Tablet growth to stay flat in 2015 as skinny laptops take off

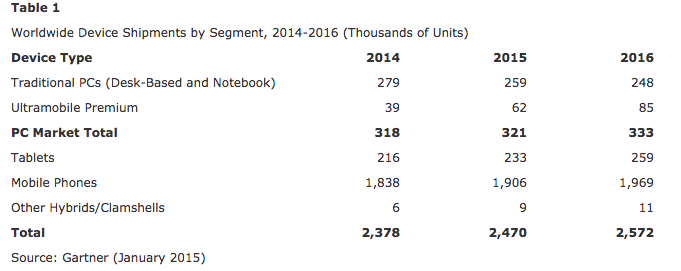

Don't expect a turnaround for the troubled tablet category: it's forecast to grow by just eight percent year on year in 2015, with sales reaching 233 million units.

Double-digit growth in tablet sales buoyed the PC industry in the years after Apple released its first iPad in 2010, but last year, the steam started running out of the category. While tablet sales continued to grow, their pace was nowhere near that seen over the past four years.

According to analyst firm Gartner, 2015 will tell a similar story for tablets, with growth in sales expected to reach just eight percent. The analyst expects shipments to rise from last year's total of 216 million to 233 million this year.

Reasons for the slower growth in tablet sales include saturation in developed economies and slower replacement cycles for the devices compared to smartphones, due in part to the relative lack of differentiation between generations of larger devices.

Ranjit Atwal, a research director at Gartner, highlighted several factors behind the "collapse" in the tablet market.

"One is that the lifetime of tablets is being extended - they are shared out amongst family members, and software upgrades, especially for iOS devices, keep the tablets current. Another factor includes the lack of innovation in hardware which refrains consumers from upgrading," he said in a statement.

While tablet sales slow, Gartner is expecting a surge in sales of "ultramobile premium" computers - a segment of the traditional PC market that has been largely cornered by Apple's MacBook Air, but which also includes some of the newer Windows 8 Intel x86 products such as Microsoft's Surface Pro line and Lenovo's Yoga series.

Gartner expects ultramobile premium sales to more than double over the next two years, from 39 million units in 2014, to 62 million in 2015, and 85 million in 2016.

The segment will be the engine of growth for the PC market, with sales of traditional desktop and notebook PCs expected to decline from 279 million to 248 million between 2014 and 2016. Thanks to ultramobile devices, the PC market will actually grow slightly, from 318 million in 2014 to 321 million in 2015.

Smartphones will continue to dominate overall device sales, rising from 1.83 billion in 2014 to 1.9 billion in 2015, and accounting for 77 percent of the 2.47 billion devices forecast to be sold this year. Smartphones sales are expected to nudge the two billion mark in 2016.

Gartner notes that the smartphone market is becoming "polarised" between a high-end dominated by Apple and a low-end ruled by Android. As Gartner has previously forecast, smartphones that cost below $100 will soon come to define the smartphone market.

"On one hand, the premium phone with an average selling price at $447 in 2014 saw growth dominated by iOS, and on the other end of the spectrum you have Android and other open OS phones' growth area in the basic phone segment, where the average phone costs $100. For the midrange smartphones, the market opportunity is becoming increasingly limited," said Annette Zimmermann, research director at Gartner.

The analyst firm expects Android to grow a further 26 percent this year, with predictions that 1.45 billion devices sold in 2015 will run Google's OS, compared to 1.15 billion in 2014. Meanwhile iOS and Mac OS combined are expected to grow by just over six percent in the same period. Gartner also expects Windows growth to outpace iOS, with sales of devices running Microsoft's OS expected to grow 15 percent, from 333 million in 2014 to 355 million this year.

Read more on this story