Square expands Payroll service to five more states

Square on Wednesday announced expanded coverage for its payroll product, Square Payroll.

The service is now available to small businesses in Tennessee, New Hampshire, Nevada, South Dakota and Alaska.

Square Payroll was first rolled out last year in California, with Texas and Florida joining in November. Square says roughly 90 percent of sellers who signed up for the product after launch are still using it today.

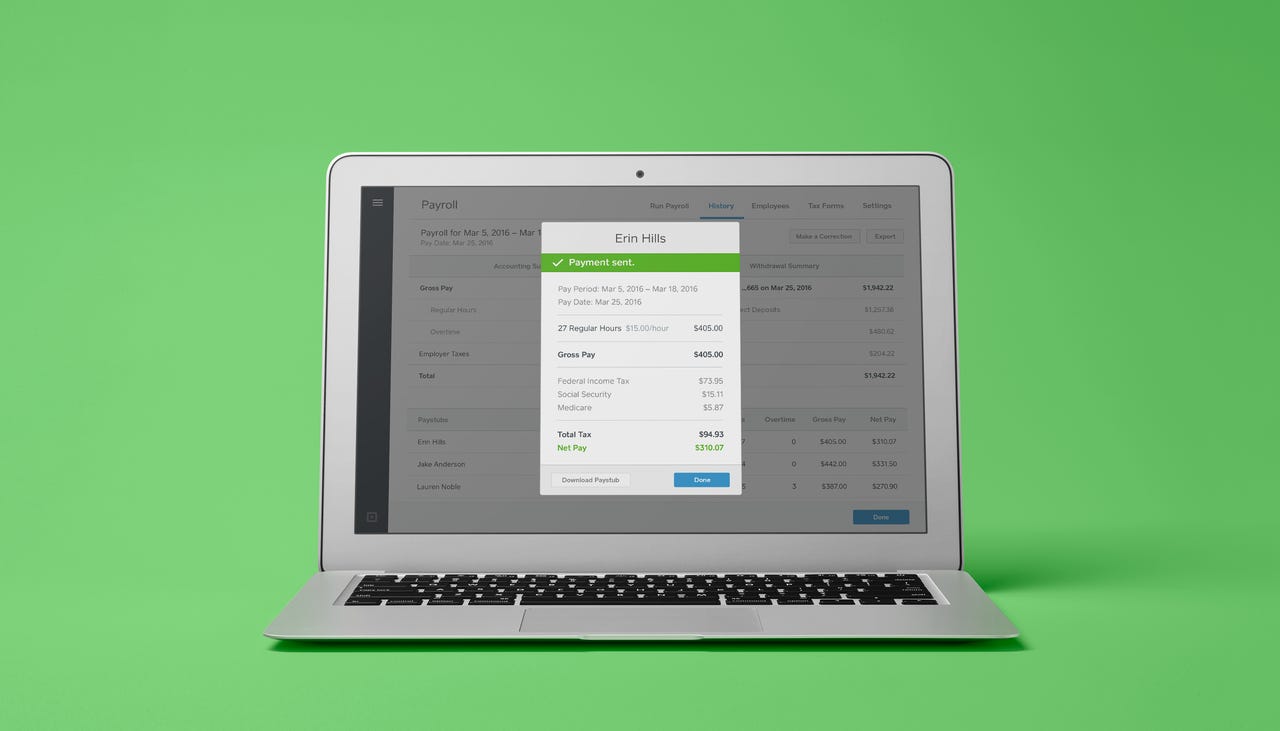

The functions of the service are pretty standard. Employees clock in and out of their shift via integrated time cards on Square's Register app. When the pay period closes, the business owner imports employee hours and Square's payroll service calculates applicable taxes and sends the funds out to workers. Employees have the ability to enter their own tax details upon setup, and state and federal payroll taxes are filed automatically for the business.

Square says Payroll is aimed at smaller businesses with staff comprised largely of hourly employees, but it works with salaried workers as well. Pricing is $20 per month plus an additional $5 per month for each employee paid.

Of course, Square faces stiff competition when it comes to payroll, even among its own customers. Giants in the space include ADP and Intuit, with the latter having its own link into the Register platform. Square must also face off against some rapidly growing payroll startups, including Gusto (or ZenPayroll, in its early days).

Nevertheless, Square says Payroll is attracting new sellers to its platform. According to a company spokesperson, 15 percent of sellers using Square Payroll don't currently process credit card payments with Square.