Verizon Q1 better than expected amid intense competition for consumers, but business net adds

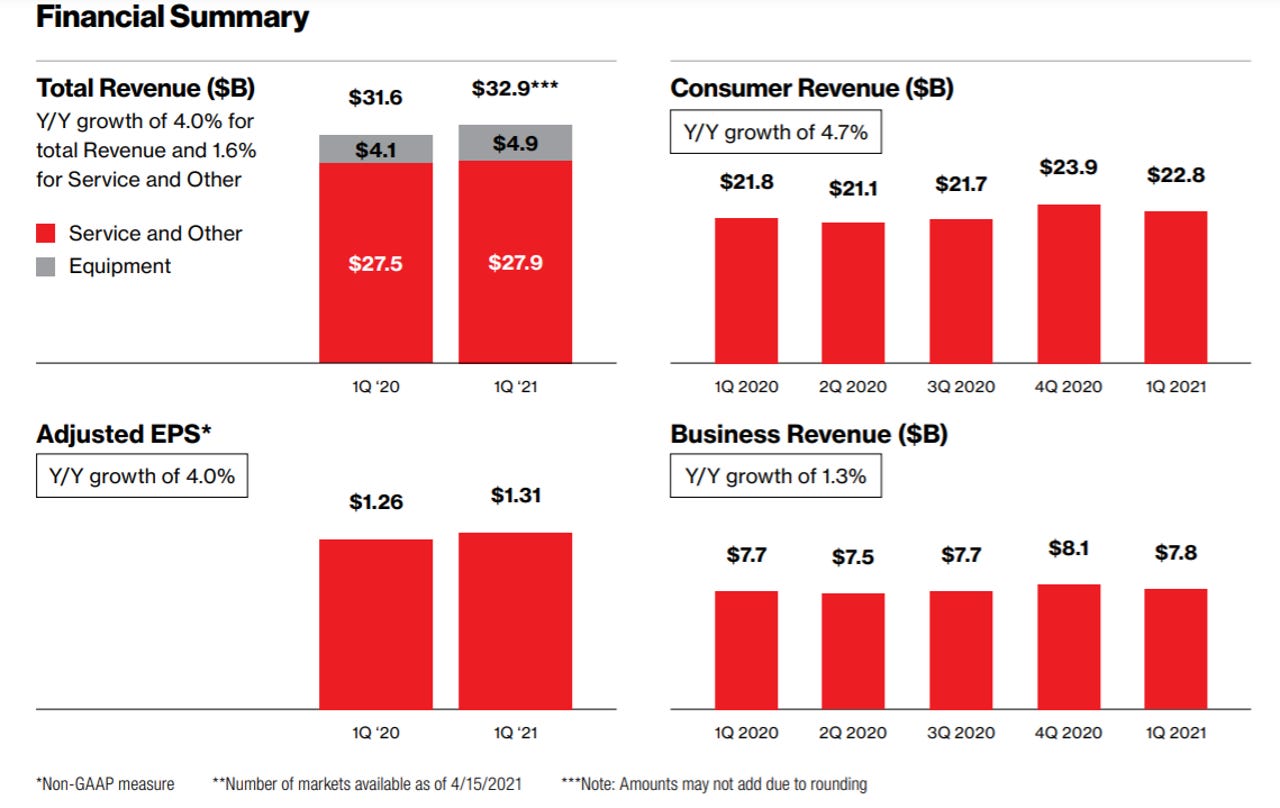

Verizon reported first quarter revenue of $32.9 billion, up 4% from a year ago, with non-GAAP earnings of $1.31 a share. Under generally accepted accounting, Verizon had earnings of $5.4 billion, or $1.27 a share.

Wall Street was expecting Verizon to deliver first quarter sales of $32.46 billion and non-GAAP earnings of $1.29 a share.

The telecom giant said its core business was strong, but there were moving parts. For instance, Verizon's consumer wireless lost 326,000 retail postpaid customers including 225,000 phone net losses. But Verizon's consumer Fios business had 98,000 Internet net additions and 102,000 total Fios net additions.

On the business side, Verizon added 156,000 retail postpaid net additions including 47,000 net phone adds.

Overall, Verizon's wireless unit had service revenue of $16.7 billion, up 2.4% from a year ago, with 170,000 retails postpaid net losses.

The results reflect the battleground for 5G consumer lines is brutal as T-Mobile takes share. The first quarter featured heavy promotions for the Samsung Galaxy S21 launch. On the business front, Verizon is better positioned and has 5G traction for edge computing with a bevy of ecosystem partners.

Verizon CEO Hans Vestberg said the addition of the C-Band spectrum will bolster its network-as-a-service strategy. That strategy was outlined on Verizon's investor day earlier this year. Vestberg acknowledged the company is facing "intense competition" but delivering revenue growth across its three business segments.

The company's plan revolves around spending to build out its 5G Ultra-Wideband and nationwide network. Verizon said it has also hit its 2018 goal of saving $10 billion in ongoing expenses.

As for the outlook, Verizon is projecting 2021 non-GAAP earnings of $5 to $5.15 a share, service and other revenue growth of about 2%. Verizon will have capital spending between $17.5 billion and $18.5 billion to build out its 5G network as well its 4G LTE network.

On a conference call with analysts, Vestberg highlighted the business 5G traction.

We continue with a high level of deployment of millimeter wave and fiber in the quarter. And we're on the track to deliver on our operational targets for the year. We brought 5G service to several additional cities. We currently have 30 5G Home and 67 5G Mobility cities live and more to come. We recently signed our first European private 5G deal with associated British ports. We also expanded our 5G edge partnership with AWS with private 5G and edge computing to our customers. We continue to scale our Network-as-a-Service strategy across new markets and verticals through a diverse set of partnerships.

Vestberg also said that the SMB market is showing signs of rebounding, but is well off its pre-COVID levels. Vestberg said:

One of the hardest-hit businesses during the COVID-19 has been small and medium businesses. And for the simple reason that they are most vulnerable of these type of things and the economic recession.

And we had enormously strong wireless business with SMBs coming into the COVID-19 that actually came down quite a lot. We have seen over the year that we slowly are coming back on that. And in this quarter, we actually had a very small growth in SMB.

I don't think SMBs are coming back immediately. But clearly, we see some signs of improvement in the base.

Among large enterprises, Vestberg said the companies most hit by the pandemic are holding back investments. 5G and edge investments are underway.

Recent developments:

- Verizon tailors BlueJeans for telehealth

- Verizon, AWS launch private mobile 5G edge computing integrations

- Verizon more than doubles mid-band spectrum for 5G

- T-Mobile, AT&T, and Verizon to duel for 5G enterprise, business subscribers

- Verizon Business expands Cisco managed services portfolio

Key items in the quarter include:

- Verizon's consumer business lost 225,000 net phone accounts and 171,000 tablet lines. The company added 70,000 other connected devices.

- Retail postpaid churn in the quarter was 0.97%.

- Verizon lost 82,000 Fios video customers, but customers are upgrading to faster Internet tiers for service and driving revenue growth.

- Among businesses, Verizon added 47,000 phone net additions and 79,000 tablet net adds.

- Verizon Media, which includes AOL and Yahoo properties, reported revenue of $1.9 billion in the first quarter, up 10.4% from a year ago.