RealNetworks: It can get worse

RealNetworks' business is struggling and it can get worse. That message was delivered by a J.P. Morgan analyst who pooh-poohed any initial euphoria over the fact that RealNetworks' Rhapsody app is now on the iPhone.

On the surface, J.P. Morgan analyst Vasily Karasyov pans the Rhapsody iPhone app's prospects and gives Realnetworks an "underweight" rating. If you recall, RealNetworks broadcast its intentions to bring its Rhapsody music service to the iPhone Aug. 24. Apple approved the app on Thursday.

Karasyov writes:

We see only limited potential for new subscriber acquisition: in our view, Rhapsody’s subscriber base (750K as of Q2 ’09, a decline of 50K sequentially) reflects the existing demand for a subscription based music service irrespective of the device on which it’s available. We don’t expect the new application to reverse the challenging trend.

That's not news. But Karasyov's other key point may be worth noting. Karasyov said that RealNetworks could wind up paying a hefty penalty to VeriSign over a 2001 alliance. VeriSign alleges that RealNetworks interfered with its plans to sell certain business units. The two parties are in arbitration.

Indeed, in an SEC filing RealNetworks says VeriSign is seeking "a material amount in damages." Karasyov reckons that:

"Every $10M of the potential payment would drive 7c per share impact—or 2% of the stock price—and we think the payment could be in the range of several dozen million dollars."

And this is for a company that is already blowing millions defending itself---and losing---against Hollywood over its RealDVD software.

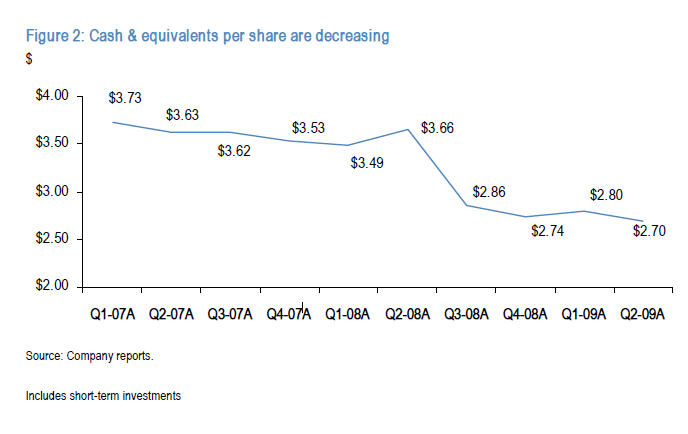

Karasyov's note also reveals that RealNetworks' primary selling point---for Wall Street at least---was its cash position. Sure, RealNetworks music, media and games businesses were struggling, but shares were selling for roughly its cash position.

The problem: That cash position is trending down. And if VeriSign wins and RealNetworks remains stuck in that RealDVD quagmire that cash hoard will shrink further. To wit: Piper Jaffray estimates that RealNetworks has spent more than $10 million on RealDVD litigation fees over the last two quarters. Simply put, Piper Jaffray analyst Michael Olsen says "RealDVD has proven to be a costly venture for the company, with no offsetting revenue."

Simply put, these million dollar distractions are adding up. For the second quarter ending June 30, RealNetworks reported a net loss of $188.3 million on revenue of $135.7 million, down 11 percent from a year ago. Here's a chart from Karasyov showing RealNetworks' cash cushion: