ServiceNow delivers strong Q1, but Q2 outlook light

ServiceNow, a cloud IT management services company, delivered strong first quarter results, but the outlook for the second quarter disappointed Wall Street.

The company reported a first quarter net loss of $58 million, or 38 cents a share, on revenue of $212 million, up 52 percent from a year ago. The non-GAAP profit for ServiceNow was $2 million, or a penny a share.

Wall Street was expecting break even results for the first quarter on revenue of $210.7 billion.

What dinged ServiceNow was the outlook. The company said it sees second quarter revenue of $237 million to $242 million. Wall Street was looking for $242 million. On a conference call with analysts, ServiceNow executives noted that a stronger dollar was a headwind for the company.

For the year, ServiceNow sees better than expected revenue of $970 million to $1 billion. ServiceNow tightened its range on the lower end of guidance. Wall Street is expecting 2015 revenue of about $990 million.

ServiceNow shares fell as much as 17 percent and were down roughly 9 percent in afterhours trading.

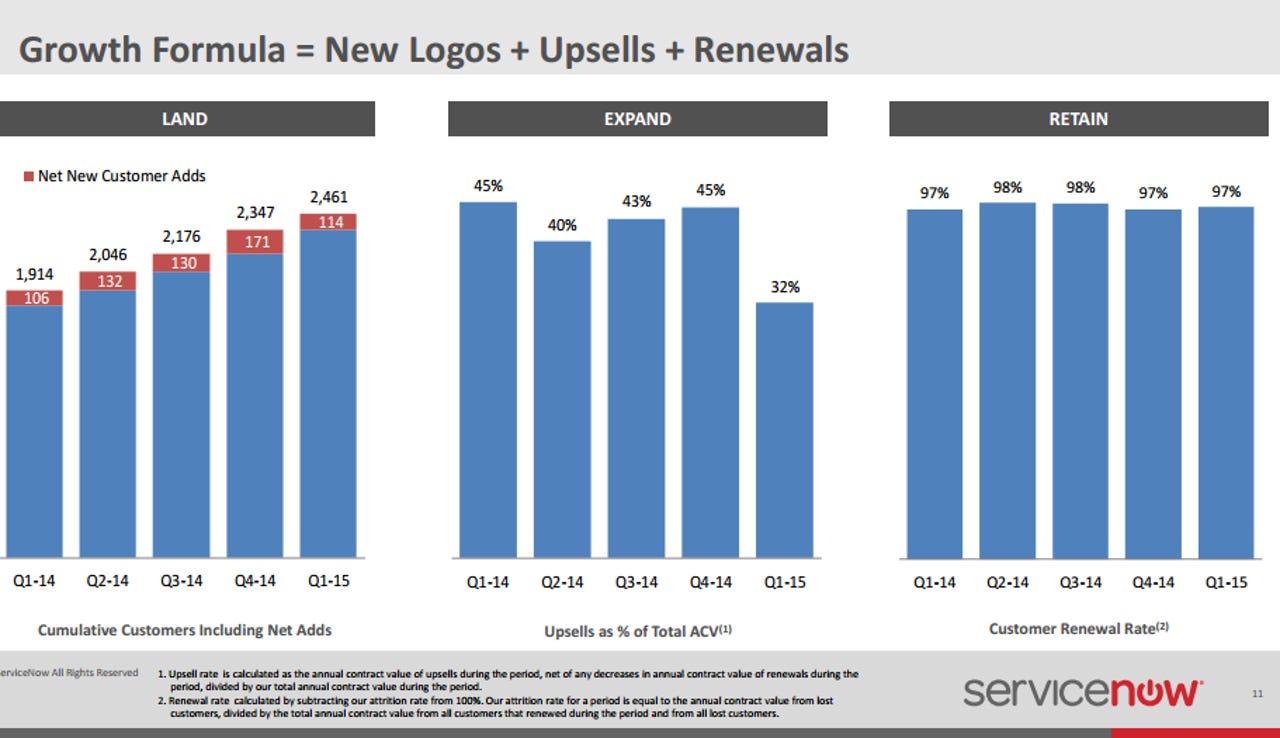

Despite the afterhours histrionics, ServiceNow is performing well. Billings in the first quarter were $268 million, up 48 percent and the company added 23 net new global 2000 customers.

In addition, ServiceNow closed eight deals with annual values north of $1 million.