SurveyMonkey rebrands as Momentive, aims to take on Qualtrics in experience management software

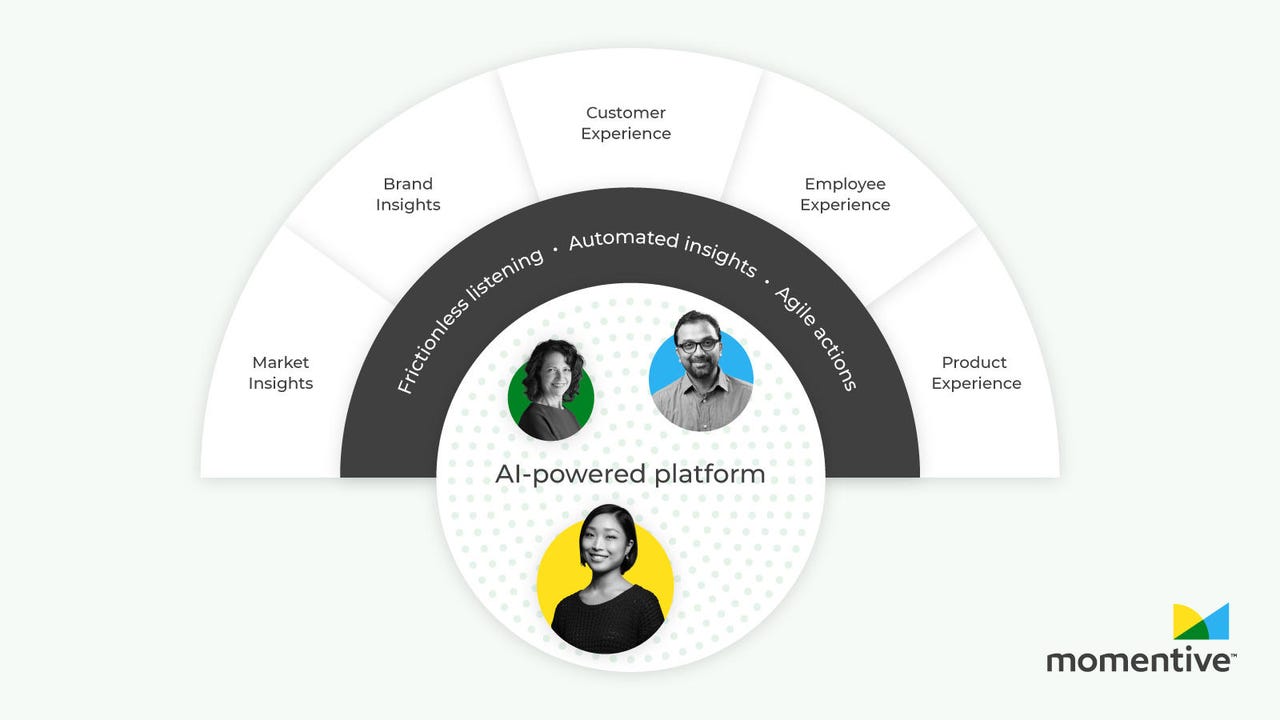

SurveyMonkey -- the more than 20-year-old company known for its online survey software business -- is rebranding under the name Momentive in a bid to better convey its portfolio of experience management services, the company announced Wednesday.

Going forward as Momentive, the company is also looking to spark a corporate relaunch that will help it compete with Qualtrics and other players in the experience management software category.

SurveyMonkey was launched in 1999 with a consumer-oriented survey product geared toward the individual user, and its array of freemium consumer services remain a core component of the company's business.

But over the last several years, the company has turned to its business and enterprise products as a way to move upmarket and generate long-term value for the company.

Eventually, the SurveyMonkey brand became restrictive and failed to communicate the breadth of the company's portfolio, said Momentive president Tom Hale.

"The term SurveyMonkey, we have outgrown it as a company and we have come to realize that we need to tell the world who we are in a different way," said Hale. "What has driven our success is the freemium self-serve survey business, but the last few years has seen us tilting upmarket."

In its recent first-quarter financial results, still under the name SurveyMonkey, Momentive's self-serve revenue increased 13% year-over-year to $71.1 million, while enterprise sales revenue climbed 24% year-over-year to $31.2 million.

"That 30% that is the enterprise portion is growing as fast or faster than Qualitrics," said Hale. "And it's the smaller portion of our business for sure, but it is growing very quickly."

Qualtrics is the newly public experience management software maker that's majority-owned by SAP. Going forward, Momentive sees Qualtrics as its most obvious competitor, but Hale acknowledges that the experience management category is large enough for multiple players. For perspective, Qualtrics' revenue in its most recent quarter was $238.6 million, with subscription revenue climbing 46% year-over-year to $186.9 million.

Momentive currently has around 8,800 enterprise customers, and Hale said the SurveyMonkey self-serve business provides an edge to its business model and allows the company to invest in its upmarket strategy.

When it comes to winning enterprise contracts, Hale said Momentive's advantages come down to speed and agility as well as its use of artificial intelligence and automated insights.

"We have been delivering a broad set of solutions as we pivot upmarket but we compete on agility," Hale said. "When we go up against Qualitrics for a customer experience use case, for example, we win when it's connected to Salesforce, but more importantly we win because of agility."

Market research is another area where Hale said Momentive competes with Qualtrics: "We excel in the AI part of this. In every one of our solutions categories, we will cross paths with competitors, and our advantage is our agility and our take on AI."

In terms of profitability and revenue-generating services, Hale said Momentive has moved to consumption-based pricing, similar to the model used by Qualtrics.

"We have transitioned to the response and consumption business model and we are doing that with surveys," said Hale. "The whole industry is trending that way and we see that as an accelerant of our business. Qualtrics charges per response, and that business model is more suited to monetize customers more effectively."

Long term, Momentive is focused on building out its market research and customer experience data platforms. On the customer experience side, Hale said the company's product strategy is in the early innings but that it's investing in acquisitions and product development. In the market research segment, Hale said Momentive needs to convert services dollars to software dollars via its capabilities in agile research.

"That market research disruption strategy is the centerpiece of Momentive," said Hale.

RELATED STORIES:

- SurveyMonkey buys Usabilla for $80 million

- SAP buys Qualtrics for $8 billion, aims to combine experience, operations data

- SurveyMonkey overhauls platform, UX, as it eyes more business users

- SurveyMonkey will lay off 100 sales staff in effort to revamp business product

- SurveyMonkey bulking up B2B platform with TechValidate acquisition