Peloton wrestles with supply, demand imbalance in Q4, but so popular it can cut sales and marketing

Peloton has so much demand that it doesn't have to advertise as it works through a supply and demand imbalance for its bikes.

The digital fitness company raised its outlook for the fiscal fourth quarter as demand for home gyms surge amid COVID-19 concerns and closed brick-and-mortar fitness centers.

Peloton said it will deliver fourth quarter revenue of $500 million to $520 million with adjusted EBITDA of $55 million to $65 million. For fiscal 2020, Peloton projected 1.04 million to 1.05 million connected fitness subscribers. Fiscal 2020 revenue will be between $1.72 billion to $1.74 billion.

- Best Peloton alternatives: Top smart exercise bikes

- Peloton's logistics, supply chain improvements bolster Q2 sales as company sees app as lead-gen tool

- Peloton has big ambitions, big IPO as competitors loom

While Peloton is losing money, the company is indicating that it has a few financial levers to pull. For instance, Peloton said that it expects "significant reductions" in sales and marketing due to lower advertising spending. Sales and marketing savings will be offset somewhat by extending free 90-day trials of Peloton Digital. That app is a primary upsell vehicle for Peloton gear.

Peloton's biggest issue in the fourth quarter may be meeting demand. The company said it has a backlog of bike deliveries and has longer-than-expected delivery windows. Peloton is also facing higher costs for expedited shipping. The company said:

We entered Q4 with a backlog of Bike deliveries in all geographies and sales continue to surpass expectations in the first several weeks of Q4 due to COVID-19. Unfortunately, the unexpected sharp increase in sales has created an imbalance of supply and demand in many geographies, causing elongated order-to-delivery windows for our customers. Over the past several weeks, we have worked closely with our manufacturing partners to accelerate the supply of goods and, as a result, we are incurring higher costs in order to expedite shipments. We do not expect to materially improve order-to-delivery windows before the end of Q4. Our guidance assumes we do not resume Tread sales prior to the end of fiscal year 2020.

Company executives noted that it will have more factory capacity online in December via the acquisition of Tonic.

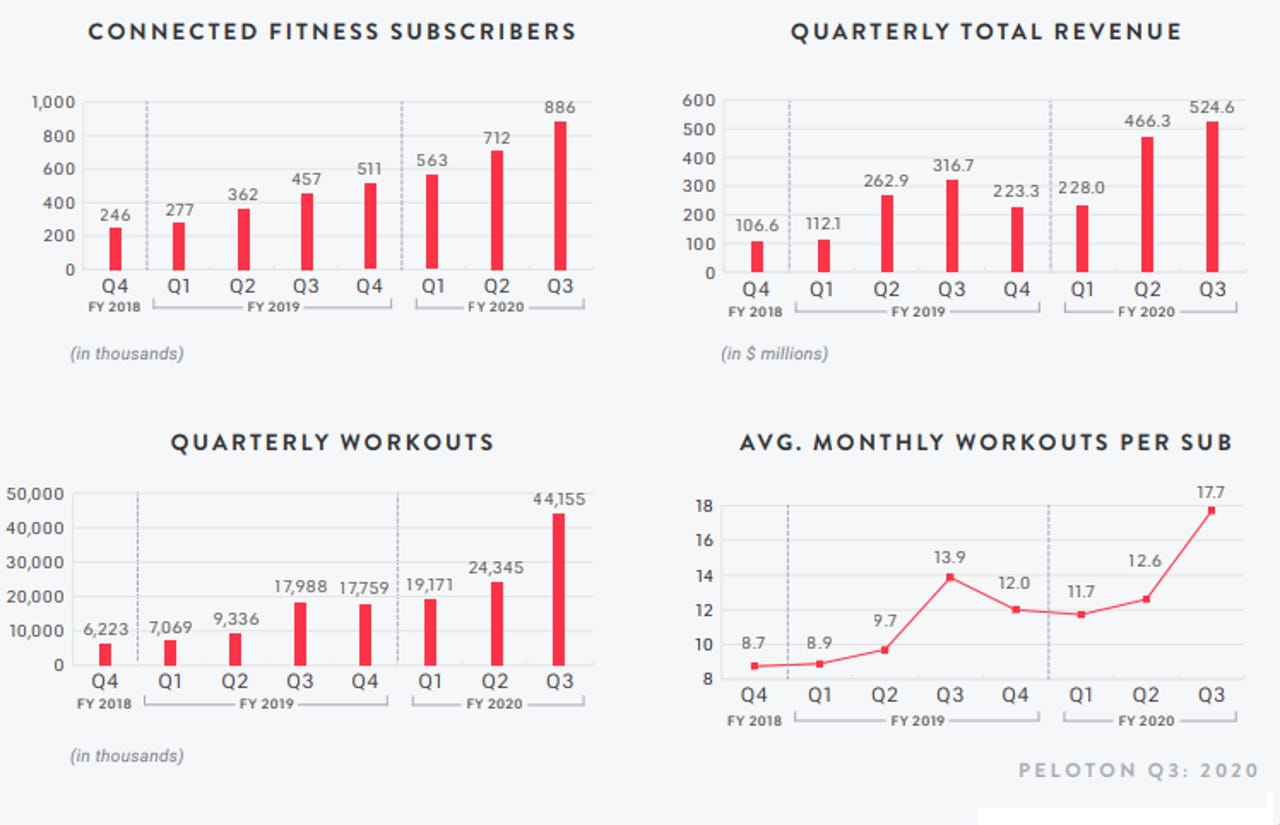

For the third quarter, Peloton posted strong growth figures. The company ended the quarter with 886,100 connected fitness subscribers and revenue of $524.6 million, up 66% from a year ago. Total workouts averaged 17.7 a month per connected fitness subscriber.

Peloton reported a net loss of $55.6 million, or 20 cents a share. Analysts were expecting Peloton to report a third quarter non-GAAP loss of 17 cents a share on revenue of $487.7 million.

CEO John Foley said on a conference call:

As you might imagine, however, the shelter-in-place and work-from-home realities have created a meaningful tailwind for Peloton and the broader ongoing consumer shift towards at home fitness experiences. While this tailwind is undeniably positive for our business financially, we are more proud of our member growth, the increased engagement of our members on our platforms and the feedback we have received from our members about how Peloton has helped them maintain their physical and mental well-being in these difficult times. Specifically, we ended the quarter with over 886,000 connected fitness subscribers, representing 94% year-over-year growth. Member count is now over 2.6 million, inclusive of our 176,000 Peloton Digital subscribers. Over the past year, we've seen steady gains in member engagement as we've expanded content verticals and launched new member experiences. With so many members now under stay-at-home orders, this quarter saw an even larger gain than expected. Our connected fitness subscribers logged 44.2 million workouts with us in the quarter, up from 18.0 million workouts in the same period last year representing 145% year-over-year growth.

Foley added that Peloton is working through some technical challenges with engagement given that the bike leaderboards may have 10,000 people or more.

We believe the current environment of social distancing and working from home is permanently influencing consumer behavior driving more people to discover Peloton as the most engaging, entertaining, immersive and motivating home platform for fitness and well-being. Our scale as a platform is a huge asset but also presents some challenges. With tens of thousands of people on the leaderboard at a time and millions of members on the platform and growing rapidly, we continue to develop ways for our community to interact with each other in a more personal way. To that end, last week, we launched tags, a new social software feature that strengthens our network by leveraging the power of groups, making it easy to feel connected to others even without existing connections on Peloton. Tags are a simple, yet highly flexible way for members to express themselves, connect with others and work out together.

In its shareholder letter, Peloton outlined a bevy of business continuity moves in the third quarter. Consider:

- Peloton closed 97 global showrooms on March 16 and moved completely to e-commerce and inside sales.

- Member support moved to remote work.

- On March 19, the company refined delivery practices to pause activities that involved entering a home.

- Peloton paused production of new classes in New York and London April 7 but resumed live programming from instructors' home April 22.