for one quarter -- one in which Apple hasn't announced anything iPhone-related. A better picture would be responses over a year's time, which would account for the ebb and flow of the product cycle.

Update: The original version of this post accidentally mislabeled sales information from a 2009 NPD survey, which I originally wrote about here and intended as context. I regret the error, and have rewritten the post accordingly.