Terrorism, floods and the DIY data centre

"Canary Wharf has to be one of the biggest terrorist targets in Western Europe." That statement alone, from HSBC's head of data-centre services, Roy Adorni, goes along way to explain why the company is currently spending millions of pounds building a new data centre away from London's financial landmark.

The company currently has a significant data centre in its Canary Wharf headquarters in London's Docklands, as well as a back-up site "a bit up the river [Thames]", according to Adorni. But on top of the terrorist threat, water is another potential source of problems, according to global-warming predictions. "The fact the current data centres are in the London flood plain, we find disturbing. Given that and the relative age of the other site, it was deemed too risky operationally to have two important data centres in Central London. A new site was needed," he says.

HSBC is not alone when it comes to problems siting its data centres. Financial services organisations, which have historically had their trading and operating centres in major conurbations such New York, Frankfurt and London, are under real pressure when it comes to positioning these key IT resources. Rents of £150 per square-foot per annum are far from unusual in the kind of prime City of London locations.

Short of turfing employees out of the trading floors, some companies are facing real problems modernising their data-centre environments. Co-location is one alternative to the expense and disruption of building a new custom-built centre, but a downsides is that using a managed provider often means compromising on space and functionality tailored to the exact needs of the business.

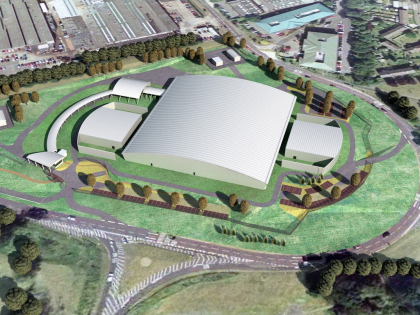

HSBC decided that cost was preferable to compromise, and has broken ground on a new facility (see below for an artist's impression of what the finished site will look like), which is expected to come online in 2008/early 2009. The bank is cagey about the physical dimensions and performance characteristics of its new facility, and is similarly tight-lipped about the location of the site, only saying it is in "suburban London". But given that the site is intended to shield the bank from threats including terrorism, such reticence is hardly surprising.

"This site has been specially designed in the most robust fashion and will feature many special ways to handle a range of threats, including adverse weather," says Adorni.

HSBC has contracted a specialist firm in the somewhat niche market of data-centre construction, called Digital Realty Trust. Digital Realty claims it will build and operate sites precisely to the organisation's specifications. Part of its service to companies such as HSBC is to act as a broker for all the support infrastructure a data centre needs: for example, getting the rights to the land, helping design the site for the client's needs, or securing agreements from local power companies that sufficient juice will get laid on — not always a given, even in a major city such as London.

The company does the majority of this business overseas. It says the HSBC deal is the first such project it has begun in London, although its client list includes BT and "Global 500" firms such as IBM, JP Morgan Chase, Allied Irish Bank Amazon and Yahoo.

So why is HSBC doing this, as opposed to, say, extending a co-location agreement? Adorni explains that a major impetus behind his role is to deal with a range of changing data-centre operating conditions. "Technology is changing with things like blades, which also bring on new questions around power, cooling and environmental impact. Then there is the fact many data centres are in the old head-office buildings with the associated cost of rent on that space."

Co-location is an option for smaller companies, but HSBC's IT requirements are on another scale. "Co-location is fine for smaller organisations — if you have, say, a 10,000 square foot computer room that you won't probably grow out of, sure. But we wanted state-of the-art on our terms, so it makes more sense to do it yourself." And HSBC didn't go it completely alone, admits Adorni — it sought third-party expertise. "We are not in the real-estate business", he points out, "and don't want to be".

HSBC doesn't want to be in the electricity supply business either, it seems. The banking giant had its eye on a perfectly acceptable site until the power company confirmed...

An artist's impression of the new HSBC data centre

...it would not be able to drive sufficient volts there for three years. This is where a specialist company such as Digital Realty can win big. "We wanted to work with a company with track record in getting this done and which had already lined up all the relationships to make it happen," says Adorni.

He also rated the company's technical competence; Digital was able to talk to him about DRUPS (Diesel Rotary Uninterruptible Power Supply kit), now being used much more commonly in Europe than the US, which Adorni wanted in the new facility.

Will other organisations take HSBC's lead here and build their own 21st-century data centres from scratch, instead of retooling their existing sites or going down the co-lo road? Digital Realty claims there is growing interest from European-based organisations for just this kind of service. Active since 2001, the company has so far set up and is operating 12 million-square-foot-worth of client data-centre space so far.

Although the company's business is overwhelmingly outside the UK at the moment, that seems set to change. In November it released market research, carried out by independent number crunchers Campos Research & Analysis, suggesting that over 80 percent of respondents plan to expand their data centres.

The average size of expansions respondents talked about was 10,000 square feet (1,000 square metres), but three-quarters of all respondents claimed to be looking to expand to data centres with more like 5,000 to 25,000 square feet (500 to 2,500 square metres).

The majority (85 percent) want to do so within the next 12 months, or two years at most — and 79 percent of that figure plan to expand in two or more locations, suggesting such expansion will be in the form of multi-site data-centre renewal initiatives. The sample was of 125 senior IT decision makers in a range of medium-sized to large firms across Europe.

The reasons for all this new real estate tend to chime with the HSBC drivers: disaster recovery and business continuity, plus a desire for extra network connectivity, upgraded cooling capacity, more raised floor area, extra power, and new applications, all of which are high on the must-have list for these planners.

"For some companies, only a completely dedicated infrastructure in a data centre will suit," says Digital Realty UK head of operations Chris Crosby, who doubles as senior vice president of sales and technical services for the firm. "This kind of company doesn't want to share equipment and generators. And given the environmental, security and pricing issues in the London market, we anticipate demand for our specialist expertise to increase."

This is still a minority market; no analyst company as yet tracks custom-built data-centre construction and operation as a separate market, tending to lump it in with generic co-location. And given the cost and time commitments, only the biggest companies — with the biggest data-centre issues — are likely to work with firms such as Digital Realty. After all, the clue's in the name: it can't be often IT meets the real-estate business. "For many people that combination is indeed a tough one to handle," admits Crosby.