RIM: What could go right

Research in Motion is betting on the BBX operating system---the primary reason the company is sticking with the PlayBook tablet---but analysts are throwing in the towel on the company's turnaround prospects. Given the pessimism it may be worth pondering what could go right if only for giggles.

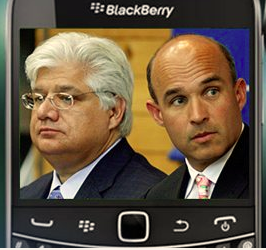

Lazaridis and Balsillie

Last week's warning about profits, revenue and PlayBook inventory set in motion a series of doomsday outlooks. What's unclear is whether current RIM management---co-CEOs Jim Balsillie and Mike Lazaridis---has anything up its sleeve to pull the company out of its tailspin.

In many respects, BBX looks like yet another savior product for RIM---a company that has had too many miracle products fail to even take seriously. National Bank Financial analyst Kris Thompson gave RIM a $10 price target.

Thompson wrote:

Many investors are expecting RIM’s new BBX operating system to resurrect the company next year. While we are cheering for this outcome, we have little confidence that any management team could save RIM in its current form. Turning around a $20 billion company with 17,000 global employees in a fast moving, hyper-competitive market is a massive task.

In addition, Thompson expects RIM's subscriber base to peak this fiscal year and then enter "a decay phase from churn as post-paid contracts expire."

Thompson doesn't even believe that RIM's patents are worth much in a breakup or acquisition scenario.

Are things really that bleak? The consensus view is that RIM is screwed and that it will lose enterprise, service revenue and money on every PlayBook it sells. Given the pessimism let's play devil's advocate and ponder what could go right.

Here's a look at the positives:

- RIM's outlook could have been worse. RIM said it expected third quarter revenue to be below its range of $5.3 billion to $5.5 billion. Earnings will also be lighter than projected, but not by much. A $485 million charge will be taken to account for PlayBook inventory, discounts and promotions.

- BlackBerry shipments in the third quarter will be 14.1 million. That's still a lot of BlackBerry devices.

- BBX turns out to be the real deal. RIM correctly is keeping its PlayBook alive if only to make sure BBX isn't tethered to a disaster. In other words, RIM learned from HP, which killed its TouchPad and WebOS in one swoop. BBX is an elegant OS and could look good on a superphone.

- RIM gains market share with money-losing PlayBooks. RIM's PlayBook is headed to $199, a price that's a screaming deal even if the company lacks much of an ecosystem. The PlayBook is a test run for future phones.

- There could be a new PlayBook in February. Paradigm Capital analyst Barry Richards said he expects RIM to deliver PlayBook 2.0 in February. RIM could benefit from low expectations and a lower bill of materials and native email.

- The BBX Android ecosystem has potential. The company is betting on a franken-tablet ecosystem that allows the PlayBook to run Android apps. Jason Perlow has tested the RIM Android approach and it's promising.

- BBX is expected to have native email and calendar in February. It's inexcusable that RIM still doesn't have native email support, but in February that problem goes away---assuming RIM hits its timelines.

- RIM could get new management. The company has issues, but the board could toss Balsillie and Lazaridis. Ditching its co-CEOS could revitalize the company.

- The company still has strong service revenue that's estimated to be up 30.4 percent from a year ago.

My point: RIM still has assets and many positives in its corner. What it lacks is credibility. New management could stabilize the company and build from there.

Related: