Rimini Street: BI support and growth avenues ahead

Rimini Street is moving up the application stack as it rounded out business intelligence software support. The move indicates that Rimini can expand its product line---something that will be necessary for future growth.

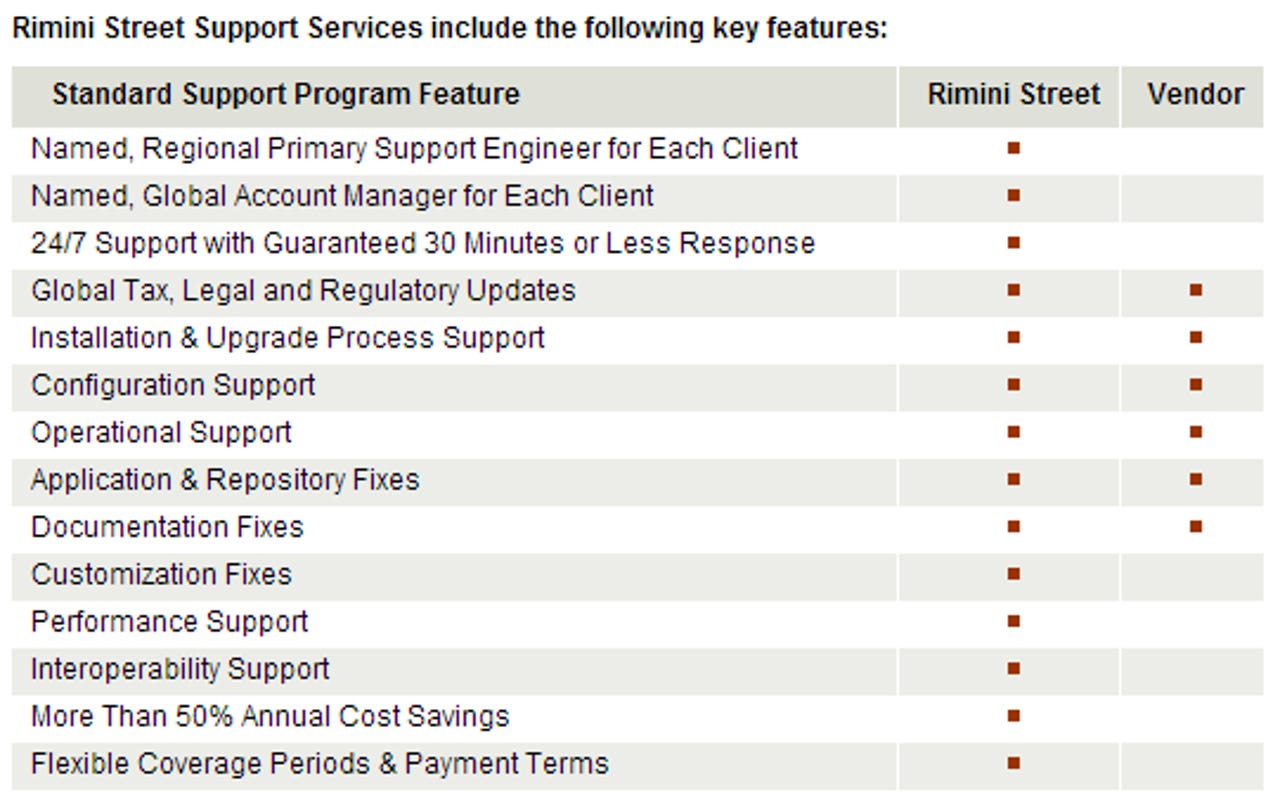

On Monday, Rimini rolled out support for Oracle's Hyperion business intelligence modules such as planning, financial management, strategic finance and analytics. Rimini is promising 30-minute guaranteed support and 50 percent savings.

The implication here is that Rimini is now offering support for a product line that's growing quickly. Rimini made its name supporting legacy ERP systems.

I caught up with Rimini CEO Seth Ravin and operating chief Sebastian Grady outside of Oracle's Open World powwow in San Francisco. Here's a look at the highlights of our conversation:

On the move to business intelligence support, Ravin said supporting Oracle's Hyperion as well as SAP's Business Objects "fills out the rest of the puzzle pieces" to its model. Business intelligence held prospective customers up from moving their transaction systems to Rimini Street. Why? Often BI and enterprise resource planning systems were on the same maintenance contract. Ravin expects business intelligence support will break through a barrier. "Analytics is the next phase moving beyond transactions," said Ravin. "We have experience in the BI space and it's often custom."

Referring to bundled contracts, Ravin said that Oracle and SAP are looking to bundle maintenance for various products since it's a defense against Rimini. Grady noted that "smart customers" aren't doing EULAs and bundled contracts because it limits them.

And about that ongoing Oracle lawsuit. Oracle has sued Rimini over third party support and Ravin remains confident his company will win. A trial date is set for sometime in 2013. "We continue to launch Oracle product lines so we don't doubt our position," said Ravin, who added Rimini's revenue growth is 33 percent despite the Oracle suit. If Rimini should win out, Ravin expects a bevy of large companies---beyond IBM, 3M, Pfizer and others---to eye third party support, which undercuts SAP and Oracle by a wide margin. Ravin is conservatively modeling a 10 percent to 20 percent invoicing jump once the lawsuit is resolved. "We have moved forward with more than 220 customers since the Oracle litigation," he said.

What's after the lawsuit is resolved? Ravin said that he expects a number of large customers to come off the sidelines. He also expects that a number of new players will enter the third party support game over time. "We will see erosion as new players enter the game," said Ravin.

There's a bit of tension between Rimini and system integrators. Ravin explained that Rimini frequently works with integrators because there's a joint responsibility to support customers and keep systems humming. However, there's a natural tension. Integrators and hardware and software vendors benefit from convincing customers to change and update software. Rimini's approach is to keep your transactional systems and milk them for lower maintenance costs. "Rimini is a threat to the money chain so we're seen in a different way (by integrators," said Ravin. "There's a tension between us and them."

What will Rimini support next? Grady noted that Rimini has its hands full supporting SAP and Oracle applications, but there are future products to ponder. Let's play this out. Rimini wins its legal tussle with Oracle, it lands new large customers and launches an initial public offering. There are plenty of software lines to support: Microsoft, Infor and Lawson are possibilities.

The SaaS plan. Another option for Rimini someday would be to support SaaS. Cloud?!? Maintenance?!? Grady noted that SaaS implementations are getting complicated for large companies and quarterly updates tend to break connections with existing legacy applications. Ravin said he sees this effect up close. Salesforce and others roll out changes and things break. And Rimini is a small company relative to 3M and a bunch of others. Where's this headed? Large companies may not want frequent updates. In this scenario, SaaS starts to look a lot more like hosting. Grady's theory is that SaaS and its multitenant approach will be tested as it scales to large complex companies. "We take releases and they cause problems," said Ravin. "The pitch is that SaaS upgrades are seamless, but they aren't." Grady added: "Support for SaaS could be a monstrous need---especially break-fix support."

On turnover. Ravin said the company's retention rates will vary based on where companies stand in the upgrade cycle. For instance, Rimini supports Pfizer's JD Edwards applications that were the result of a few acquisitions. 3M has a 7-year plan to move to SAP. At some point, Rimini's work will be done, but Rimini could phase out PeopleSoft support and take on more SAP. "It's a normal lifecycle," said Ravin. "Customers will come for a few years and then leave and then come back." Grady added that maintenance isn't going away no matter how the software industry changes.

More: