Tableau delivers strong Q3, hits $100 million quarterly revenue mark

Tableau Software, an emerging analytics vendor, reported strong third quarter results and the first quarter where it topped $100 million in revenue.

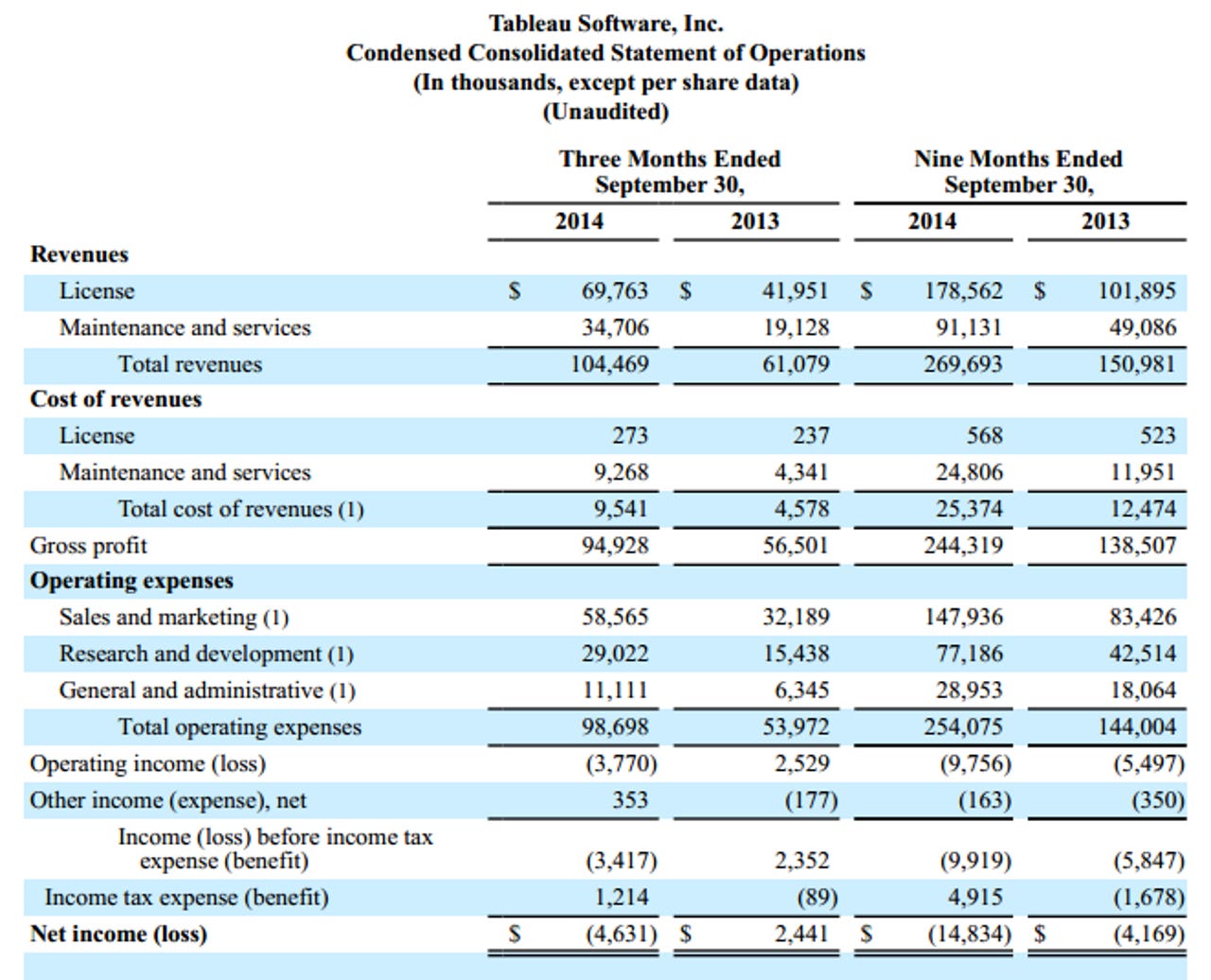

The company reported a third quarter net loss of $4.6 million, or 7 cents a share, on revenue of $104.5 million, up 71 percent from a year ago. Non-GAAP earnings were 6 cents a share.

Wall Street was expecting a non-GAAP loss of 6 cents a share on revenue of $94.4 million.

For Tableau, the third quarter appears to be an inflection point for adoption of its software. The company added more than 2,500 customer accounts, closed 200 sales orders of more than $100,000 and saw license revenue spike 66 percent compared to a year ago.

On a conference call with analysts, Tableau CFO Tom Walker said the company will report fourth quarter revenue between $118 million and $122 million. The high-end of that range equates to 50 percent growth from a year ago. Non-GAAP earnings will be between $8 million and $12 million. For 2014, Tableau projected revenue between $388 million to $392 million with operating earnings between $30 million to $34 million.

Walker also gave a glimpse into 2015. He said:

For the full year of 2014 we are raising our prior guidance of total revenue from a range of $366 million to $372 million to a range of $388 million to 392 million, representing annual growth of approximately 69% at the high end of this range. For the full year we expect non-GAAP operating income to be anywhere from $30 million to $34 million.

We remain optimistic about our potential, and believe we are still in the early stages of investing and capitalizing on our large market opportunity. As we did last year at this time, we thought it would be helpful to give you an early glimpse into the outlook for 2015. Please note that we're still in the midst of planning for next year, and will give you specific guidance on our next quarter's earnings call.

We are anticipating 2015 revenues to increase approximately 40% year over year. We are planning for 2015 to be another investment year with respect to operating expenses. From a dollar perspective, we expect non-GAAP operating income to be lower than 2014 as we continue to make forward investments in the long-term growth of our business.