Tech

'Tis the season for ID fraud: Retailers face $100 billion in losses

As retailers enter the key holiday shopping season they're about to get pummeled by identification fraud losses.

As retailers enter the key holiday shopping season they're about to get pummeled by identification fraud losses.

LexisNexis Risk Solutions and Javelin Strategy & Research have cooked up a study the looks at how U.S. retail fraud hits merchants. Retailers face $100 billion in losses attributed to ID fraud in 2009. Toss in lost and stolen inventory and losses swell to $191 billion.

In the study, LexisNexis argues that retailers take on most of the costs of fraud. Among the key points:

- 52 percent total fraud losses are due to ID fraud and bogus transactions.

- Digital goods merchants say 54 percent of their fraud losses are related to unauthorized purchases.

- Telecom, social networking and online gaming companies attribute anywhere from 64 percent to 67 percent of their fraud losses to identity fraud.

- Credit card crimes continue to rise, but alternative payment schemes (online and mobile) are also ripe for fraud.

- One in five merchants saw an increase in unauthorized transactions due to ID fraud.

- For $48 billion of ID fraud crimes consumers pay $4.8 billion in out-of-pocket costs related to ID fraud. Financial institutions pony up $11 billion and merchants take the $100 billion hit due to lost sales, reputation harm and other lingering effects.

- Friendly fraud accounts for more than a third of total fraud for online merchants. What's friendly fraud? A consumer makes an Internet purchase via credit card and issues a chargeback after receiving the purchase.

Smart Planet: Old documents and the big identity theft threat

Among the key charts:

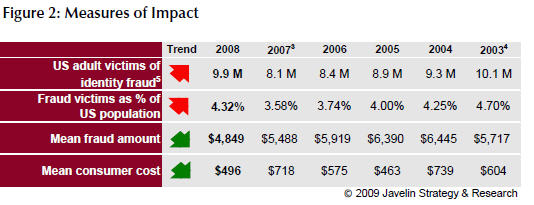

A look a consumer ID fraud trends:

The impact on behavior:

The impact on online actions: