PwC's Q2 report: Stronger market fueling tech IPO activity in U.S.

Last quarter, PricewaterhouseCoopers predicted that initial public offerings made by U.S. tech companies were poised for a comeback following a rather disastrous 2012.

The optimism continues this quarter at the global consulting firm based on confidence in a stronger market and the momentum resulting from it.

Read this

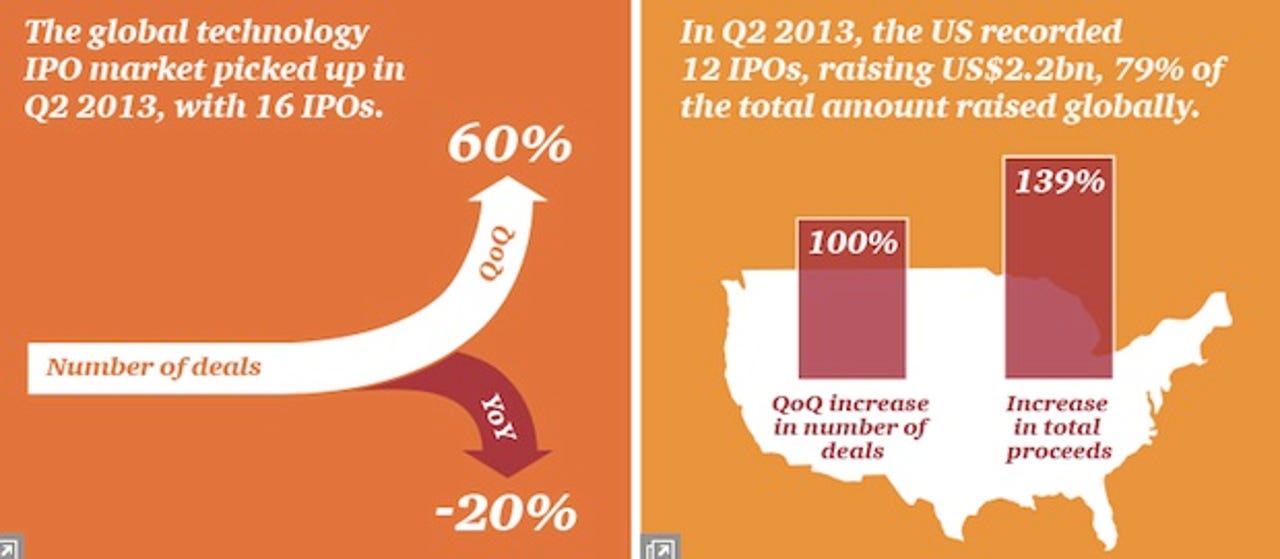

According to PwC's second quarter Global Tech IPO Review, there was a surge in IPO activity over the three-month period, led by the United States in the number of deals and proceeds.

Here are some of the highlights from the report:

- With the absence of Chinese IPOs, the U.S. led IPO activity over the first two quarters of 2013

- The US accounted for six out of 10 IPOs along with 12 out of 16 IPOs during the first and second quarter, respectively.

- Total proceeds raised in the U.S. in Q2: $2.2 billion, or 78.5 percent of global total proceeds.

- U.S. exchanges still the most active with $2.6 billion proceeds raised and 14 IPOs (88 percent of the deals and 92 percent of total proceeds).

- Total number of U.S. IPOs increased to 12, up 100 percent sequentially and 50 percent annually

- Nine of the top 10 global deals traded on either the NYSE or Nasdaq

- NYSE led with 10 IPOs and total proceeds of $1.7 billion

- Nasdaq had four IPOs with total proceeds of $891 million

All of this sharply contrasts the sentiment in the tech industry (at least stateside) concerning public debuts at this time last year.

While enterprise business debuts from the likes of Workday and Marin Software fared better, consumer ones inspired nervousness and fear in analysts, investors, and end users alike.

Facebook was the unfortunate poster child of this phase.

But again, one can always rely on the mantra of what a difference a year makes.

Last September, Facebook CEO Mark Zuckerberg made his first public appearance following the disastrous debut on the Nasdaq at TechCrunch Disrupt 2012.

This year, Facebook shares continue to soar well above the IPO price.

At his follow-up appearance at the annual startup-heavy summit on Wednesday, Zuckerberg quipped (likely in reference to rumors surrounding a Twitter IPO) that he was the last person that anyone should look to for IPO tips.

Image via PwC