Twilio Q2 sales up 70 percent with 30,780 active customers

Twilio ended the second quarter with 30,780 active customer accounts, up from 21,226 a year ago as the company delivered its first financial results since its IPO.

The company reported a net loss of $10.9 million, or 45 cents a share, on revenue of $64.5 million, up 70 percent from a year ago. Non-GAAP loss for the quarter was 8 cents a share. Wall Street was looking for second quarter revenue of $58.2 million with a non-GAAP loss of 14 cents a share.

CEO Jeff Lawson said Twilio will use the funding from its IPO to build brand visibility and growth.

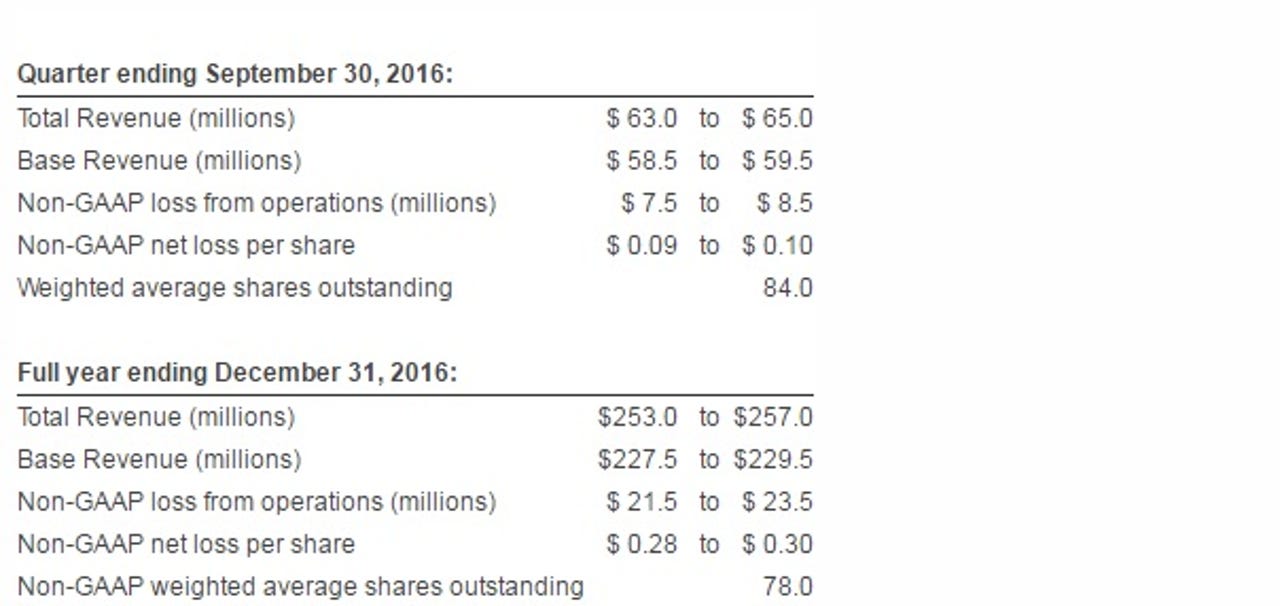

As for the outlook, Twilio said its third quarter sales will be between $63 million to $65 million with a non-GAAP loss of 9 cents a share to 10 cents a share. That outlook ahead of current Wall Street estimates.

For 2016, Twilio projected revenue of $253 million to $257 million with a non-GAAP loss of 28 cents a share to 30 cents a share.

More: Beyond Twilio's IPO success: Rapid growth and significant risks | Twilio IPO launches: Why it's successful