Singapore tax on overseas digital services kicks in tomorrow

Singapore consumers will be charged a goods and services tax (GST) on overseas digital services from January 1, 2020, expanding the tariff beyond locally procured products. This will impact a wide range of services including downloadable content such as e-books and mobile apps, software such as office suites, subscription-based media such as music streaming and online games, as well as electronic data management such as cloud storage and web hosting.

According to the Inland Revenue Authority of Singapore (IRAS), more than 100 providers of such services had enrolled under the city-state's Overseas Vendor Registration (OVR) regime, which meant they would begin charging GST on the sale of their digital services from tomorrow. The government agency defined digital services as services supplied online or an electronic network that required minimal or no human intervention and were "impossible without the use of information technology".

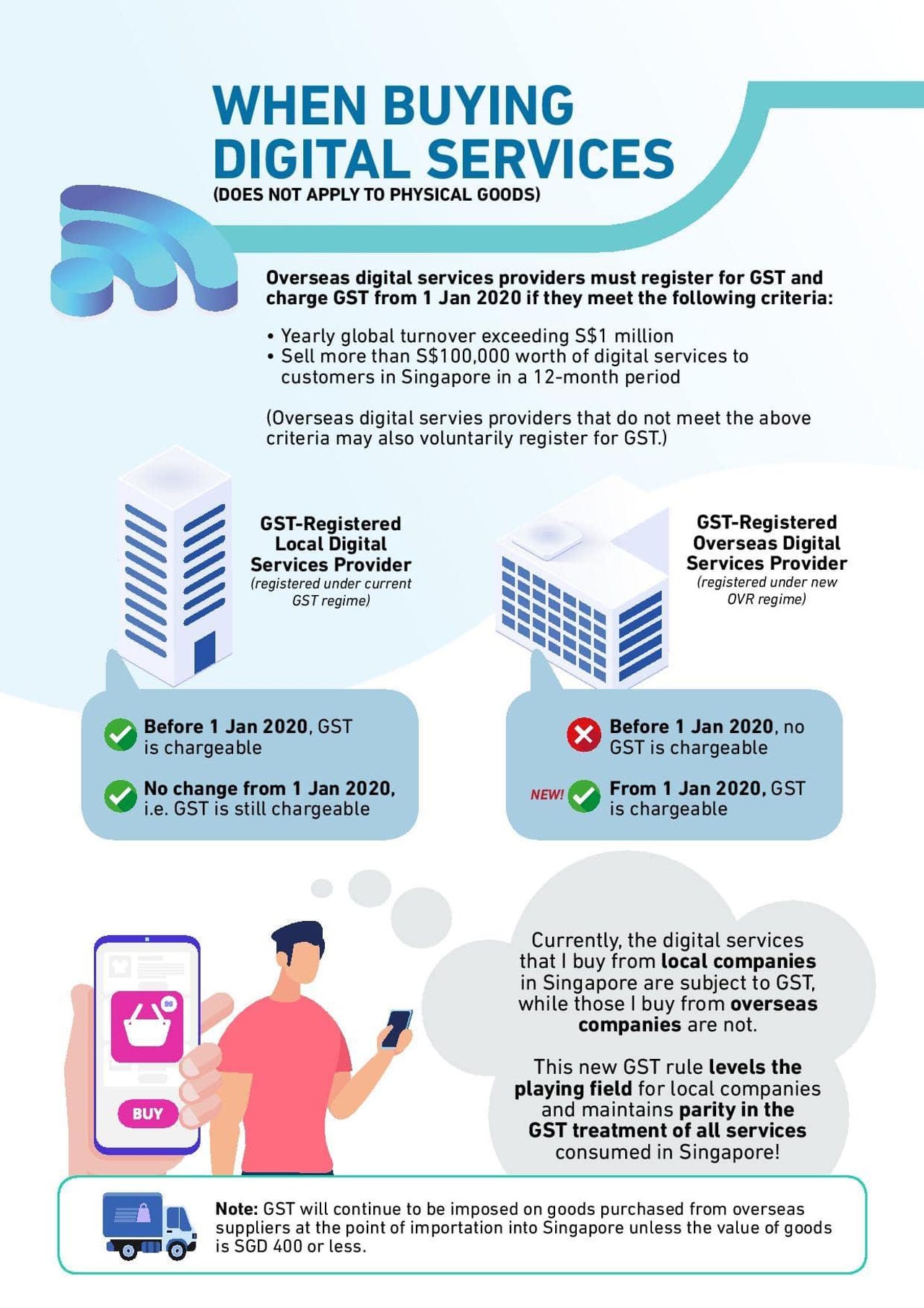

Under the new regime, overseas digital service providers with a yearly global turnover of more than S$1 million and sold more than S$100,000 worth of digital services to customers in Singapore in a 12-month period were required to register for GST and charge GST.

The new tax would not apply to online purchases of goods, IRAS said, noting that GST already was payable on goods--valued above S$400--imported into Singapore, via air or post.

The government, however, had said it would continue to review the tax regime on such e-commerce transactions before determining how it should proceed.

It first unveiled plans to impose a GST on imported digital services in its budget statement February 2018, announcing plans to apply the tax to business-to-business (B2B) and business-to-consumer services, such as marketing, accounting, and IT services as well as apps, online software subscription fees, and video and music streaming services. Suppliers of such services that already had establishments in Singapore would not be subjected to the new tax.

Commenting on the import tax, Gartner's research director Adrian Lee then had said digital service providers would face higher operational costs to ensure compliance when they exceeded S$100,000 in transactions. They also would have to deal with added pressures on margins from the Singapore government's proposed increase in GST to 9% for all businesses within the country, scheduled to kick in from 2021. Lee said: "Needless to say, this will dampen the growth of digital services in Singapore, but should not constrain it, as consumers progressively digitise their services."