Report: Tech component inventory lean (perhaps too lean)

Inventory levels of key items in the technology industry's supply chain---components like semiconductors, hard drives and interconnects---are very lean, according to a report by Goldman Sachs.

These tight inventories are the result of some proactive management in the supply chain. The tech industry saw demand slow and cut inventories to muddle through economic Armageddon. The problem: If Armageddon doesn't come, Windows 7 boosts demand, Apple continues to deliver and consumers fall in love with tech we're looking at potential component shortages.

Goldman Sachs analyst David Bailey writes:

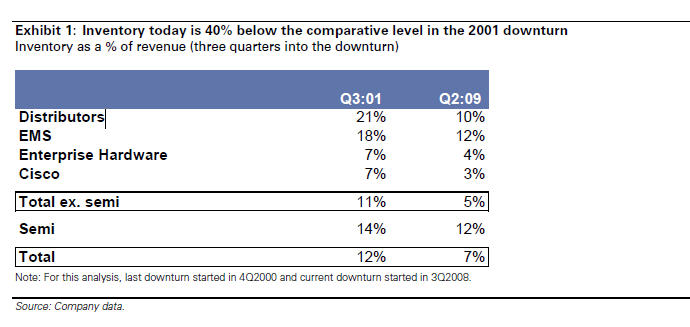

The technology supply chain cut production levels significantly at the end of 2008 and in early 2009, bracing for an extended downturn. That said, the macro dislocation has proved shorterlived versus prior expectations, resulting in unsustainably low levels of inventory relative to the improving demand trends that we anticipate. Inventory across the tech supply chain is 40% lower three quarters into the current downturn relative to the 2001 downturn.

Bailey looks at those inventory levels as a positive. The tech sector is likely to have a fast snapback cycle should demand improve. He argues that companies like Arrow, Avnet, Seagate and Western Digital are likely to benefit from tight supplies.

However, there's a downside. If demand snaps back too quickly component shortages could put the brakes on growth. Here's Goldman's recap on inventory as a percentage of revenue:

The wild-card here is technology demand. There are a few green shoots from the likes of Intel and Dell (to some degree), but demand estimates are still a crapshoot. Dell argues there's an enterprise PC demand cycle ahead, but that projection is still mostly a hunch.

Simply put, inventory levels today are justified, but if demand does snap back the supply chain better ramp itself up quickly.