Oracle spinning its numbers a tad too much?

Michael Hickins at BNet accuses Oracle of 'lying' about its competitive position vis-a-vis SAP. Such statements are always fraught with difficulty for several reasons:

- The year ends are five months apart

- The economy has been changing over time

- Currency rates are volatile: Oracle reports in US dollars, SAP reports in Euros

- Each company makes slightly different assumptions about the way they report

- Trying to get behind the figures is never easy - claim and counter claim abound. Whenever Oracle takes a pop at SAP, SAP comes back saying it is seeing no real evidence or that reported Oracle wins are in small subsidiaries.

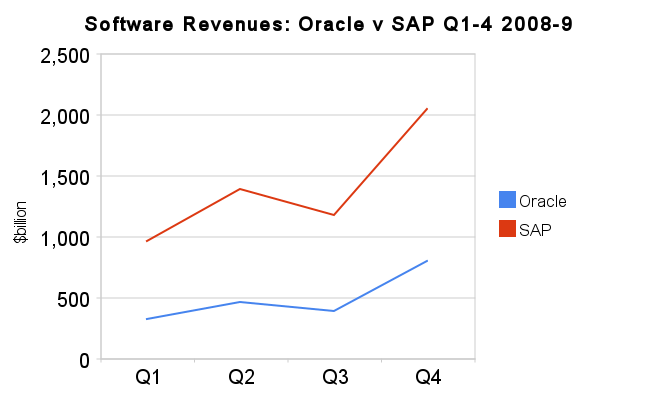

The table at the top of this post attempts to show what is happening on a like for like basis. I've taken SAP's applications software results for Q1-4 2008 which ended December, 2008 and compared those with Oracle Q1-4 2009 which ended 31st May, 2009. I've then adjusted SAP's Euro rate for the currency rate Oracle used for its non-GAAP earnings report. I realize this is an odd way to do things but it provides a better like for like comparison based on the way software sales actually happen in the real world. On that basis, the revenue patterns look remarkably similar. SAP dipped more sharply at Q3 than Oracle but accelerated faster in Q4.

In comments to Hickins post, Karen Tillman of Oracle Communications said:

Michael ? Lying? If you look at year-over-year growth rates of Oracle and SAP for the last two quarters, whether in constant currency or in USD, we are outperforming SAP in every region.

And, that doesn't take into account that SAP includes Business Objects sales in their applications numbers. Oracle's apps numbers are purely applications. If you took Business Objects out of SAP's applications number for an apples-to-apples comparison, the difference would be even more dramatic.

The beauty about facts is, they don't lie.

That depends on who's doing the telling and on what basis. In this case, she cites BusinessObjects but I could equally cite past acquisitions such as PeopleSoft, JD Edwards, Hyperion and Siebel. I"m betting that if those were stripped out there would be precious little left for Oracle to crow about, whichever way you slice 'n' dice the numbers.

The more egregious part of Oracle's earnings statement comes where President Charles Phillips says:

We grew faster and took market share from SAP in every region around the world” said Oracle President Charles Phillips. “In Europe our applications business grew 5 percent in constant currency versus negative 27 percent growth for SAP in their most recent quarter. Historically Europe has been an SAP stronghold, but these results prove that we can compete and beat them everywhere.”

There is no way to prove that claim one way or the other. Oracle's comparisons may look impressive but remember that Oracle's Q4 results represent two-thirds of as yet unannounced Q2 earnings for SAP on my basis for comparison. Also remember that while the percentages look starkly different, Oracle is assuming that its only competition is SAP. That's simply not true. Neither is the converse.

This is not a new story by any means. Check what Frank Scavo said back in October, 2007:

These results do not look great in comparison with Oracle's most recent quarter (its Q1). Last month Oracle reported a 35% increase in new license sales, including a 65% increase in application software revenue. Of course, Oracle's results include the benefit of its new acquisitions of Hyperion and Agile Software. Its not clear to me how much of the increase is due to revenues from those product lines, but it certainly can't explain all of the difference from SAP's growth rates...

...Separately, SAP announced that it had won a deal with Wal-mart for financial management software.

Go figure?

SAP is due to report its Q2 numbers next month. I'm sure they will be pored over as well.

PS - I'm an accountant by trade - line six more up against me and you'll get seven different results. ;)