Target's Q1 growth turbocharged by digital demand, Shipt, store-based fulfillment

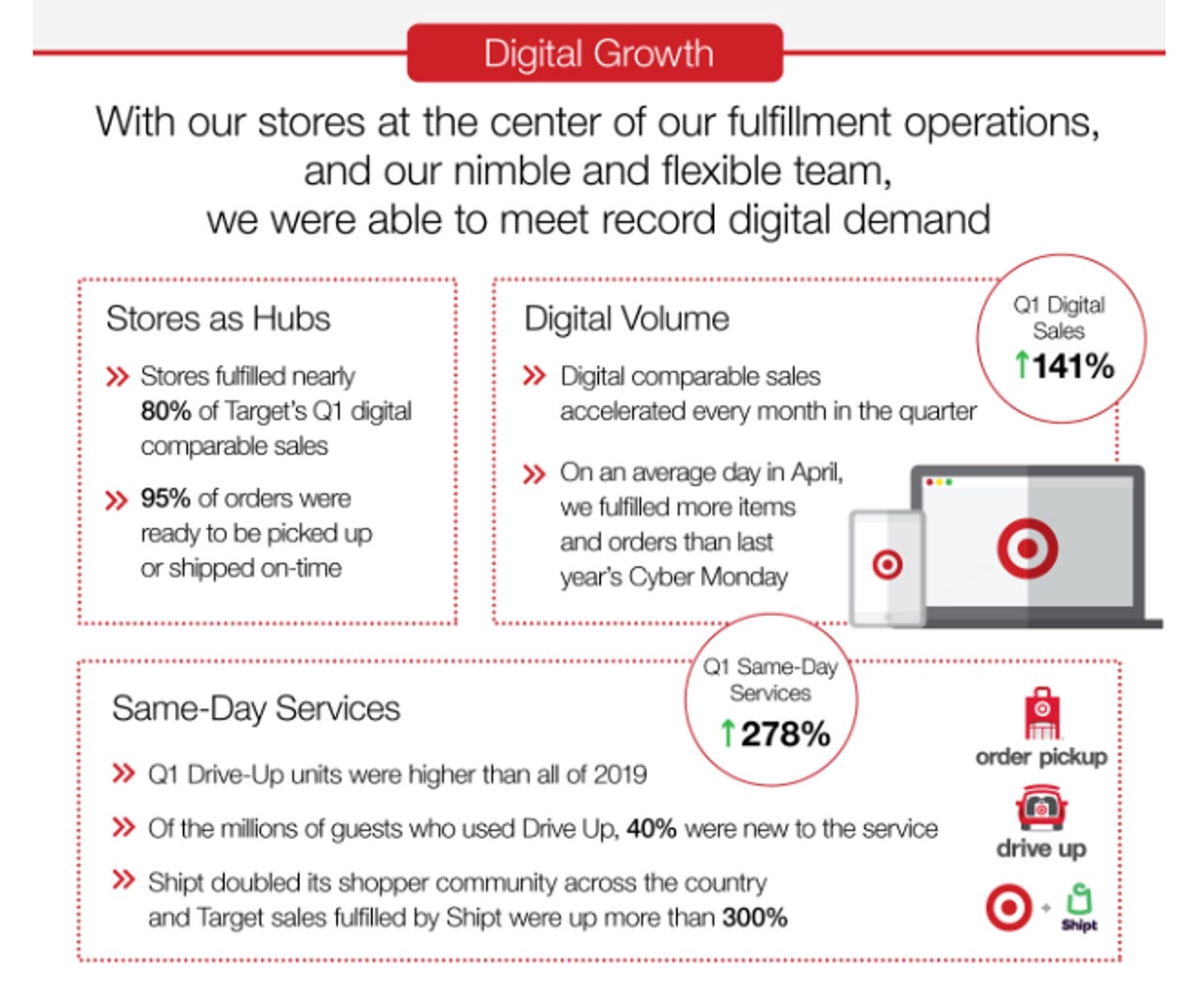

Target's digital same store sales were up 141% in the first quarter and accounted for most of the retailer's growth as the company's same-day services such as order pick up, curbside and Shipt grew 278%.

Overall, Target handily topped Wall Street estimates. Target reported first quarter sales of $19.6 billion, up 11.3% from $17.63 billion a year ago. Earnings in the quarter ended May 2 were 56 cents a share. Adjusted earnings were 59 cents a share.

Target's standout performance during COVID-19 aided by digital decisions made in 2017

Wall Street was looking for adjusted first quarter earnings of 44 cents a share on revenue of $19.02 billion.

Like Walmart, Target noted that its expenses increased in the first quarter, but digital bets made before the COVID-19 pandemic paid off. Key items in the quarter include:

- First quarter same store sales were up 10.8% as shoppers made fewer shopping trips but spent more.

- Brick-and-mortar same store sales were up 0.9%, but digital comparable sales were up 141% and accounted for 9.9% of total same store sales growth.

- Digital same store sales accelerated each month of the quarter from 33% in February to 282% in April.

- Target fulfilled almost 80% of those digital orders with local stores.

- Order Pick Up, Drive Up and Shipt grew 278% and added about 5% of growth to same store sales.

- First quarter operating margins were 2.4%, down from 6.4% due to higher costs for labor, digital and supply chain as well as lower apparel sales, which have higher margins, and a shift to lower-margin sales of essentials, food and beverage.

CEO Brian Cornell said Target was flexible and agile in dealing with COVID-19. "With the dedication of our team, the benefit of a sustainable business model and a strong balance sheet, we are confident Target will emerge from this crisis an even stronger retailer, with higher affinity and trust from our guests," said Cornell.

Target didn't provide an outlook for the second quarter.