SMB transformation centers on technology

If your small or midsize business still resists the thought of relying on some sort of technology -- whether it's a business process application or a cloud service or even "just" a smartphone -- for a business-critical task, it could wind up at a competitive disadvantage.

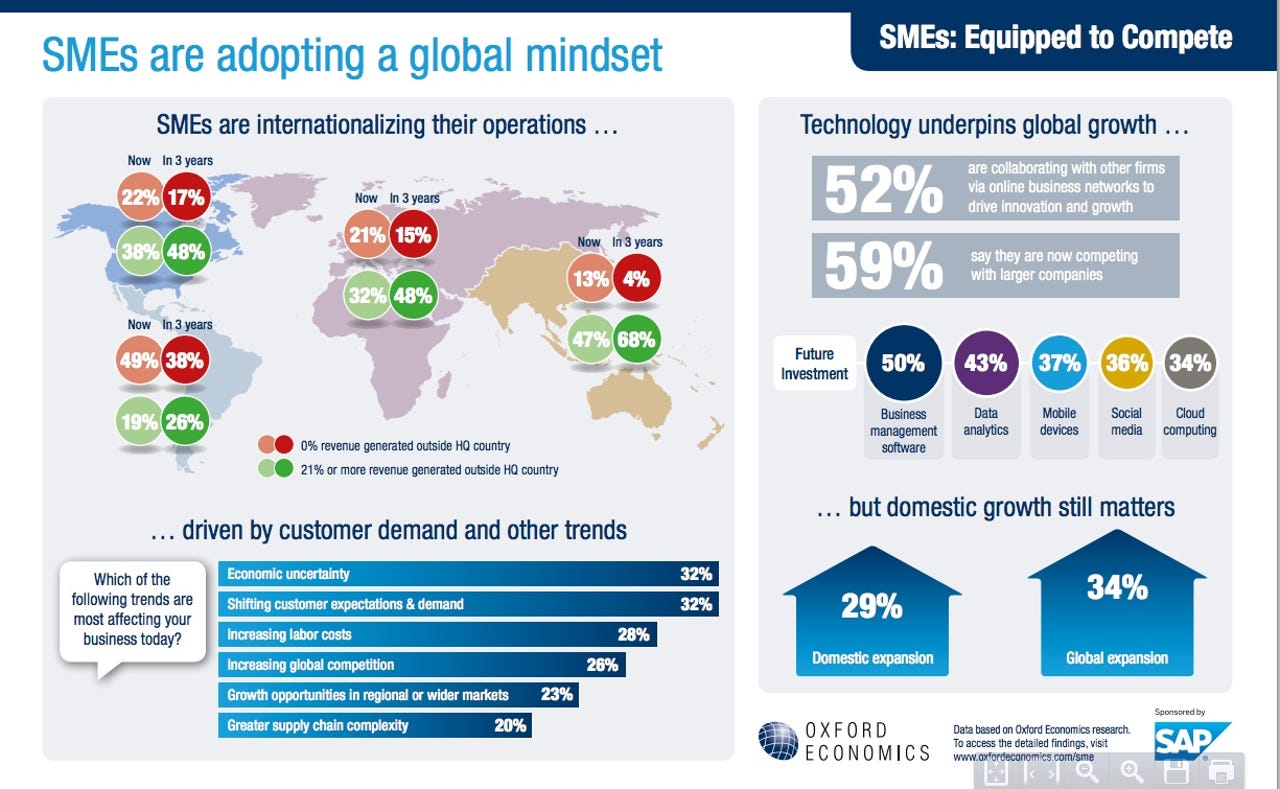

More than half of small and midsize enterprises (SMEs) believe that technology is making their traditional ways of doing business obsolete, according to an Oxford Economics survey published this week and sponsored by SAP. What's more, almost two-thirds of them agree with the idea that technology is a key element of business transformation and that it helps "achieve longevity and sustainable growth."

It follows that investing in new technologies should be a strategic priority, but it's actually a pretty small number considering the nature of their dilemma -- approximately 26 percent of them are thinking this way. Still, there is progress being made among the survey base, which included 2,100 executives from SMEs in 21 countries. These companies had annual revenue of between $20 million and $750 million; approximately two-thirds of them had fewer than 500 employees. For country-specific highlights and infographics, see this link.

For me, there were several high-level findings that really resonated. Here are those highlights:

More than one-third of SMEs are early adopters. The number was higher for North American firms included in the survey, and larger companies were more likely to be early adopters than their smaller peers.

Customer service improvements are linked to technology investments. Almost 60 percent of the survey respondents said that technology benefited their customer service processes, especially social media (31 percent), mobile solutions (25 percent) and business analytics (21 percent).

Cultural issues can affect technology adoption. Some employees are still coming to grips with the potential benefits of mobile tools, social media and cloud services. Making sure they have the right mindset is important if investments are going to pay off.

Size has nothing to do with being tech-savvy. Even though they might have trouble justifying the investment, a majority of smaller companies are "confident they can handle technology and understand its relevance." That's at odds with the common perception that some small companies are intimidated by IT.

Mobility is viewed as transformational. Almost 60 percent of the surveyed SMEs considered mobile devices as integral to innovation and change, and that number rose to almost 70 percent for the most profitable firms. In some emerging economies, there is no other way to complete transations.

Business analytics investments will grow the fastest. Over the next three years, the survey respondents plan to substantially increase their use of business intelligence and Big Data tools. More than half of the SMEs with sales of less than $100 million said that they will use these sorts of tools within three years, which is a jump of 43 percent from now.

Cloud computing adoption trails. Cloud infrastructure and services represented the least important investments for the survey respondents from among the five major technology areas considered (business analytics, mobile, social media, business management and cloud). The cloud's influence was strongest in Asia Pacific (where 45 percent of SMEs see it contributing strongly) and among the most profitable companies from within the survey respondents (44 percent of that group sees cloud as a strong or significant driver of revenue growth).