Square files IPO paperwork, plans to trade under ticker symbol 'SQ'

Square finally announced on Wednesday what many analysts, investors and technophiles have been expecting for some time now.More about Square on ZDNET:

The digital payments company is planning to go public.

Square has filed a Form S-1 with the U.S. Securities and Exchange Commission for a proposed initial public offering of Class A common stock.

The San Francisco-headquartered business has yet to reveal how many shares it plans to offer nor a price for the IPO.

But Square did note it plans to trade on the New York Stock Exchange under the ticker symbol "SQ."

Goldman Sachs, Morgan Stanley, and JP Morgan have been tapped as lead joint book-running managers. Barclays, Deutsche Bank, Jefferies, RBC Capital Markets, and Stifel have all been enlisted as additional book-running managers with LOYAL3 Securities acting as a co-manager.

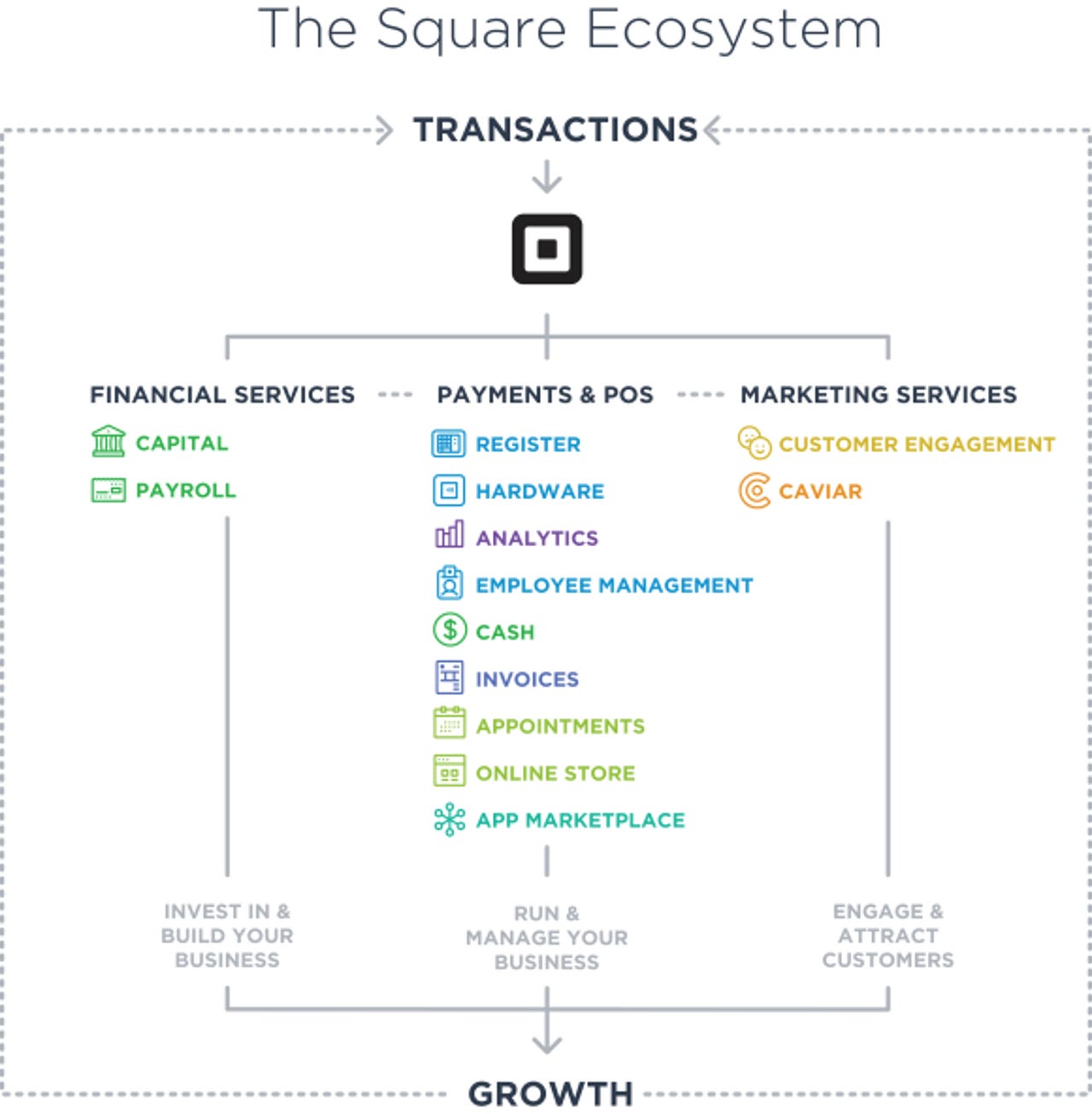

While Square has broadened its portfolio to software over the years (with some mobile apps coming and going quickly), Square said in the S-1 that 95 percent of its revenue derives from digital payments and point-of-sale (POS) services -- including sales from its collaboration with Starbucks.

Square reported a total revenue of $850.2 million in 2014, up 54 percent annually.

During the first half of 2015, Square posted revenue of $560.6 million, up 51 percent compared to the same time frame the previous year.

But profits prove to be a sticking point as Square has also generated significant losses, which haven't slowed much.

During the first six months of 2015, Square reported a net loss of $77.6 million, slightly less than $79.4 million during the first half of 2014.

But Square generated a net loss of $154.1 million in 2014, compared to $104.5 million in 2013.

Nevertheless, Square stressed the increasing switch toward digital payments among consumers and merchants alike as part of its growth strategy. Although it was also listed as a risk factor, Square also pointed toward the recent EMV chip card transition as another milestone and opportunity.

Square started shipping a new version of its Reader supporting EMV chip cards earlier this year. Another model comprised of a chip and contactless reader combining EMV and NFC technologies is scheduled to ship during the second half of 2015.

But beyond just responding to market trends and stuffing the product portfolio, many investors will likely be asking questions about the stability of Square's leadership on the upcoming IPO roadshow.

The business was co-founded by computer engineer Jim McKelvey and Jack Dorsey, who had then just left the role of CEO at the other tech company he co-founded: Twitter.

Dorsey has since found himself not only back as Twitter as executive chairman but subsequently as interim CEO this summer and then permanent CEO of both Twitter and Square just last week.

Amid the hullabaloo of Dorsey's dueling leadership roles, many questions remained about the future of Square. Square's rumored intent to go public was even pegged as one of the examples as to why Dorsey wouldn't be chosen for the Twitter CEO seat, although that turned out not to be the case.

Square has acknowledged the obvious potential difficulties under the Risk Factors section of its S-1 paperwork.

Our future success is significantly dependent upon the continued service of our executives and other key employees. If we lose the services of any member of management or any key personnel, we may not be able to locate a suitable or qualified replacement, and we may incur additional expenses to recruit and train a replacement, which could severely disrupt our business and growth. Jack Dorsey, our co-founder, President, and Chief Executive Officer, also serves as Chief Executive Officer of Twitter. This may at times adversely affect his ability to devote time, attention, and effort to Square.

Dorsey didn't address or even mention Twitter in his note in the S-1, instead focusing on Square's role in the financial industry.

"We'll measure ourselves by our commitment to take the long view and focus on building a company that creates value over decades and not just a few fiscal quarters out," Dorsey wrote.

Images via Square's Form S-1