Square scores funding to fuel Capital financing program

Payment technology company Square has boosted its cash reserves to keep up its lending program to small businesses.

Square says Victory Park Capital has tripled its investment in the Square Capital program, which, when combined with new money from Colchis Capital, will allow Square to lend "hundreds of millions of dollars this year" to SMBs.

Specific financial terms of the investment were not disclosed.

More about Square on ZDNET:

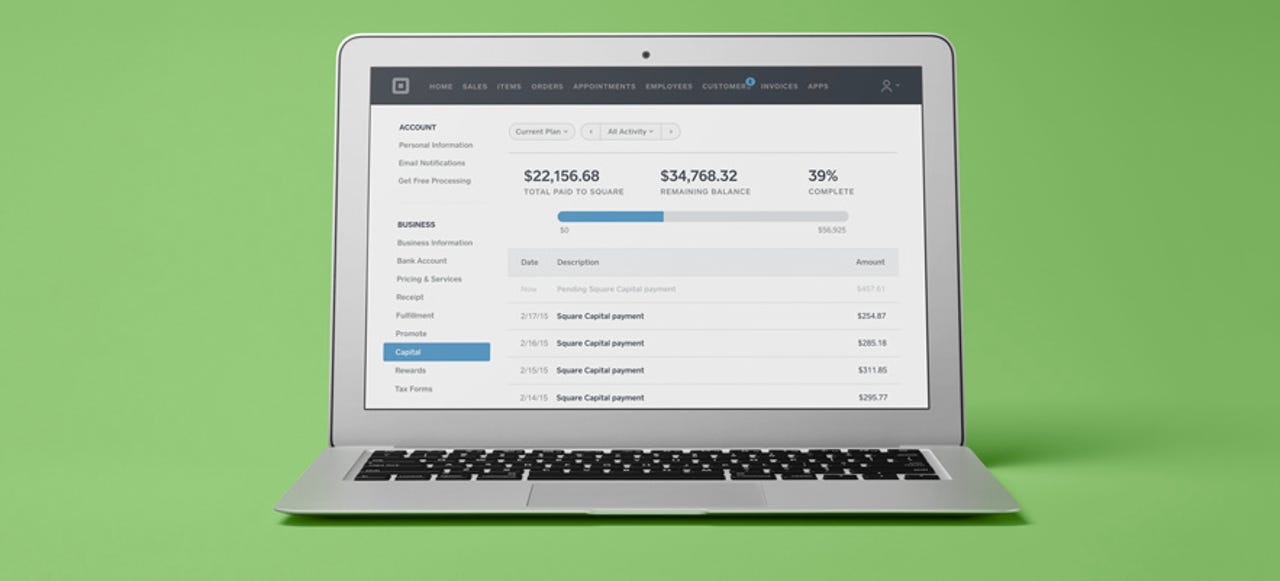

Debuted just about a year ago, Square Capital is a financing program offered to small merchants actively using Square's platform.

It promises cash advances with fewer hassles found with traditional bank lending, such as lengthy applications and expensive fees.

Profit for Square comes in the form of a $1,000 lending fee it charges for each $10,000 advance. Square says it has started proactively reaching out to businesses eligible for financing, taking advantage of its core payments business to peak into a company's sales and financial stability.

In other words, Square is able to safely lend only to those businesses most capable of returning the cash.

Square says the Capital program dispersed $25 million in capital to customers in just the last month. Estimates for last year's lending total are around the $100 million mark.

Those numbers put Square far below other peer-to-peer lending services, and even PayPal, which just yesterday said it loaned $500 million to SMBs in the last 18 months. But the program is still young, and given its progression metrics and investment backing, it could easily become a more challenging player over time.

More: