Oracle: Delivers strong quarter; Outlines plans for Sun

Updated: Oracle delivered better-than-expected fiscal second quarter results, touted its applications business vs. SAP and said it expects the European Union to "unconditionally clear the acquisition of Sun in January." Oracle also outlined some of its strategy for taking Sun hardware upmarket.

The company reported net income of $1.5 billion, or 29 cents a share, on revenue of $5.9 billion, up 4 percent from a year ago. On a non-GAAP basis, Oracle had earnings of 39 cents a share, 3 cents better than Wall Street estimates. Oracle's second quarter sales were also better than the $5.7 billion expected by Wall Street.

According to a statement, Oracle reported its best second quarter operating margin in its history. In addition, the third quarter outlook was also strong. Sun projected GAAP earnings of 36 to 38 cents a share, or 30 to 33 cents a share in constant currency. Wall Street is expecting fully loaded earnings of 29 cents a share and non-GAAP earnings of 36 cents a share.

Meanwhile, Oracle said it expected the EU to approve its acquisition of Sun. Oracle president Safra Catz confirmed reports that the EU was leaning toward approval of the merger. Oracle moved to reassure MySQL customers earlier this week. On a conference call, Catz said that the Department of Justice, advisers and other U.S. representatives were helpful in dealing with the EU and getting a good outcome. Catz said:

"We expect the European Commission to unconditionally clear the acquisition of Sun in January."

And no Oracle quarter is complete without a few jabs at SAP. The company said it took share from SAP in every region. The applications business grew 1 percent in the Americas and 2 percent in Asia Pacific in constant currency. Keep in mind that comparing Oracle and SAP has historically been difficult because the two companies don't deliver figures that are directly comparable. For its part, SAP announced a global enterprise agreement with oil giant Valero.

Catz said SAP "was coming apart at the seams." So much for diplomacy (and accuracy). SAP isn't firing on all cylinders, but it's far from collapsing.

On a conference call with analysts, Catz said the strength in the quarter was "broad based" and "our pipelines continue to be strong."

Catz added that Oracle is closing deals and spending is picking up overall.. "We are seeing a real recovery," said Catz.

CEO Larry Ellison spent his time on the conference call talking about Sun. He added that he expects Sun to improve market share and margins when the deal closes. That would be a good move considering Sun is being targeted by IBM and HP and losing share.

Ellison also gave some insight to his Sun strategy. In a nutshell, he's staying out of the high-volume, low margin game that IBM and HP play. Simply put, Ellison is taking Sun upmarket with hardware-software devices like the Exadata database machine. Exadata has been a hit, said Oracle executives, who noted that orders have tripled sequentially and the biggest problem right now is manufacturing enough systems.

The future of Sun will rest with high-value systems, said Ellison, who added the computer industry is focused on selling components instead of complete packages. Ellison, who is modeling Oracle-Sun after T.J. Watson's IBM, added that Exadata can be a multi-billion-dollar business "not including maintenance."

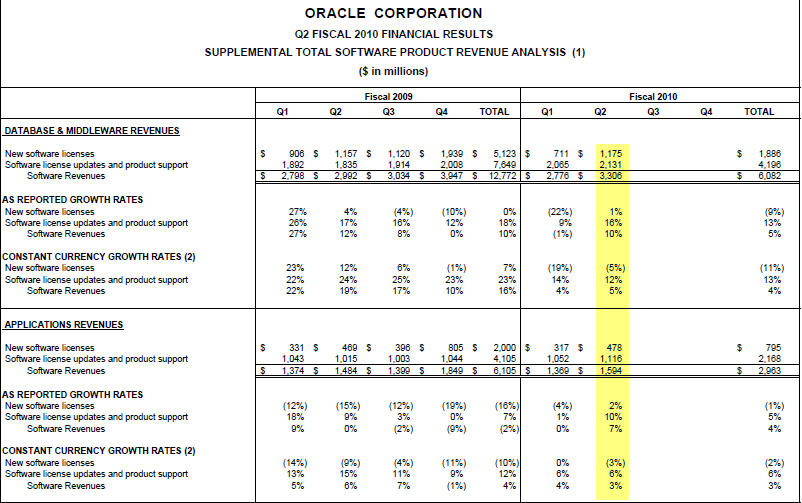

- Oracle's database and middleware revenue in the second quarter saw a jump in new software licenses to $1.17 billion, up from $711 million in the first quarter. Compared to a year ago, new licenses for database and middleware was up slightly. Overall, revenue for database and revenue was $3.3 billion, up from $2.99 billion a year ago.

- Application revenue was $1.59 billion in the second quarter, up from $1.48 billion a year ago. New software license revenue for the second quarter was $478 million, up from $469 million a year ago.

- Consulting revenue in the quarter was $692 million, down from $842 million a year ago. On demand revenue was $188 million, down from $189 million a year ago.

- The company ended the quarter with 83,366 employees, down from 84,639 in the first quarter.

The big question for Oracle is whether large deals are coming back. Analysts were mixed, but executives sounded upbeat. JMP Securities analyst Patrick Walravens noted:

As we have previously noted, there appears to be some indication that the strategic business is coming back to life including indications regarding a couple of transactions that appear to have been in the eight-figure range.

Jefferies analyst Ross MacMillan adds:

We think applications saw a pick up in RFP activity in the quarter, but we don't believe close rates improved materially nor did we see a return of larger deals. We believe the applications business could improve as we work through sales cycles in the February and May quarters.