Search ad spending to fall 20 to 30 percent in Q2, eMarketer predicts

The search advertising business could take a hard hit from the COVID-19 pandemic, according to eMarketer. In the second quarter of this year, the research firm expects US ad spending to fall between 20.2 percent and 29.4 percent on a year-over-year basis due to the crisis.

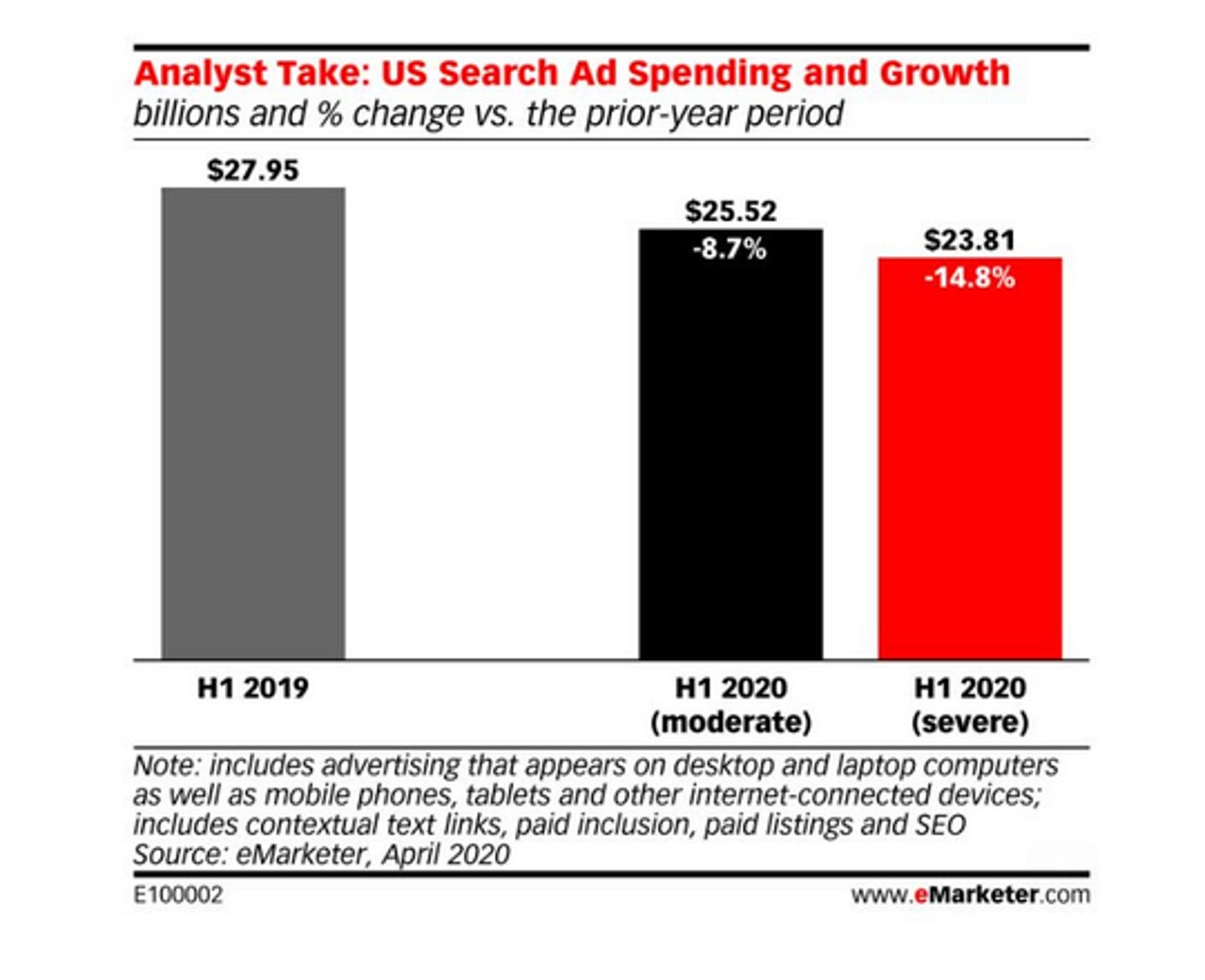

For the first half of 2020, eMarketer expects spending on search ads to decline by between 8.7 percent and 14.8 percent. Based on this estimate, search ad spending would fall somewhere between $23.81 billion and $25.52 billion in the first half of 2020. That's about $6 billion to $8 billion less than eMarketer previously forecast. By comparison, in the first half of 2019, search ad spending in the US came to $27.95 billion.

Google is the overwhelmingly dominant player in the market, netting more than 70 of US ad search spending, according to eMarketer. In FY 2019, Google made $134.8 billion in advertising, which accounted for the bulk of its revenue. The internet giant is expected to report its Q1 2020 results in May.

While search advertising is typically considered a safe investment, that's not the case during the current crisis, eMarketer notes. Search ads can no longer be counted on to drive conversions, given that stores are closed and supply chain disruptions have created inventory shortfalls. The numbers in the search ad market can change quickly, since search budgets aren't committed in advance.

EMarketer expects travel advertisers to cut back on search ad spending most dramatically, with the media and entertainment industry also making search cuts.

US search ad spending was effectively flat year-over-year in Q1 2020, eMarketer says, with major decreases beginning in March.