OK, Vonage IPO investors may catch a break, but what were you smokin' to begin with?

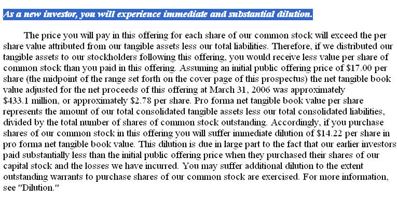

There it is. A living, breathing, frank admission on the part of Vonage that the IPO price ($17 a share, now declined to $11.63 at the end of Thursday's trading) was not going to hold up in the short term.

I didn't say, and they didn't say might not dilute. I said, and much more importantly, Vonage said, will dilute.

Hope and denial. I know them well.

In the past, I have pursued business relationships and personal relationships when all I wanted to think about were that a vague concept would really throw the till into high gain, or that a polite smile was equal to love.

Hope and denial. I've seen this over the last few weeks, when several of my posts explaining Vonage's long-term challenges as they've headed into this IPO were met by legions of "Vonage is great" comments - some possibly part of an organized lobbying effort.

Now, even some of those enthusiastic IPO participants and backers seem to be having second thoughts. The Vonage Forum's Vonage Stock Forum area is replete with a wide range of opinions. Some still are keeping the faith, others wonder if they refuse to pay for their IPO share allotment, whether or not Vonage will hire a collection agency to go after them.

"Wrong, Wrong, Wrong.... A judgement will be required to hit your credit report (depending on your jurisdiction)," writes Vonage Forum Member btrader.

Then btrader adds:

"Suck it up? Why? We got the shaft... This stock should be HALTED until the SEC and/or NASD (National Association of Securities Dealers) decide on the following...

1. Mispricing of the securities

2. Disclosure infractions, as reported about an hour ago on Bloomberg

3. Contradictory statements made to CNBC during the quiet period.

4. Website problems, and liquidity issues involving DSP customer/clients."

The whole matter of shareholder liability for declared purchases as part of the Vonage IPO's Directed Share Program is still somewhat unclear. Just this morning, The Wall Street Journal reports that errors in the DSP could enable purchasers to catch a break.

"In its prospectus filed with the Securities and Exchange Commission, Vonage said an active hyperlink to the prospectus was missing in its initial e-mail to prospective participants in the Vonage Customer Directed Share Program," the Journal reported. "As a result, Vonage said it is possible that it could be determined that the e-mail and the first page of a Web site about the IPO, vonageipo.com, could be determined to be an "illegal offer" in violation of securities laws.

Recipients could seek to recover damages or seek to require Vonage to repurchase shares at the IPO price, the Journal noted.

Busy time ahead for phalanxes of lawyers.