Retail stinks, but Amazon doesn't; E-tailer delivers strong fourth quarter

Amazon managed to get stronger even as retailers across the U.S. struggled amid weak holiday sales.

The company reported fourth quarter earnings of $225 million, or 52 cents a share, on revenue of $6.7 billion, up 18 percent from a year ago. Those results handily topped Wall Street estimates, which called for earnings of 39 cents a share on revenue of $6.48 billion. Analysts had expected Amazon to outperform, but the magnitude is impressive.

For context, the National Retail Federation on Jan. 14 said that holiday sales (November and December) declined 2.8 percent. That tally was the first decline since the NRF began tracking retail sales in 1995. Given that prognosis, expectations for Amazon's results were subdued even though many analysts thought the company would do better than the retail industry.

For instance, Piper Jaffray analyst Gene Munster said in his earnings preview that Amazon is "clearly the best e-commerce company in a bad consumer spending environment," but predicted earnings of 32 cents a share on revenue of $6.44 billion.

In the same quarter a year ago, Amazon had earnings of $207 million, or 48 cents a share, on revenue of $5.67 billion.

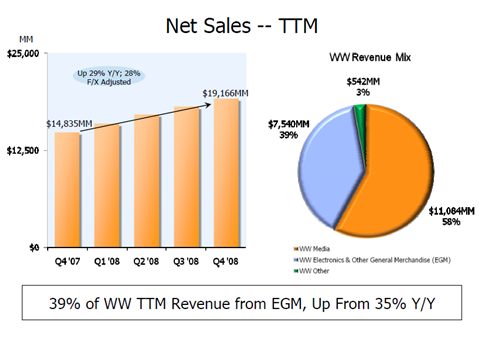

For the year, Amazon reported earnings of $645 million, or $1.49 a share, on revenue of $19.17 billion, up 28 percent from 2007 (statement).

As for the outlook, Amazon projected first quarter operating income of $125 million and $210 million. That range indicates some serious uncertainty. Simply put, Amazon will either see a 37 percent decline in operating income or 6 percent growth. Revenue is projected to be $4.52 billion and $4.92 billion, good for growth of 9 percent to 18 percent from a year ago.

Wall Street certainly liked the results and drove shares 10 percent higher after hours.

By the numbers:

- Amazon's "other" revenue--Amazon Web Services primarily--had revenue of $175 million for the fourth quarter, up from $131 million a year ago. For 2008, the other category had revenue of $542 million, up from $383 million. Since Amazon doesn't break out its Web services result, the "other" category is the line to watch.

- On a conference call with analysts it was pretty clear that the "other" line was an area of focus. Amazon CEO Jeff Bezos was asked almost immediately about Amazon Web Services. "EC2 and S3 are already being used by enterprise class customers and we expect that trend to continue," said Bezos.

- Bezos also talked about Kindle sales, adding that e-book readers buy more and add to unit sales. "The biggest surprise has been unusually strong demand in the fourth quarter," said Bezos, who yet again didn't outline how many Kindle units the company sold.

- Amazon generated operating cash flow of $1.7 billion for 2008.

- Amazon spent $333 million in the fourth quarter on fixed assets such as software and Web site development.

- North America fourth quarter sales were $3.63 billion, up 18 percent from a year ago. International sales were $3.07 billion, up 19 percent from a year ago. North American sales are 54 percent of Amazon's revenue pie.

- Media sales were up 9 percent to $3.64 billion, but Amazon really gained on electronics and other categories. Electronics and other general merchandise sales were $2.89 billion, up 31 percent from a year ago.

- Amazon ended the year with 20,700 employees.