ShoreTel to explore strategic alternatives including a sale

ShoreTel said it is forming a committee to evaluate "a range of strategic alternatives" including a sale, divestments, joint ventures, restructuring, and partnerships.

The company is a key unified communications and phone systems vendor and is moving toward more of a cloud model. The business model transition rhymes with what Polycom was facing. Polycom initially planned to sell to Mitel, but then it took a better offer from Siris Capital with plans to go private.

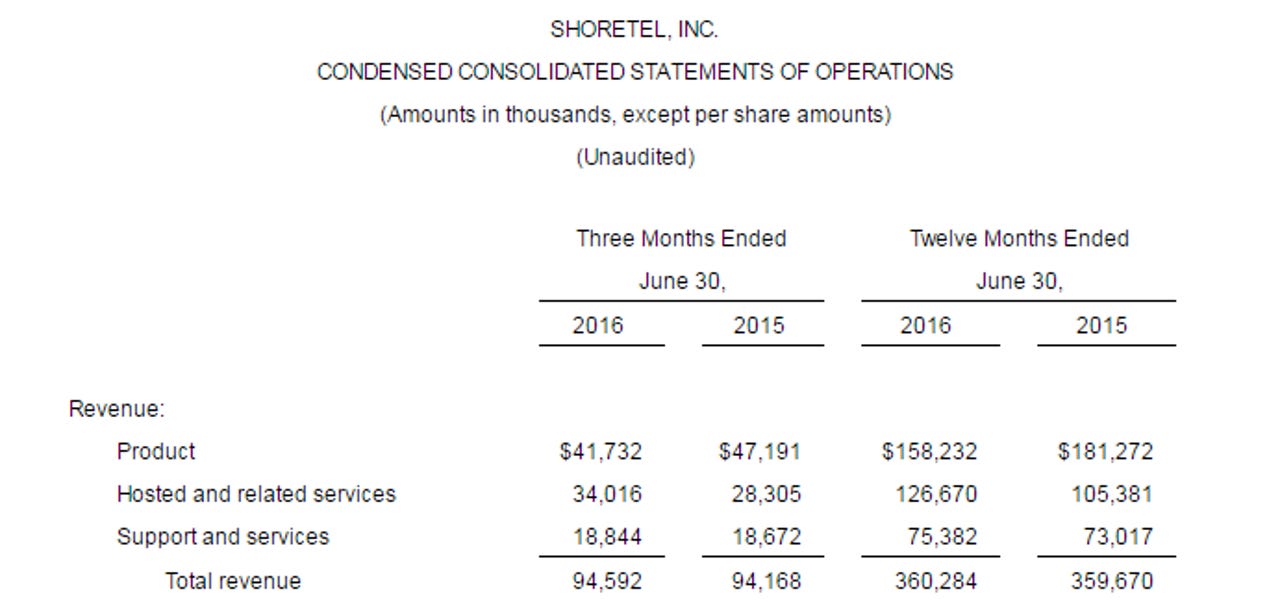

In addition to looking at strategic moves, ShoreTel reported better-than-expected sales for its fiscal fourth quarter. The company reported a fourth quarter net loss of $700,000, or a penny a share, on revenue of $94.6 million. Non-GAAP earnings for the quarter were 5 cents a share.

Wall Street was looking for a non-GAAP loss of a penny a share on revenue of $90.57 million.

As for the outlook, ShoreTel projected first quarter revenue between $86 million to $92 million. That outlook is in the range expected by analysts.