SAP software revenues plummet, announces new deal on maintenance

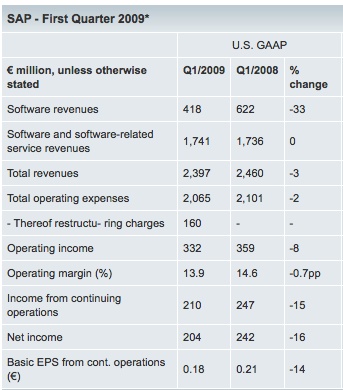

SAP has announced its Q1 results. total revenue was €2,397 million compared to €2,460 in Q1 2008, a fall of three percent.

While operating income was only down eight percent, software revenues were off 33%, falling from €622million in Q1 2008 to €422 million. Support revenue climbed 18% to €1,252 million. Restructuring costs were €160 million, partially offset by savings in R&D and sales and marketing totaling €137 million.

From the prepared remarks:

“While visibility for software revenues remains limited, we continue to take the necessary steps to protect our margin in this tough operating environment,” said Léo Apotheker, co-CEO of SAP. “The cost containment measures that we initiated in October of last year and carried into the first quarter of 2009 have really taken hold, and we are pleased with the resulting margin performance. We will continue to maintain tight cost controls. Our ability to deliver good margin performance in this environment, especially when you consider the restructuring charges related to the reduction of positions, is due to the strength, flexibility and scalability of our business model.”

In the detailed reports we can now see where the ax has fallen most often. The Americas have taken the brunt of cuts with the loss of 935 heads or about seven percent of the December 2008 count. In Germany and EMEA, the equivalent cuts of 315 accounts for a little over 1 percent of December 2008 numbers. In Asia Pacific, 350 jobs were lost or about 3 percent of December 2008 headcount. Overall, sales and marketing positions were most affected with the loss of 626 positions or just under six percent compared to December 2008.

One figure that puzzles is deferred income which climbed from €611 million to €2,070 million in the quarter. I'm guessing the bulk of this relates to maintenance revenues that have yet to be earned. SAP will host an analyst call today at 9 am ET - expect further updates.

In a separate press release, SAP announced a climbdown on its maintenance price increase program and agreement with SUGEN on the KPIs that will be used to assess the effectiveness of SAP's new maintenance program:

In consideration of the current economic climate and discussions with SUGEN on SAP Enterprise Support, SAP is extending by three years the four-step price increase program announced in July 2008 (see "SAP Enterprise Support Offering Rolled Out to All Customers") for customers that were migrated to SAP Enterprise Support at that time. Originally scheduled to run until 2012, the program will now conclude in 2015, coinciding with the recently introduced 7-2 maintenance strategy. Starting in 2010, the price of SAP Enterprise Support for existing customers will continue to increase based on individual contract terms but will not be higher than a yearly fixed upper cap. This translates to an increase average of no more than 3.1 percent per year from 2010 onwards. The price of SAP Enterprise Support will be capped at 22 percent through 2015. With this adjustment, SAP demonstrates a clear commitment and responsiveness to its customers and the challenging global economic conditions they must navigate today.

This should not be a surprise. Last year, I asked Apotheker whether the company was prepared to share the economic pain of its customers. At the time, I drew a blank stare. I'm convinced SAP had no choice but to take these steps as a way of mollifying a very unhappy and increasingly vocal customer group. Even so, it is good to see that SAP has finally bent to the inevitable and now has an opportunity to put this fiasco behind it.

Announcing the change at the same time as the results gives the financial analysts an opportunity to take one large dose of bad news rather than dripping it out over time. It also means SAP's management team can stand up at the forthcoming SAPPHIRE event and claim they have listened to what customers are saying. There will be some who would look on such statements with a wry smile.

Has SAP gone far enough to at least stem the flow of adverse commentary? Probably. Will this prevent pressure from those who believe that software vendor maintenance costs are an unreasonable tax? No.

Ray Wang summarizes the changes concluding that:

Expect customers to take the new with cautious optimism. Should the benchmarks succeed, customers may gain value. Failure to meet targets meet a freeze on maintenance. In any case, this is welcomed news and provides a hard fought win-win for the customer and the vendor-client relationship. Congratulations go out to SUGEN and SAP for coming to a common ground. The only thing left in the choice, value, predictability equation is choice - meaning a tiered maintenance program or access to third party maintenance. With the less than positive Q1 earnings report announced today, let’s wait to see how other chips will fall into place.

Note: Updated for headcount detail and color provided by Ray Wang