Nuance navigating cloud curves

Voice recognition company Nuance Communications is seeing some financial turbulence as it transitions from a licensing model to one based on cloud computing subscriptions.

It's a transition most enterprise software companies are facing, but Nuance is seeing a pronounced change in its once fast growing mobile business.

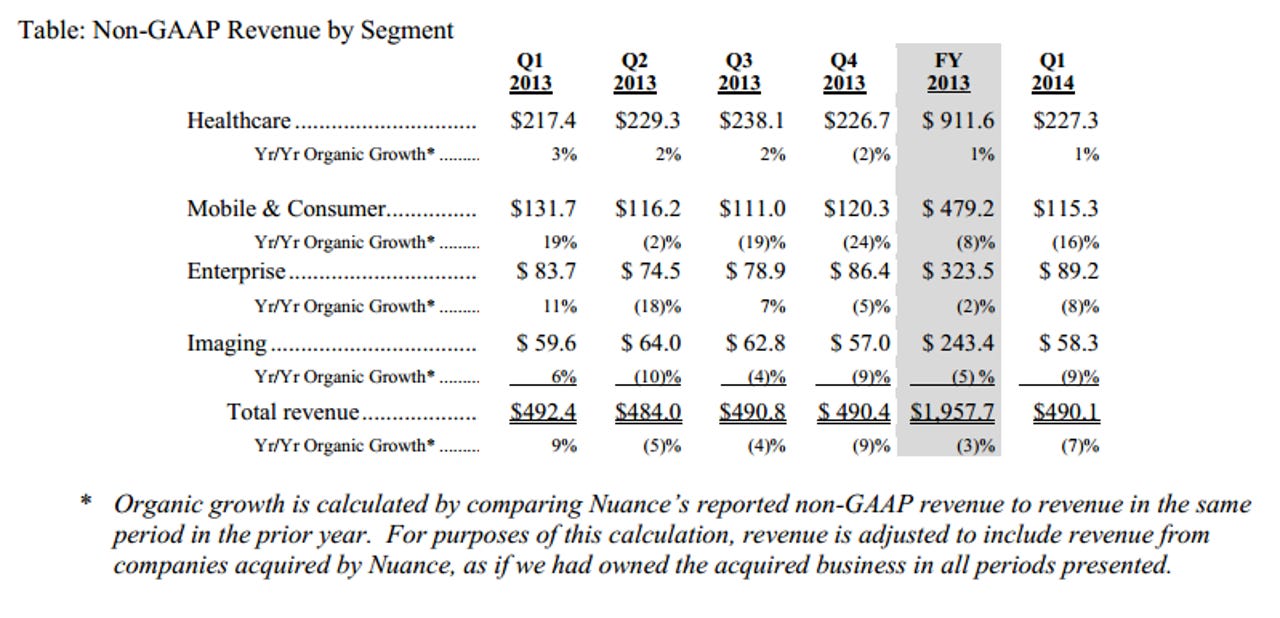

Nuance reported a fiscal first quarter loss of $55.4 million, or 18 cents a share, on revenue of $470 million. Non-GAAP earnings for the quarter were 24 cents a share, three cents better than expectation.

The company said its quarter was carried by the renewal of a healthcare contract with the Veterans Administration as well as a connected car deal with General Motors.

But what was worrisome to analysts was Nuance's mobile and consumer revenue declines. Mobile revenue fell 16 percent from a year ago in part because Dragon NaturallySpeaking sales were down and customers are moving toward Nuance's cloud services over embedded deployments.

In prepared remarks, Nuance noted:

Over the last two years, we have driven a transition in this segment to more comprehensive, cloud-based solutions across a variety of devices and products as we have seen continued strong demand for differentiated, natural language virtual assistants and other solutions.

Nuance said that it delivered connected software for the Samsung Galaxy Note 3 and Samsung Galaxy Gear in the quarter. The company also said that it will have to invest in its cloud infrastructure for mobile as well as research and development.

Fortunately for Nuance, its healthcare business is already transitioning to the cloud and has made the turn recently. Nuance also said on-demand revenue and renewals were strong in the enterprise unit.

As for the outlook, Nuance projected fiscal 2014 non-GAAP revenue of $2.03 billion or $2.09 billion and GAAP sales between $1.97 billion to $2.03 billion. Nuance added that non-GAAP fiscal 2014 earnings will be between $1.07 to $1.17 a share.

The second quarter revenue tally will be $476 million to $490 million on a non-GAAP basis with earnings of 21 cents a share to 25 cents a share.