Pure Storage's mixed bag: Q2 better than expected, Q3 outlook cut and CFO departs

Pure Storage reported better-than-expected second quarter results, but also said Tim Ritters, chief financial officer, will be leaving the company, and lowered its third quarter revenue outlook.

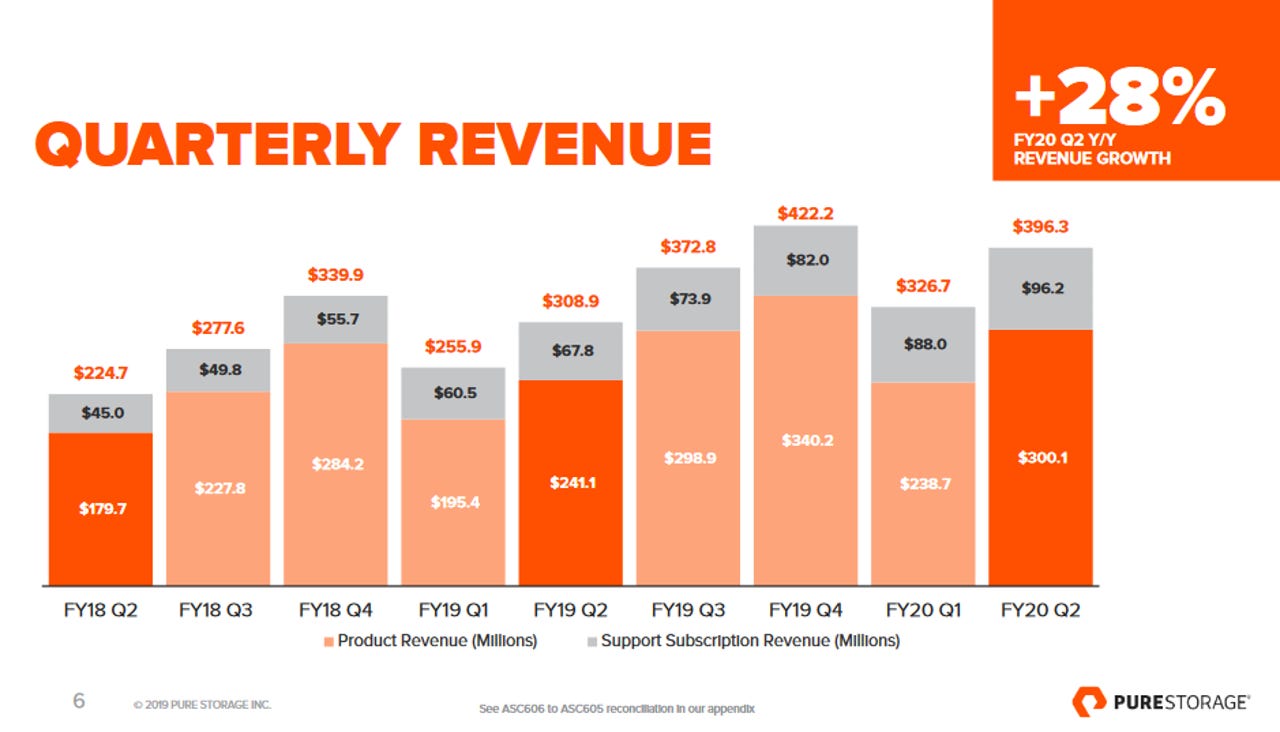

The company reported a second quarter loss of $66 million, or 26 cents a share, on revenue of $396.3 million, up 28% from a year ago. Non-GAAP earnings for the second quarter were $2.5 million, or a penny a share.

Wall Street was expecting second quarter a second quarter loss of 4 cents a share on revenue $392.5 million.

For the third quarter, Pure Storage projected revenue between $434 million to $446 million. For fiscal 2020, Pure projected revenue between $1.64 billion to $1.71 billion.

Wall Street was expecting third quarter revenue from Pure Storage to be $466.3 million with non-GAAP earnings of 14 cents a share.

Storage vendors have delivered mixed quarters at best. Consider:

- After cutting outlook, NetApp beats Q1 market estimates

- NetApp cuts outlook for fiscal Q1, fiscal 2020

- Western Digital says flash market has hit its trough

- Seagate says cloud, hyperscale storage demand improving

CEO Charles Giancarlo said that the company continued to gain market share with its solid-state storage and software-centric approach to the data center. The company added more than 450 customers in the second quarter.

On a conference call, Giancarlo added:

Looking at the market as a whole, Pure is clearly outexecuting our traditional competitors, some of whom have expressed concerns around the macro economy. We do not believe the macro environment has affected us this past quarter. What we do see is a significant transitory NAND supply/demand imbalance, which impacted component prices and the storage industry as a whole. We expect the situation to continue to affect us for the balance of the year, given the natural lag between component costs and storage market pricing. However, we are already seeing NAND pricing rise in the spot market, and suppliers are delaying additional capacity. We believe these signals point to an improving market next year.

Ritters departure comes after a five-year run where Pure Storage increased revenue 10X. Pure also said it authorized a $150 million stock repurchase program.