Smart meters feeding data-driven new era for utilities

With smart-meter rollouts progressing apace, energy companies are shifting their focus from rollout logistics and politics to identifying ways to utilise smart-meter data for everything from better network management to showing customers the energy cost of individual appliances.

That's a big shift in an industry transition that has already run for several years and will, with the completion of Victoria's smart-meter rollout covering 1.2 million households next year, make the state a world leader in smart metering. And while distribution companies like Jemena, CitiPower, PowerCor, and United Energy have recently debuted consumer portals for monitoring usage information by time of day, authorities are already looking toward far more sophisticated smart-meter applications to improve network management.

"We see the meter as basically being a network sensor that gives us 720,000 points of monitoring our network," Neil Webb, Smart Networks business intelligence customer lead with Melbourne-area distributor SP AusNet, told attendees at last week's Smart Utilities conference.

"We've never had this level of visibility on our current load volumes in the network," he continued. "Sure, it does meter reading, but we recognise that the smart meter is an extensible architecture that has a heck of a lot of capacity to do a lot more than just meter reading, and we're taking advantage of that."

Webb's team of three developers is working on a range of uses for the smart meters that will by next year be installed in the properties of SP AusNet's customers. The meters communicate by using WiMax wireless network and the ZigBee wireless mesh protocol, taking potentially thousands of readings per day that paint a detailed picture of customer usage.

This high level of detailed information allows, for example, for the company to perform voltage profiling that quickly spots anomalies in electricity voltage and phase. The meters can raise alarm flags, react by dispatching maintenance crews, or, if necessary for safety reasons, shut off power to the property until the situation is brought under control.

Better visibility of usage information also allows the distributors to profile ageing infrastructure assets, more accurately detect brownouts and loss-of-neutral situations, and predict failures so that maintenance can be better scheduled.

"This is big data, absolutely," Webb said. "We do a lot of data analysis and have bought an appliance just for that. Even though we have very large servers, they can't cope with producing these results."

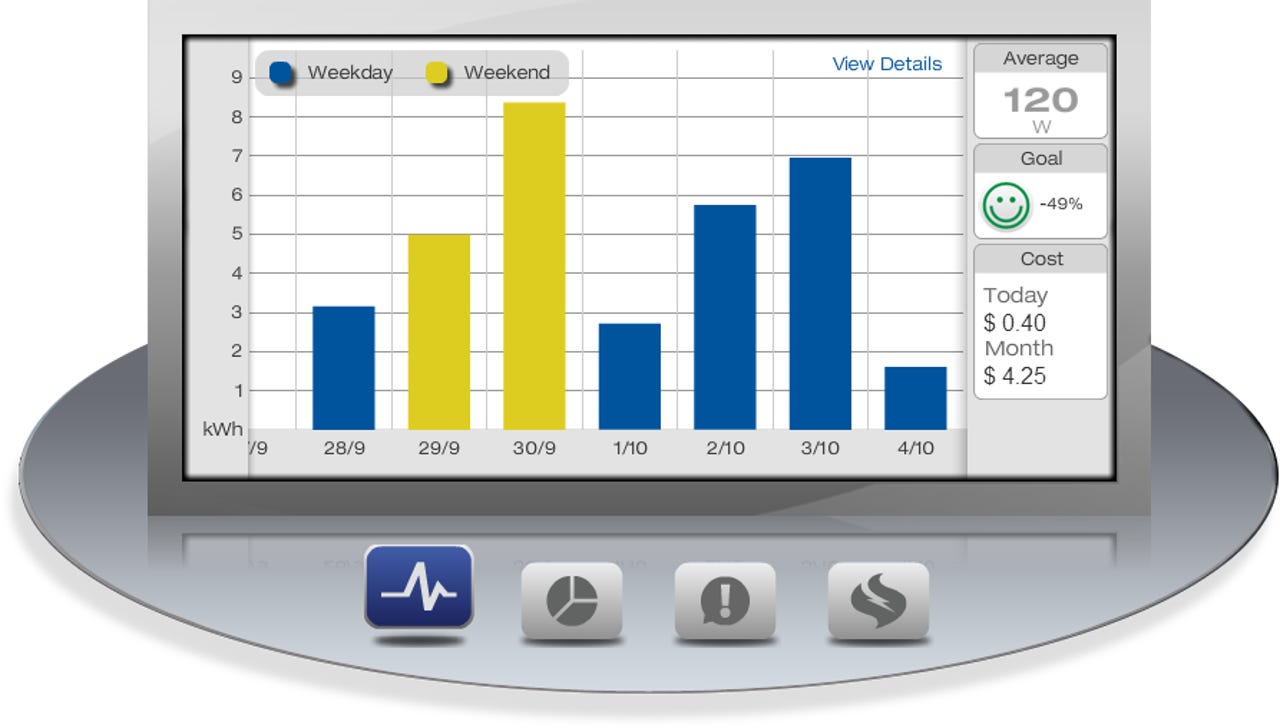

The smart-meter data will also, Webb said, enable the company "to go forward and engage customers more" by adding enhancements to new usage-monitoring portals — SP AusNet's myHomeEnergy debuted earlier this month, after six weeks of intensive development by Webb's team — such as better support for monitoring solar installations and electric vehicles.

Improved use of smart-meter data will drive the industry toward the ideals espoused in the Commonwealth government's Energy White Paper, which is guiding the transformation of the industry.

Industry transformation isn't necessarily a long-term proposition exclusively. Anil Gadre, executive vice president of products with smart-meter software supplier Silver Spring Networks, said that smart-meter rollouts are already saving many utilities hundreds of thousands of truck rolls per year by allowing remote connection and disconnection of power supplies — and he's bullish on the prospects for smart meters to present usage information to customers in new ways.

"On a global basis, the consumer is getting more and more powerful," Gadre told ZDNet. "It's leading to more and more interesting solutions and answers in every industry, and price pressure is going to cause consumers to get more interested in them.

"Studies have shown that simple energy awareness causes people to wake up and use less energy, so all of this work is about how you give consumers more insight. Right now, there is no insight, except letting customers say, 'I used this much power.'"

While many utilities have touted the promise of smart meters being able to control home appliances to better manage power usage, taking advantage of these capabilities requires consumers to buy new appliances that aren't yet readily available in Australia.

That's not stopping Gadre and his team, however; using new usage-modelling tools, he believes that vendors will soon be poring over mountains of smart-meter data to identify telltale usage signatures for different types of home appliances.

This capability would allow a utility to present customers with a bill that says not just how much power was used, but also how much power the dishwasher, refrigerator, water heater, and other appliances used during the course of the month.

Paired with demand-side management — the practice of allowing the meters to defer appliance runs until power rates drop, which is estimated to save over AU$200 per year for Australian consumers — power distributors can not only shape their usage curves, but also target customer incentives to replace old and inefficient equipment.

This sort of intelligence could finally turn smart meters into the change agents they've been positioned as for some time. "This is the tip of the iceberg with how you actually empower the consumer with more interesting things," Gadre said, noting that modern smart meters support downloadable applications that can work in conjunction with network-management systems to facilitate the monitoring of premises usage in real time.

Upgrades to water and gas meters will also eventually allow them to communicate with electricity smart meters, extending their monitoring and control capabilities to all key utilities.

There are still hurdles for distributors, however; Simon Orme, director of utility-industry research firm Sapere Research Group, noted the ongoing confusion over standards around the timeliness of usage data access, lack of consensus over how long the data should be kept (SP AusNet's myHomeEnergy, for one, keeps five years' worth of data), and the lack of standards for data representation that would facilitate the smooth flow of usage data between analytics platforms and comparative-pricing retailers.

"Consumers are past really being fully empowered by the existing regimens," Orme said. "For example, how can you compare two time-of-use offerings without knowing what your profile looks like? That's a pretty good competitive advantage in terms of customer targeting."