Social Commerce Big Data not being effectively used by retailers according to new report

Social Discovery company 8thBridge has released the results of its third annual Social Commerce IQ (SCIQ) report and has discovered some intriguing facts about how companies use – or don’t use the data they ask for when profiling users.

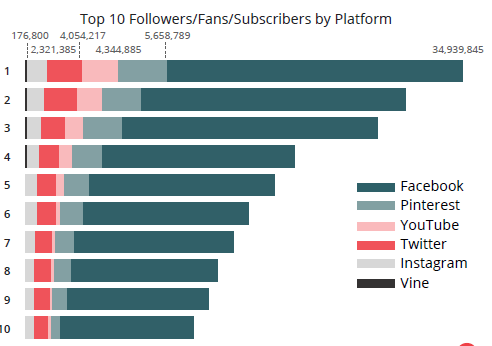

872 retailers were included in the survey and seven social platforms were analyzed: Facebook, YouTube, Instagram, Pinterest, Twitter, Google+ and Vine. The survey focused on brand awareness, social upstream traffic, website social lift and social CRM to calculate the social commerce IQ scores.

The report measured upstream traffic from the social networks, engagement metrics including the number of followers and user interactions. it also measured metrics of how extensively a retailer incorporated social features onto its own ecommerce site.

The report says that the most effective social media marketers present on social networks and drive customer engagement. These retailers also have great website social experiences that incorporate customer curation, crowd-sourced discovery and social rewards.

When social discovery is integrated directly into the buying process it is a better experience for customers. The report says that brands are still not harnessing the power of social data.

Companies are not collecting significant social profile data meaning that the move to Social CRM and Big Data applications is still in its infancy. The issue is that most companies have not provided significant social features to justify to their customers that accessing their data is warranted.

Companies that use OAuth to allow their users to log on with their Facebook accounts have the opportunity to collect significantly more information about their customers than from those customers using a simple login dialog box.

The report says that 27percent of retailers collect customer Likes so are not benefiting from the insights and personalization that can be gained from understanding their customer’s interests.

Although 89 percent of the companies in the report ask for the customer’s Friend List during the authentication process, it does not provide much value to them.

Requesting access to a customer’s Friend List and discovering which likes that users has can provide a brand with extra insights. Brands can then gain information about friends who share similar interests and might be potential customers in the future.

Although engagement using social media has dropped, 8th Bridge says that on-site social discovery “was proven in 2013 to be the key to cracking the code on monetizing social -- lifting revenue per visit by 10-15 percent and doubling the time people spend shopping”.

Facebook is “evolving into a traditional marketing platform” according to the report. Although Facebook engagement on Facebook brand pages was down 27 percent from 4.1percent last year as measured by “Talking About This” and “Brand Likes” there are increases in other areas.

There is an exponential increase in shared stories overall according to the report although brands have not invested in Facebook advertising to compensate for the decrease in brand story distribution.

99 percent of retailers have a Facebook page. YouTube comes in at a close second with 98 percent having a presence on the video platform. Vine has been adopted by only 38 percent of retailers.

The Pinterest Pin it button, has been placed on more retailers’ sites than the Facebook Like button or Tweet button, which were launched several years before Pinterest’s 2010 launch.

Loyalty and stickiness occurs on YouTube. The survey found that 80 percent of brands with the most subscribers on YouTube also had the most views on YouTube. This indicates that customers will want to continue listening to a brand if it is creating engaging content.

Although not appearing high in the social commerce index, tech companies such as Microsoft and HP appear high on Klout scores. Microsoft has a Klout score of 99.

Interestingly, traffic from Twitter and Instagram is non-existent for most retailers. Only 85 retailers are getting traffic from Twitter and 55 retailers are getting traffic from Instagram.

This begs the question whether it is worth having a presence on these platforms in terms or Return on Marketing Investment (ROMI).

Of the sites that had social shopping functionality, most of them were discovery or curation. Rewarding customers with discounts and prizes for rating and/or creating content generates awareness of social shopping features and gives retailers access to social profile data.

Retailers with access to this rich data goldmine of information would be wise to leverage the data they can use from the social networking sites.

Big social data can give them more efficient use of their marketing budget and help them to discover what their users really want from the brand.