Twitter Q4 sales strong, growth rates in question in post politics, COVID-19 hangover

Twitter said it saw advertising traction in the fourth quarter and grew average monetizable daily active users to 192 million, but future growth may be challenged.

In a shareholder letter, Twitter said:

Given the unusual circumstances this quarter, we wish to share that the increase in average absolute mDAU through the end of January was above the historical average from the last four years, and we expect to see mDAU growth of approximately 20% year over year in Q1'21, despite 24% year-over-year mDAU growth in Q1'20. Looking beyond Q1, the significant pandemic-related surge we saw last year continues to create challenging comps and may lead to quarterly growth rates in the low double digits on a year-over-year basis in Q2, Q3, and Q4, with the low point likely in Q2. We expect this will result in an average annual growth rate of ~20% from Q4'19 to Q4'21.

Twitter may also suffer from a post US election hangover in usage.

The company said:

In the months leading up to the US election we launched a series of policy, enforcement, and product changes to add context, encourage thoughtful consideration, and reduce the potential for misleading information. Some of the changes were very effective, and we will continue to build on them in the weeks and months ahead, while others were less effective and, as a result, have been discontinued. In aggregate, the discontinued changes had a small but measurable negative impact on global mDAU in Q4, which was as expected and well worth the effort to protect the integrity of the conversation around the election period in the US.

CEO Jack Dorsey said it is investing in product changes that will result in "healthier conversations for those who use our service, including advertisers and partners."

- Twitter introduces 'community-based' Birdwatch pilot to address misinformation

- Twitter bolsters academic research access to its API

- Twitter permanently suspends President Trump's account

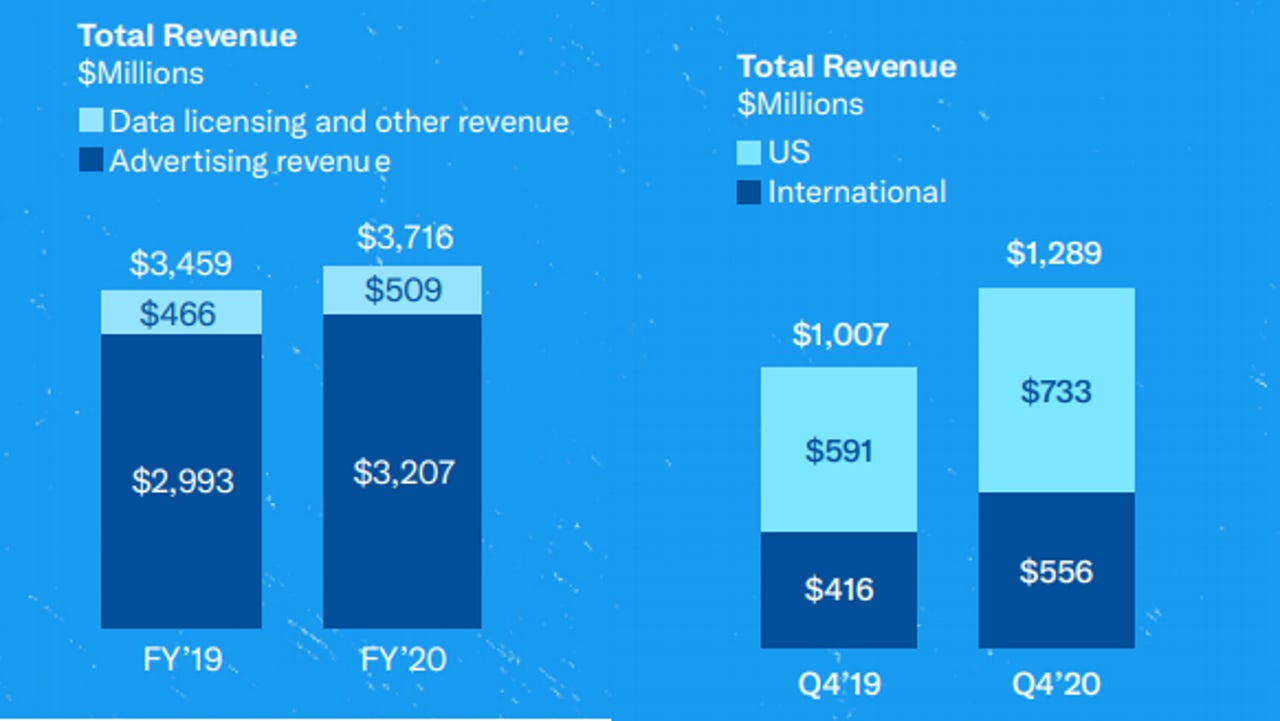

In the fourth quarter, Twitter reported earnings of $222 million, or 27 cents a share, on revenue of $1.29 billion, up 28%. Advertising revenue was $1.15 billion, up 31%, with ad engagements up 35%. Data licensing and other revenue was up 9% from a year ago. Wall Street was modeling fourth quarter earnings of 31 cents a share on revenue of $1.19 billion.

Twitter said US monetizable daily active users (mDAU) were 37 million in the fourth quarter with 155 million international.

For 2020, Twitter revenue was $3.72 billion, up 7% from a year ago, with a net loss of $1.14 billion, or $1.44 a share.

For 2021, Twitter is projecting the following:

- 20% increase in headcount "especially in engineering, product, design, and research."

- Total costs and expenses up 25% in 2021.

- Investments also include a final buildout of a new data center.

- Total revenue to grow faster than expenses depending on the economy and direct response product roadmap.

Twitter said first quarter revenue will be between $940 million and $1.04 billion with operating income between a loss of $50 million and break even. For 2021, Twitter is looking at capital expenditures to between $900 million and $950 million.