Server sales: US leaps forward as Europe falters

In the second quarter of 2015 server shipments grew by eight percent year-on-year while revenues did nearly as well, increasing by 7.2 percent, according to the analysts Gartner.

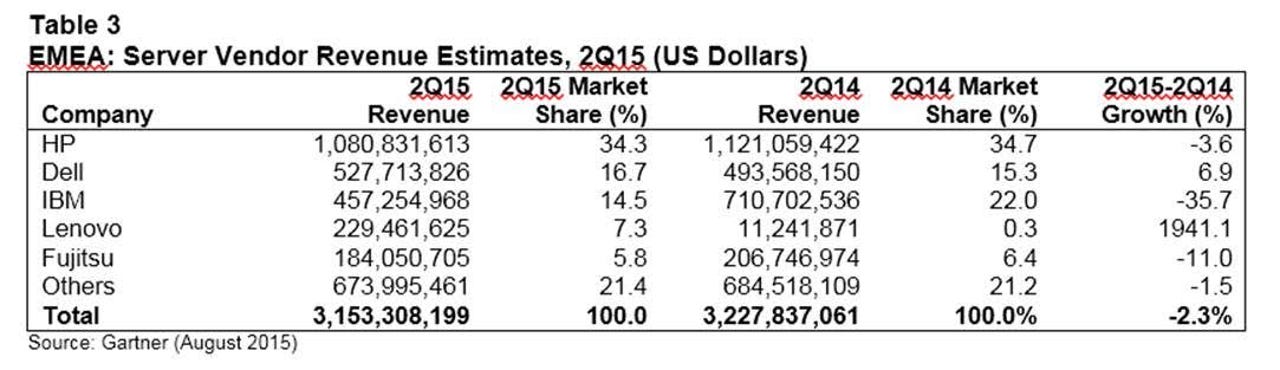

But in EMEA server shipments in the second quarter declined by 5.6 percent while server revenues contracted by 2.3bn to $3.7bn.

"Following a resurgent start to the year, the second quarter marked a return to the decline in server shipments and revenue in EMEA," said Gartner research director, Adrian O'Connell. "Ongoing economic pressures and currency-driven price increases from the strong US dollar combined to offset the server replacement cycle in EMEA."

But it is a tale of two markets, according to O'Connell. "At the top you have what we call the hyperscale vendors [selling to] the Amazon's, the Google's and so on - and they are doing just fine," he told ZDNet. "The rest of the enterprise market is finding it far more challenging."

So Google and the others are basically propping up the market? "Yes, you could say that," said O'Connell. "Without them the market would look very different."

Interestingly, Gartner believes it also benefitted from "the shifting competitive dynamics" as Lenovo acquired IBM's x86 server business. Third-place Lenovo's market share remained below that of IBM's x86 business a year ago indicating that it still has some way to go if it is to see growth again.

For the server business as a whole the second quarter year-over-year growth for 2015 slowed compared with the annual growth of the first quarter of the year, according to Gartner vp for research, Jeffrey Hewitt.

"Currency exchange rate changes have started to show their impact by reducing relative spending power in regions like Western Europe," said Hewitt. "It is likely that in anticipation of further currency rate shifts, some organisations utilised their budgets earlier in the year rather than waiting until the third or fourth quarters."This is a sign that they think their purchasing power may be further reduced because of these relative currency changes, he said.

Hewitt said that x86 server shipments increased 8.3 per cent in the second quarter of 2015 and revenue grew nine per cent. "RISC/Itanium Unix server shipments declined 18.7 per cent globally for the period, while RISC/Itanium revenue declined 9.7 per cent compared with the same quarter last year," he said.Another bright spot was the mainframe which showed an increase of 7.8 per cent, Hewitt said.

Looking at the wide picture, from a regional standpoint, North America grew the most significantly in shipments with a 14.8 per cent increase. The region also posted the highest vendor revenue growth at 14.7 per cent for the period.

Further Reading:

LinuxONE: IBM's new Linux mainframes

Lenovo's CTO talks R&D, IoT, Windows 10, servers and more

Dell aims new PowerEdge server at HPC, big data deployments